A Week in Review

Did you watch the 3 For 3 video? MSFT, Tucson and a smidge of an “Everest Fun Fact” will spice up what’s below. You choose!

I have written a lot regarding the month of September and the end of this quarter. Historically, it has been the single worst-performing month for the S&P 500 Index, the Dow Jones Industrial Average, and the NASDAQ Composite.

Historically Speak—NOT!

The Almanac says that on Wall Street “leaves and stocks tend to fall.” Fall is here! The Almanac and other goofy euphemisms include “Sell in May and go away (until November).”

As we anticipated, September is down -4.4%. This week, a valued client asked: “Why don’t you simply sell, when you know the market is seasonally weak?”

#1. RULES. Why do we follow rules? COMPOUNDING. Charlie Munger said it best. “The first rule of compounding: Never interrupt it unnecessarily.”

Being overly tactical and selling at every inkling of weakness is NOT the path of higher long-term compounded returns. Following strict portfolio rules driven by time-tested indicators, NOT the Stock trader’s almanac or what past history of September has to report.

Compounded, disciplined returns is a much better portfolio management choice. Our rules supported staying mostly “long” in stocks the month of September, with our proprietary “Switching Model” still invested in the market and with 67% of the Alphavest portfolio’s overall holdings having outperformed the S&P 500. Quarterly update to come next week.

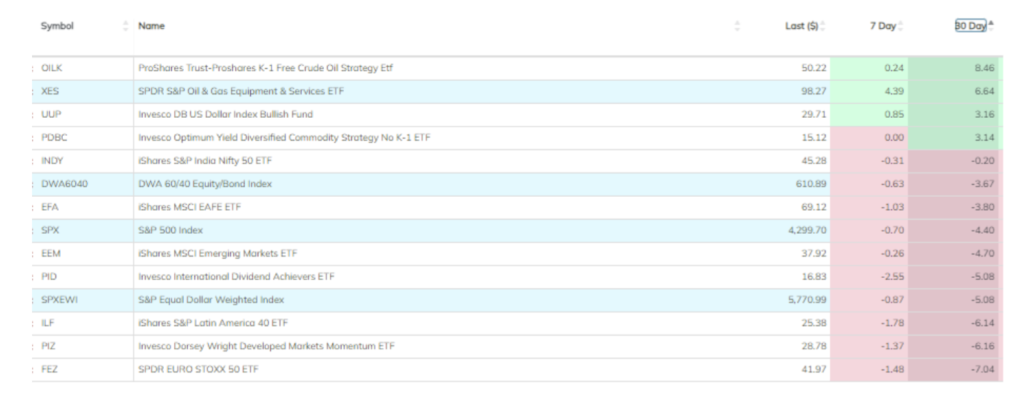

The past week and month, if we eliminate an FOMC/interest rate discussion (you can thank me later) it has been a story of the US Dollar, the Asset Scale line-up near tie for positions 1-3 and the much predicted September seasonal weakness and the decline in International equities.

Hot & Bullish!

The Dollar: Since its inclusion in the portfolio, 8/29 is up 3.16% vs. -4.40% S&P 500. While the dollar can impact a variety of different investable assets, the one most typically associated with the greenback movement is the international space. Not the first time you’ve heard this from me–the new data for you to digest is how this strength in the dollar has impacted the Asset Scale tracked by our partners at NASDAQ Dorsey Wright & Associate, which has validated our move to the dollar last month and, our decrease in international holdings, in tandem with increasing our oil and commodity exposure.

Those familiar with the decades that we have relied on the Asset Scale line-up to help determine, overall market “temperature reading” HOT vs COLD or Bullish vs Bearish, the Asset Class line-up helps us do that.

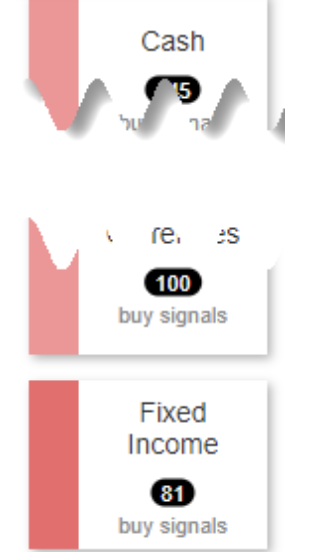

HOT/Bullish is having Domestic and International Equities in the top #1 and #2 positions as is currently the case. However, as you can see below, that is currently being challenged by Commodities, which will look and feel a whole lot like 2022. Not ideal for those seeking equity-like or double digit returns. The international equity group lost 11 buy signals since 7/31, and is now only one buy signal ahead of commodities; with Positions #1-3 having only a difference in sub-ranking of 256-249–NOT a wide dispersion. In the overused horse race analogy, all are within a “nose” of one another.

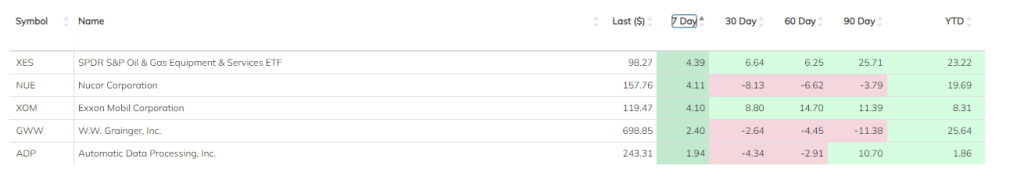

What can I say about winners and losers this week that hasn’t been written above? Interestingly, most of BOTH the winners and losers are from our Alphavest Aristocrat and Alphavest Equity Income Models, up +19.07% and +2.23%, respectively vs. the Dow Jones Industrial Average of 2.72%; substantiating a long-communicated view of a flight to quality; strong “blue chip” dividend paying US stocks, and the importance of individual stock selection.

Winners:

Some of the more notorious market meltdowns have occurred, or at least escalated, in October. Still, the S&P 500 (SPX) has had more double-digit gains in October than it has double-digit losses since 1950. While seasonality is not a justifiable trade rationale by itself, as we head toward the end of September the optimists could have some extra fuel in the tank based off recent monthly return tendencies. So, let’s keep our eyes set on the right things as we go forward.

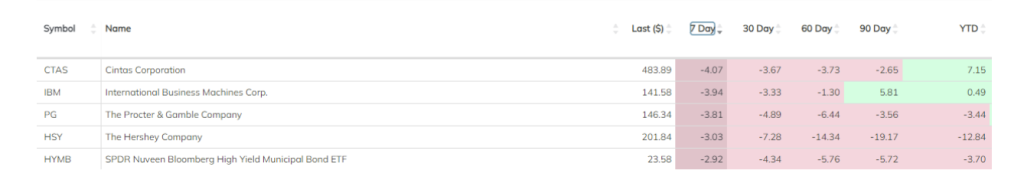

Losers:

Hershey/HSY, a repeat offender may be eliminated with the worst of the losers, YTD return of -12.84%. Hard to reconcile when I know I’m consuming more chocolate than ever before–and so the way of the stock market. HYMB, a holding in our Alphavest Fixed Income model, while in top 5 losers this week is ever close to performing up to its AGG bond index returns of -2.95%.

The bottom line: steady as we go, follow the rules and yes, we’re happy about our elevated cash holdings. Bring it on, October, we’re ready with quality, commodities and cash.

Fun Facts (perfect day + market head turners)

What is your personal dress code?

Recently, the U.S. Senate unanimously passed a resolution for a formal dress code. This means that Pennsylvania Senator John Fetterman’s shorts and hoodies are gone! Since COVID, office attire has had its ups and downs—as it has for most firms. What’s your opinion on dress code in the Investments/Planning workplace, or otherwise? Jeans OK? Hoodies? Formal dress for all client meetings? Inquiring advisors want to know!

From the Client’s Mouth

We love your feedback and engagement! Partner with us. HOW? Earn points for connecting and engaging with us…. Social media/email engagement/feedback, referrals, attending client events in-person or Zoom for those far off–WHY? Points rack up, and fees go down. YUP. Help us IMPACT more (and you, too!) with your WHY for being a valued Alphavest client.

In response to our Jane Goodall article, here’s the response to “What’s my next great adventure?”

Having reached age 62, the deepest glimpse of profound happiness or “perfect days” that I’ve experienced since moving to Lake Geneva, WI, came this year. Planting my long-awaited vegetable garden in our rental home backyard on make-shift raised beds, I have experienced wonderful crop yields for the last couple of months. So my next great adventure is keeping my winter garden crops alive and thriving throughout the long winter season in my basement! I’m up for the challenge and while I’m also taking a break from a Raw Vegan/Intuitive lifestyle of eating, my plan is to regulate some of my internal imbalances by leaning more on Keto and maybe even Carnivore. Thanks for giving me the opportunity to make this claim to the world. By next April I shall have an update of what and how my great adventure transpired. – Always Gratefully (Inspired by Jane)

Have you opted in for our cutting-edge text technology? Sometimes text is best . . . connect with us! Just text ‘CONNECT’ to 866-662-5742

As always, sending you a Perfect Day!