A note from Cokie: America’s stock market appears to be signaling that the economy will recover quickly from the coronavirus crisis. But many sophisticated investors are being far more cautious about what lies ahead. While a lot of fund managers expect a V-shaped recovery, according to a survey released by Bank of America on Tuesday.

Nearly three-quarters of fund managers expect a more modest U-shaped recovery rather than a V-shaped recovery or even a dreaded W-shaped recovery, which means a rapid rebound followed by a second decline and then an eventual rebound. I’m staying with the more cautious side and want you to know that I’m available for a free 15-minute COVID-Market response call. So, let’s talk.

Recovery is coming, but a solid recovery is still off in the future. While we continue to track the challenges surrounding America’s reopening, I can show you how to navigate through these unsettling times. Click on the link above and set up an appointment with me!

Below is a weekly update from Wealth Enhancement & Preservation.

The Week in Review

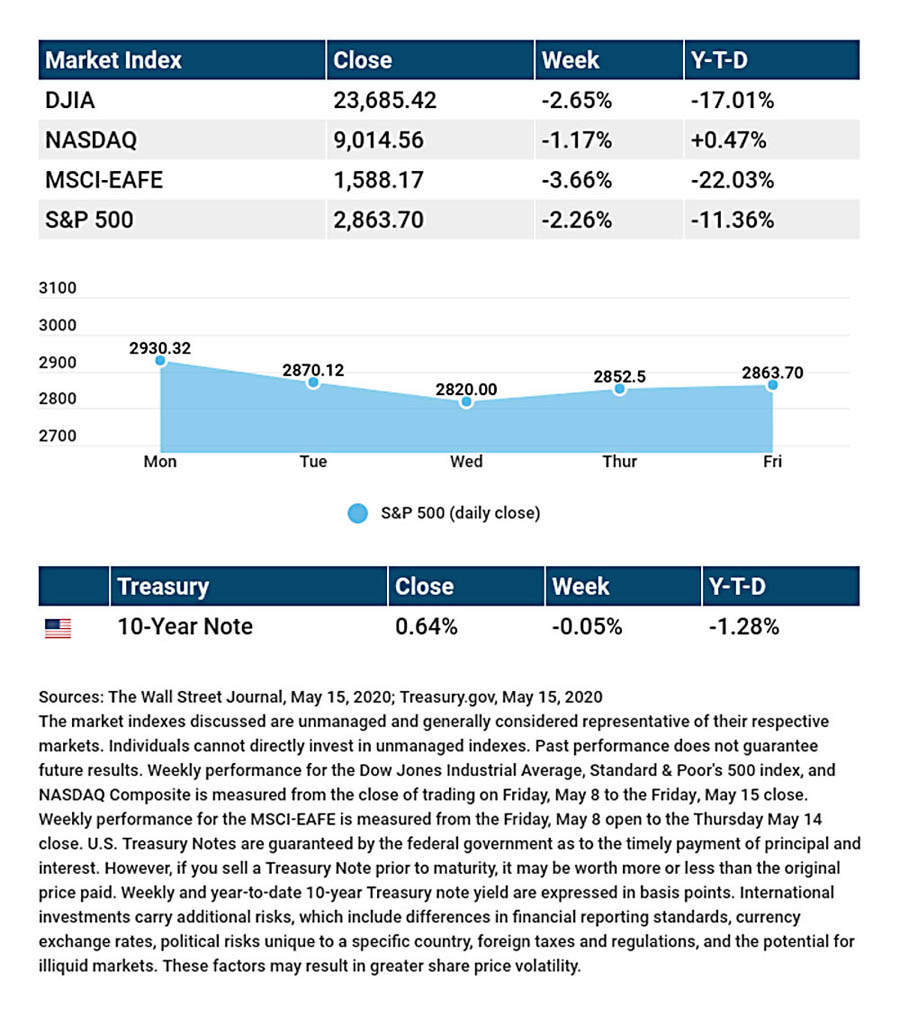

Stocks drifted lower last week, weighed down by Federal Reserve Chairman Jerome Powell’s unsettling comments on the economy and signs of renewed tensions with China. The Dow Jones Industrial Average fell 2.65%, while the Standard & Poor’s 500 retreated 2.26%. The Nasdaq Composite Index slipped 1.17% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, slid 3.66%.[1][2][3]

Stocks Pull Back

Stocks moved lower throughout most of last week on worries that the emerging economic reopening might accelerate the spread of COVID-19. Comments by Fed Chair Powell added to the downside pressure when he expressed concern about the path ahead for the U.S. economy.

The stock market managed to find some firmer footing, posting a strong gain on Thursday. Stocks rallied again on Friday, overcoming headlines that suggested a souring relationship with China and a report that showed U.S. retail sales dropped 16.4% in April.[4]

Powell Speaks

Fed Chair Powell spoke last Wednesday and painted a somber economic outlook, remarking that “the path ahead is highly uncertain and subject to significant downside risks.” He urged the White House and Congress to pass additional financial relief to help the economic recovery, adding that there was no plan on the Fed’s part to cut the federal funds rate to below zero.[5]

Powell also referenced internal Fed research that found those least able to weather the current economic environment were most impacted, with nearly 40% of households making less than $40,000 per year having lost a job in March.[6]

THIS WEEK: KEY ECONOMIC DATA

Tuesday: Housing Starts.

Wednesday: FOMC (Federal Open Market Committee) Minutes.

Thursday: Jobless Claims. Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, May 15, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Baidu (BIDU)

Tuesday: Walmart (WMT), Home Depot (HD)

Wednesday: Kohls (KSS), Target (TGT), Lowes Cos. (LOW), Expedia Group (EXPE)

Thursday: Nvidia (NVDA), TJX Cos. (TJX), Ross Stores (ROST), Intuit (INTU)

Friday: Deere (DE), Alibaba Group (BABA), Pinduoduo (PDD)

Source: Zacks, May 15, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative,

Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information.

By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[1] The Wall Street Journal, May 15, 2020

[2] The Wall Street Journal, May 15, 2020

[3] The Wall Street Journal, May 15, 2020

[4] CNBC.com, May 15, 2020

[5] The Wall Street Journal, May 13, 2020

[6] The Wall Street Journal, May 13, 2020