What You Need To Know About Tax Reform

Proposed Tax Reform: Key Details to Know

1. What Similarities the Plans Share

At their core, the plans aims to reduce tax burdens for both individuals and businesses while simplifying the tax code. To pursue these goals, the House and Senate each propose to:

- Increase the standard deduction

- Remove personal exemptions

- Maintain current 401(k) rules

- Maintain deductions for charitable donations

- Remove the Alternative Minimum Tax

- Raise the child tax credit

- Reduce or eliminate state and local tax deductions

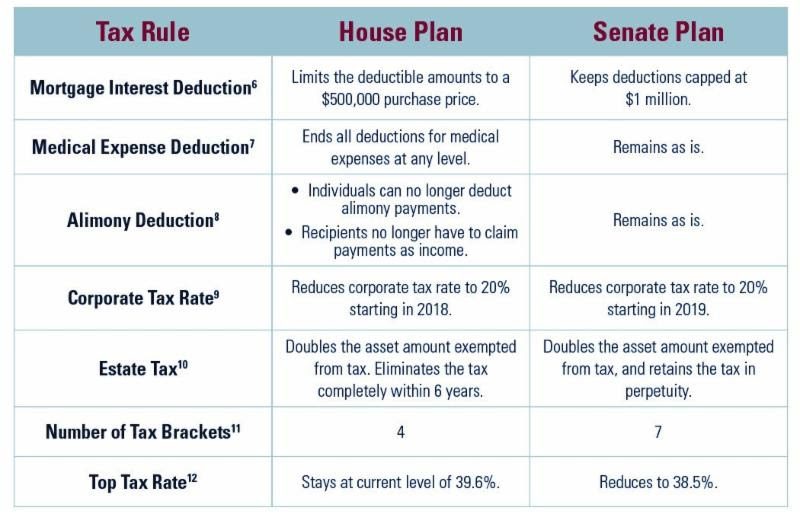

2. How They Differ

Members of the House and Senate met for months as they worked to align their bills and encourage the legislation to pass by year’s end. Despite these efforts and the similarities outlined in number 1, the plans are far from identical. Some of the major differences are outlined below.

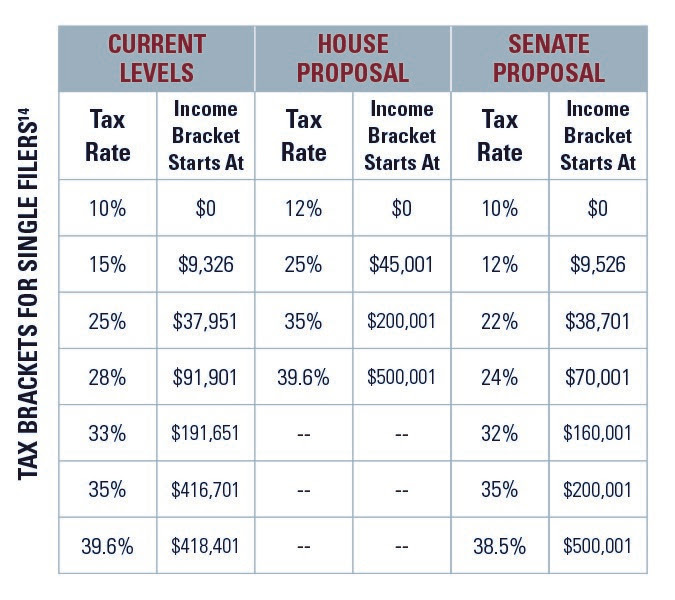

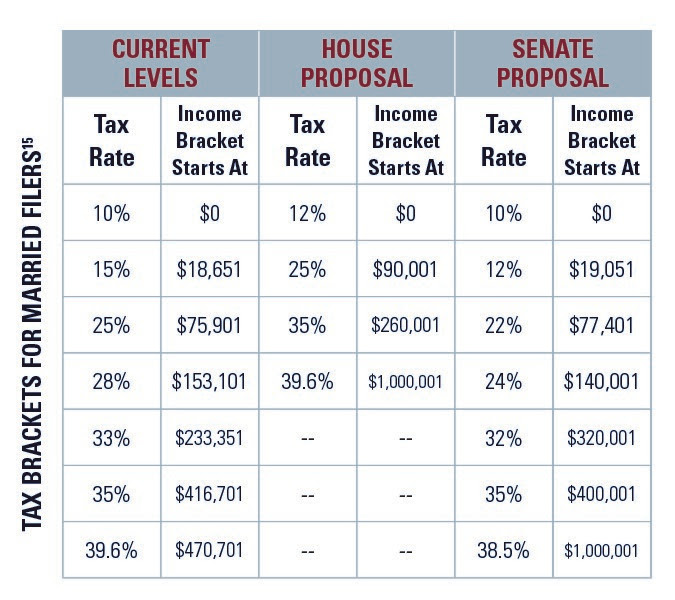

3. How Tax Brackets Could Change

Currently, the IRS has 7 tax rates ranging from 10% to 39.6%. Both the House and Senate proposals would make changes to the tax brackets, though their approaches differ.

NEXT STEPS:

Now that the House and Senate have approved their separate bills, the Joint Committee on Taxation must develop an acceptable compromise bill for them to approve. President Trump expects Congress to complete this process before the end of 2017. Whether or not this timeline is achievable remains to be seen.