Yes, you’re right, April showers usually bring May flowers, but as another adage goes — “Sell in May and go away” is more in alignment with the showers that we, in fact, have seen.

Yes, you’re right, April showers usually bring May flowers, but as another adage goes — “Sell in May and go away” is more in alignment with the showers that we, in fact, have seen.

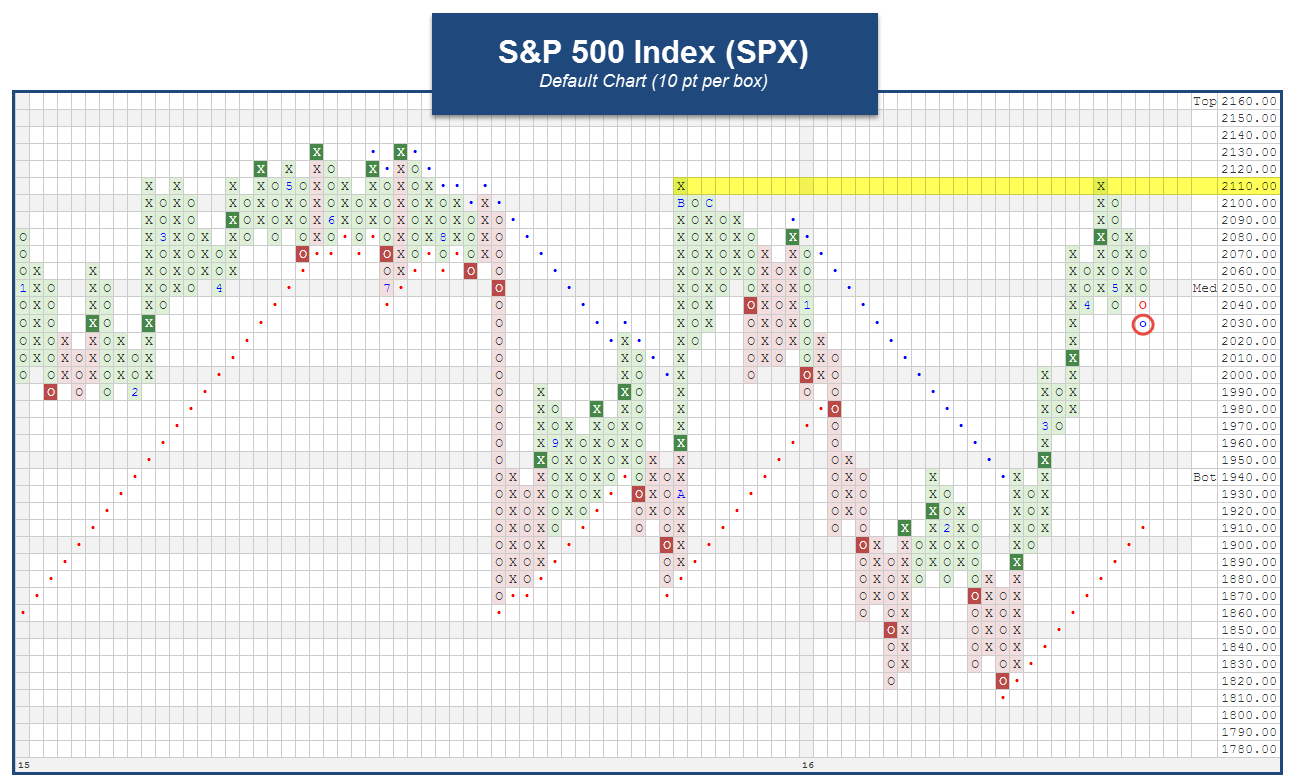

In April the S&P 500 actually didn’t flower at all to be fair — returns were down under one-half of one percent. Flat, basically. So for May to not be flowering is, well, disappointing — but not unexpected.

And the forecast is, unfortunately, calling for more rain. I’m not going to add lightening or thunderstorms at this point — but I’ll go out on a limb with 60% chance of rain for the next few weeks, and most likely through the end of the quarter. Why?

Thursday, the S&P 500 Index (SPX) gave some negative downside guidance — yes, that sounds gloomy, but it’s not a call to run for the hills. This is the first time since February that we have gotten a rainy forecast, yet look what March had in store — good things. So don’t batten down the hatches just yet — simply watch less of the nightly news until we see the sun peaking out from behind the clouds (I suspect this will be after the Fed raises rates in June).