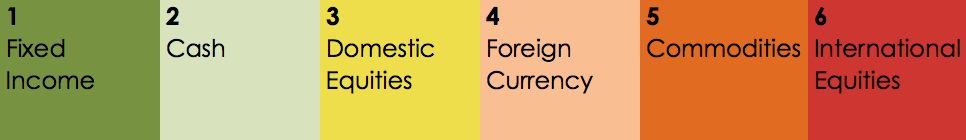

Q1 2016 Asset Scale Activity:

- Fixed Income/Bonds surpass Domestic Equities/Stocks.

- Cash and Currency remain in the #3 and #4 positions.

- Commodities, driven by precious metals, NOT oil, moved up to the #5 spot.

- International Equities/Int’l Stocks slip down to the #6 spot.

2/11/2016 Status:

- #1 Asset Class: Bonds/Fixed Income

- #2 Asset Class: Stocks/Domestic Equities

- Market Status: BULL (yes, Bull NOT Bear)

Yesterday, after more than 4 years in the #1 spot on the Asset Scale, Bonds put an end to Stocks unprecedented rein by narrowly slipping into 1st place.

This occurred after many short and medium term equity indicators hit low risk levels and positive reversals last week.It is common for these indicators to reverse up and then dip back down before a meaningful upward move. Absent Domestic Equities slipping to the #2 spot, we would hold our equity positions steady — as long as each equity position’s relative strength performance exceeds that of cash in their individual model matrix — we monitor this weekly, and more when appropriate. However, with Bonds moving into the #1 Asset Scale position, our Cash and Bond levels have increased, and our equity exposure has been reduced.

While I realize this communication may be quite technical and therefore, confusing, it’s simply meant to instill confidence that we are upholding what we have promised: to adhere to a disciplined set of time-tested rules that drives the investment allocation in your account with the overarching goal of honoring risk over return.

You own cash. You own bonds. Despite the fact that we may miss a short-term bounce in equity markets in the coming weeks (absent Domestic Equities moving back into the #1 spot), you will continue to remain at lower risk levels visa vie that of the broad equity markets. This is what we do — Tactically move your allocation and investments in concert with the market. Bonds are doing better than Stocks, so let’s increase that allocation. CHECK.

Finally, are we in a Bear Market? NO. It may feel like it, but if we will see more significant changes in indicators (Cash moving above Domestic Equity on the Asset Scale, for example) — then you can expect further risk reducing measures to take place in your accounts at that time.

As always, remember, “we’ve got you managed.”

Contact us if you have any questions! Just remember: We’ve got you managed.

As always, thank you for your feedback as we try to keep you updated on the market and your investment portfolios.

P.S. Want to know more? Click here to email Cokie!