Break free from the financial chains of Wall Street. The Liberated Investor Guidebook will teach you how to do this!

WALL STREET MODEL #1

If your advisor or robo-platform adheres to this method, there is good news and bad. The good news is that it is a disciplined platform. The bad news is the discipline means you will also participate in all the down markets.

The buy and hold model suggests that markets take care of investors over time if they are disciplined and stay the course with a balanced mix of investments. This strategy, from a 20,000 foot perspective works. Most of the time.

The Buy and Hold model delivers a false sense of security with flawed “Diversification.” The buy and hold model can cause a portfolio “performance drag” simply for the sake of diversification, even during a positive market. Investors should challenge the purpose of owning underperforming assets when they could own what works when it’s growing and drop it when it starts to struggle.

The benefit of diversification does not outweigh the performance drag and the false sense of security investors have with owning many asset classes purely for protection’s sake.

WALL STREET MODEL #2

This subjective investment model fares no better for investors, allowing circumstantial issues to influence the advisor. These issues and options can come from crop reports, news alerts, economists, self-described experts, and the government. Based primarily on guesswork and emotion, this model can cause significant harm to investors in their pursuit of wealth. This model is the opposing argument of the buy and hold model but is similarly flawed.

Where the buy and hold model is too passive and generic with its investment criteria, the market timing model advisor uses too many subjective variables and relies mostly on the name of a stock and its company’s statistics. The result: the wrong move at the wrong time. You can buy

a good stock at the wrong time. It happens all the time.

Market timing model advisors use fundamental analysis–determining stock value by evaluating economic, financial, quantitative, and qualitative factors. These advisors backed by large fee hungry Wall Street firms also look at macro-economic factors and pass judgment, frequently interpreting the data incorrectly, all while typically charging excess fees and commissions to execute numerous buy and sell transactions.

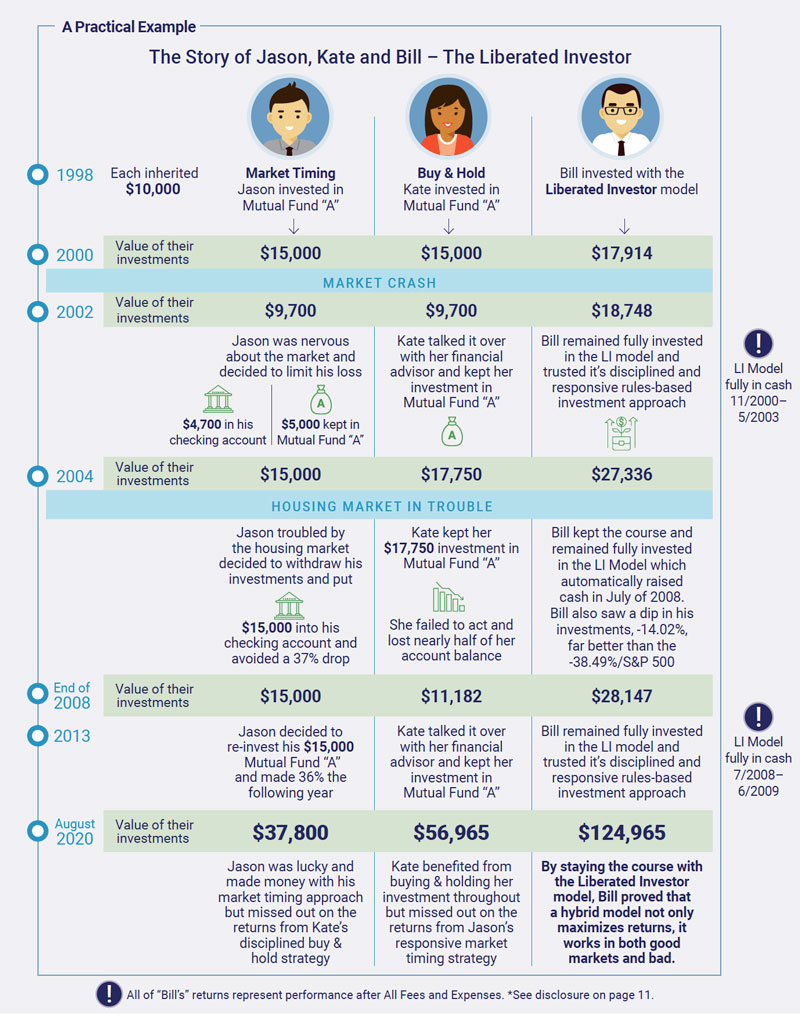

The Story of Jason, Kate, and Bill – The Liberated Investor

Investors are paralyzed by the over-promise and under-deliver nature of the two prevalent models that dominate Wall Street. They’re not aware that a hybrid model exists.

Dalbar – source for this example

The Liberated Investor Solution

When it comes to making a “right decision,” the problem can be a lack of true understanding, or it may be a careless attitude toward your investments. Don’t be careless, be involved!

The solution for capitalizing in today’s market is an active and responsive investment management approach that aims to minimize losses while participating in an upside opportunity. Not possible? Research back to the 1950s suggests and proves it is possible.

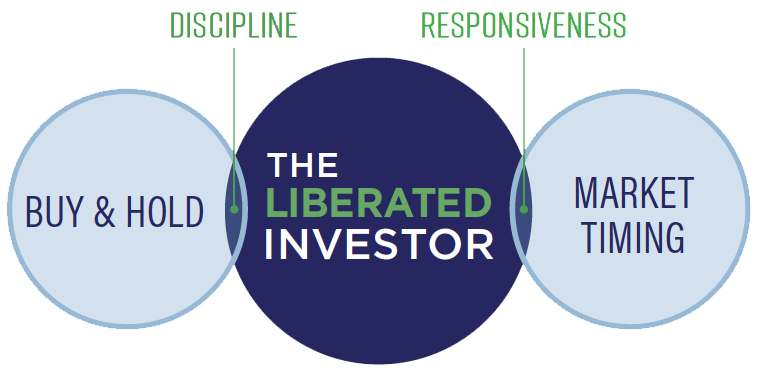

When planning for a financial future, planning alongside raw emotions will never work. The Liberated Investor™ solution is a common-sense investing method with a customized multifaceted approach that actively leverages the most effective elements of other Wall Street traditional investment models. It borrows the discipline of the buy and hold model without passivity and captures the responsiveness of the market timing model while allowing data instead of emotion to drive investment decisions.

If you could invest in a model that consistently out-performed the market, held cash during times that stock ownership was too risky, would you?

The Liberated Investor model has outperformed Wall Street’s returns in Bull and Bear markets with much lower fees.

Patience is Key

Patience is the non-financial cost of investing in a Liberated Investor solution. If your expectation is to achieve respectable, long-term returns while minimizing recessionary bear market downturns, then neither buy and hold or market timing investment strategies will align with your financial goals.

What Liberated Investors know:

If you invest in stocks in a “bear market” you will LOSE money. Cash, yes, CASH is a valuable tool to be used in a long-term winning investing strategy. Relative strength and momentum strategies have been used by market technicians for stock selection for many years.