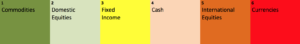

After over 12 months in last place of the Asset Scale, a relative strength performance measure of asset class leadership—International Equities have given up last place to Currencies. This, after the improvement in the International arena, resulted in Fixed Income or Bonds slipping from second to third place just last week.

I’d have to say the loudest noise on Wall Street this year was clearly Brexit— a noisy distraction to investors as the heartbeat of International Equities got stronger. Albeit markets have recovered the Brexit blip, I believe that European market woes are far from over.

I’d have to say the loudest noise on Wall Street this year was clearly Brexit— a noisy distraction to investors as the heartbeat of International Equities got stronger. Albeit markets have recovered the Brexit blip, I believe that European market woes are far from over.

While the risk-reward scenario is getting better for international holdings— diving into the pool of international investing will require some caution at this time. Given the greater strength, however, in domestic equities, bonds and in the commodity arena— an allocation to International investments at this time will be small, if any. The strength in the gold, stocks and bonds simply outweighs most of the potential reward of international investing abroad right now.

What to do? Ready for International Equities now?

Much of the newfound strength in International Equities has come from Emerging Markets, specifically; Latin American ETFs such as the S&P Latin America 40, ILF and countries such as Mexico, Brazil, Peru, and Argentina have performed very well, YTD.

I’d leave developed European countries and Broad European ETFs for another day, which may be far, far, away given Brexit and the UK’s decision to depart from the European Union.

What are others saying about portfolio allocations and International holdings? Fidelity offers a more strategic and less tactical view of international allocations for investors;

Fidelity’s Range of Diversified Asset Mixes

For illustrative purposes only— The purpose of the target asset mixes is to show how target asset mixes may be created with different risk and return characteristics to help align with an individual’s goals and risk tolerance.

While Fidelity is not alone in their guidance, say, for aggressive investors to have 26-30% in International Equities— we disagree. Tactically, our allocation is ZERO to international holdings right now—and while we don’t profess to always getting it right, our clients understand that our mostly tactical (not strategic) decision to do so is rooted in a philosophy of honoring risk over return.

Strategic, long-term bets on International holdings can make sense. But why not, tactically, go into and out of asset classes that are clearly in and or out of favor and simply wait until they are clearly back in or out of favor before committing hard earned investment dollars to that space? NOTE: tactical portfolio allocation should not be confused with market timing— Not the same. (This is a blog of another color…stay tuned)

I think the primary answer is that a majority of investors, who have either been conditioned as DIY investors or as high-fee big-brokerage-advised investors, simply don’t know a way to assess this “in-favor-out-of-favor” concept. To most I query, this methodology seems logical, yet they simply don’t know how to implement it.

Sidebar: Thankfully, and not so thankfully, there has been a massive influx of investor assets to a space that is not DIY and not high-fee big-brokerage; this is the “robo-advisory” space. As with everything in life, there are pros and cons to so-called Robo Advisors. A big con, is the overwhelming bias to strategic vs. tactical portfolio allocation.

Case in point, Wealthfront, a Robo-Advisor at the forefront of the asset movement away from Big Brokerage/traditional Wall Street firms (kudos!), had Aggressive investors allocated with 42-50% of their accounts in International investments on June 23rd, 2016, going into the Brexit vote. 42-50%!

I polled my Twitter followers after I learned of this lofty allocation— I had to know how other investors, and professionals who follow me felt about this strategic allocation. In 20+ years of portfolio and investment management, I have never had any client invested in 42% in international holdings, NEVER. I had to know what the public, informed or not, thought:

Well, it is always nice to be validated, and the poll did just that. Only 3% of respondents felt that 42% invested internationally seemed “prudent” with the highest amount of respondents, 42%, voting that it seemed “risky.” FWEH!

Fair is fair— and this is where a strategic vs. tactical discussion can really take shape; while the aforementioned Wealthfront model was down -4.64% on Brexit day (-4.64% yes, in one day), the day that the UK voted to leave the European Union (EU), that portfolio has actually gone up 3.46% since the day before Brexit, and is up approximately 8% YTD.

This realization brings to the forefront the real question in the investment arena today that investors should be asking themselves; how much risk am I taking on in order to achieve, say that +3% additional return? Are you OK with 4% down days, and/or 35% losses say, in 2008? Or are those down days acceptable to you for the returns you have received for say, long-term strategic asset allocation? This is a very personal suitability question that only you can answer.

While this market continues to try and establish investment leadership— which the International space has far to go off of bottom before it can establish itself as a leading asset class, it seems clear as I observe asset inflows to international funds and bond funds alike, that investors appear to be taking on undue risk for nominal increases in portfolio return.

If you find that you’d prefer less risk, at the risk of watching some investments go up (AKA international investments) while allowing more time to wait for those particular investments to establish themselves as investment leaders, then you need to seek tactical strategies to perhaps supplement a traditional (ahem, stale, for the most part) strategic allocation.

For the 20-somethings reading this that don’t fall into that category, buying and holding a strategic allocation with 42% in International holdings may work just fine for you when you wake up in the 2041 and you are 60.

JUST REMEMBER: Keep your fees low, don’t look at your statements and your retirement nest egg should be just fine. Maybe?

The time is here; get tactical, investors!