The 4 Biggest Market Stories of 2023 — and What’s Next in 2024

PRESS PLAY for 3 For 3:

Mrs. Claus is my favorite role EVER. Thank you Jerome Powell for granting me this wish this week!

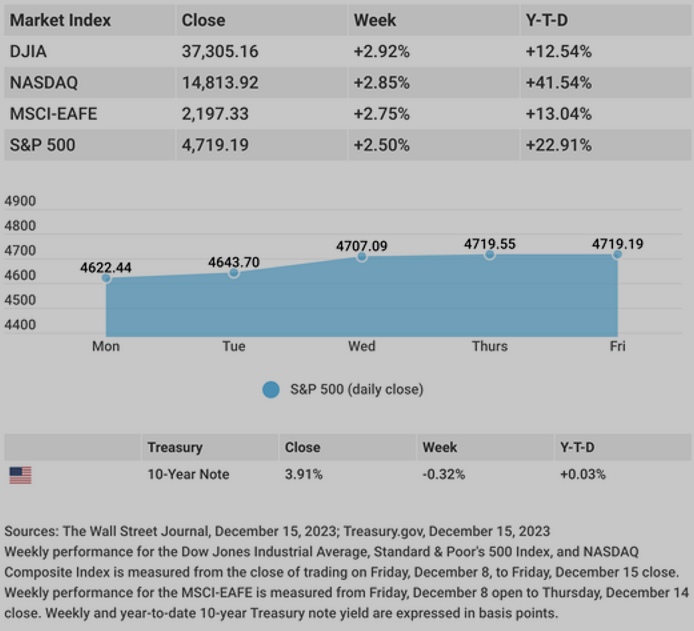

Week in Review:

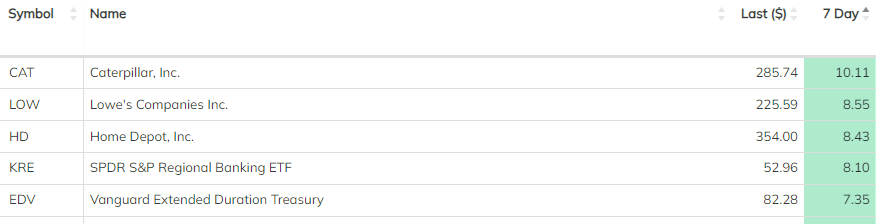

The Santa Rally continues. As does our aim on quality and hitting bullseyes not only with the Magnificent 7 (see below), but with other high quality diversifiers like this week’s top portfolio winners; CAT, LOW, HD, and regional banking ETF, KRE. Oh, and there’s the bullseye aim at rates falling and the Alphavest quiver pointed at EDV, up 30.27% since we took our shot 10/20/2023.

Thank you, Santa Powell for pressing PAUSE.

Here is a quick Week in Review in lieu of a longer, yet truncated version of 4 main themes from 2023 and how they may continue to play out in 2024.

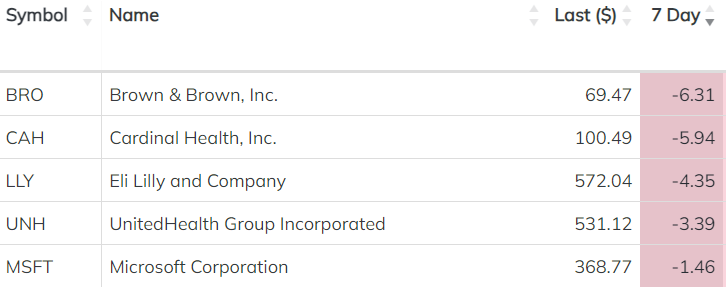

Winners and Losers:

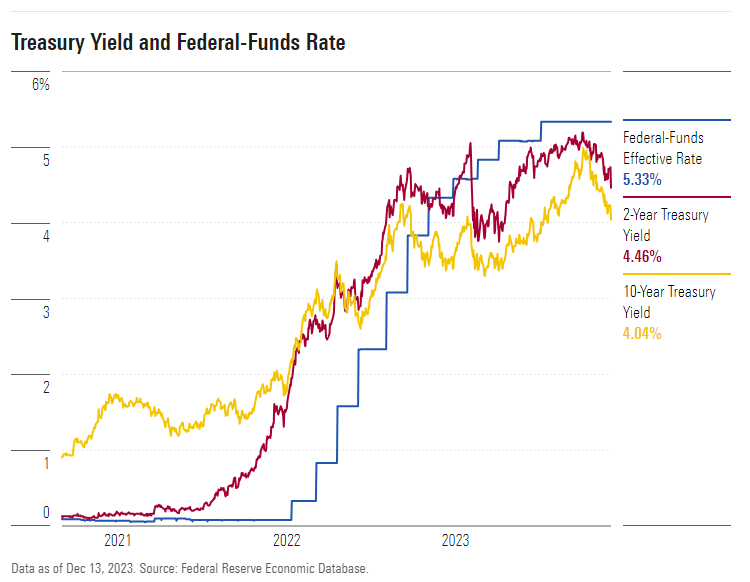

Higher Rates for Longer — For Now

Here are the four stories that were top of mind for investors this year, and how analysts say those stories will play out in 2024.

In many ways, the story of the markets this year was about macroeconomics. “2023 has been all about rates and inflation and the Fed,” says Jeff Buchbinder, chief equity strategist at LPL Financial.

The Federal Reserve hiked interest rates four times over the year—the culmination of an aggressive campaign it began in 2022 to bring down stubborn inflation and prevent the economy from overheating. Higher interest rates generally weigh on the prices of stocks, bonds, and other financial assets. Market watchers spent this year with a close eye on the central bank, reading tea leaves for clues about the likely direction of its monetary policy.

Data as of Dec 13, 2023 Source: Federal Reserve Economic Database.

The Fed spent much of the middle of the year signaling that rates would stay “higher for longer” as inflation remained sticky, which sent stocks falling and benchmark bond yields soaring to their highest levels since 2007.

Now, after a few months of encouraging economic data, most analysts expect cuts in 2024, though there’s little agreement on exactly when they will happen. Right now, bond markets are pricing in a hefty six interest rate cuts next year. That would make for a 1.5-percentage-point reduction in the target federal-funds rate. In their latest economic projections, Fed officials anticipated roughly 0.75 percentage points of cuts.

“Whether that actually comes to pass relies in large part on if inflation continues to slow,” says Ben Bakkum, senior investment strategist at Betterment. “There is a ton of uncertainty around that.”Read More: Fed Inches Closer to 2024 Rate Cuts

The Magnificent Seven

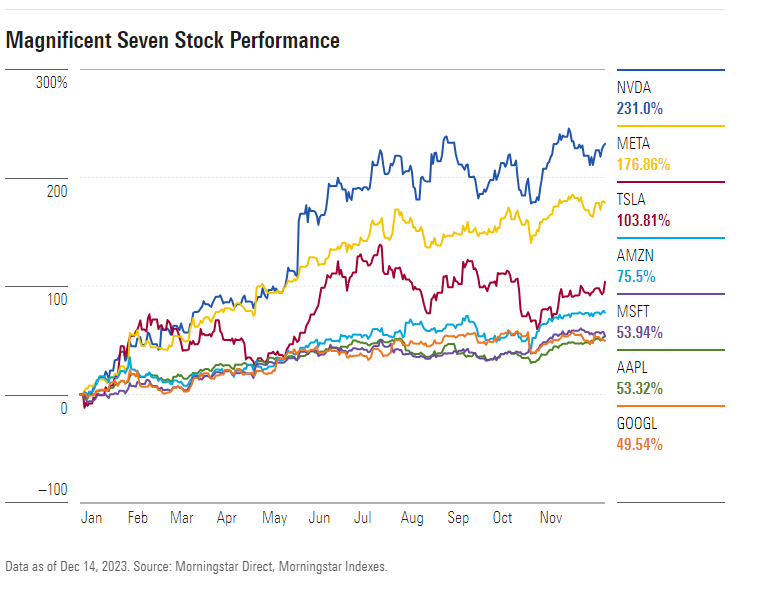

In 2023, investors continued to love the biggest stocks on the market, the mega-cap tech companies known as the “Magnificent Seven.” They are Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL. After climbing steadily in the first half of the year, the group stumbled in August as bond yields soared, then recovered as the market rallied in November.

This year, “there’s been a lot to love with the Magnificent Seven,” says Adam Hetts, global head of multi-asset investing for Janus Henderson Investors. He points to robust earnings and positive interest rate risk, which investors find attractive when the economic outlook is murky. Investors also like that these stocks have heavy exposure to artificial intelligence.

While Morningstar assessed these stocks as undervalued at the beginning of the year, Dave Sekera, chief U.S. markets strategist at Morningstar, says they’re all now “fully valued.” They’re neither cheap nor overwhelmingly expensive. For now, many investors are still willing to pay the full price. In the face of economic uncertainty, “it’s worth paying a premium for some reliability and quality,” Hetts says.

But these stocks’ dominance has come against a backdrop of anxiety over an overly concentrated market. The Magnificent Seven has had an outsized impact on the returns of the entire market this year, and some strategists are warning that a narrow market won’t be sustainable forever. They say areas like small-cap stocks and international markets could eventually catch up.

“The concentration issue is probably not going to change too much [next year],” says Buchbinder. “There is going to be some safe-haven demand for big tech in 2024.”

Artificial Intelligence

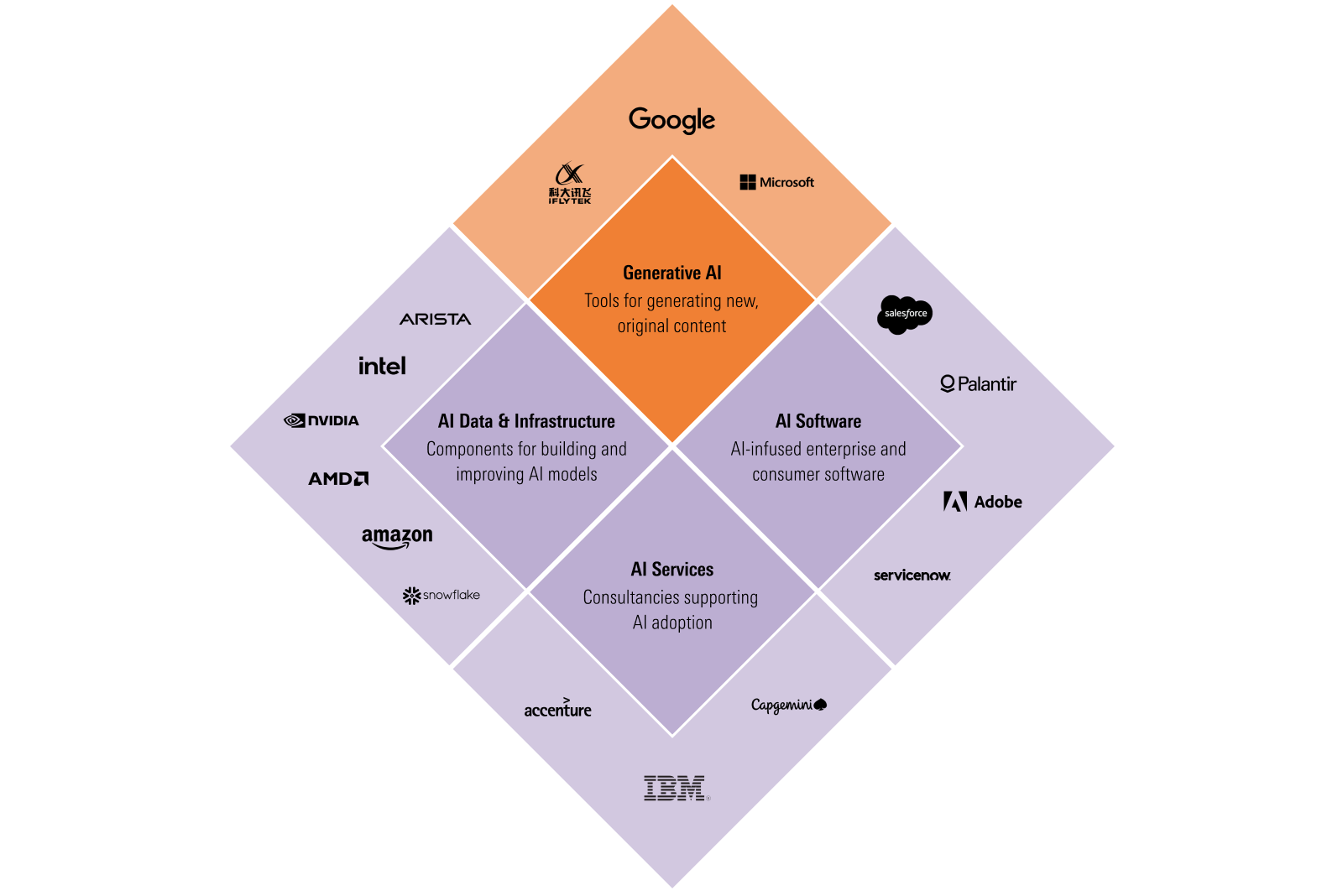

Undoubtedly the biggest market buzzword of 2023 was AI. After ChatGPT landed with a splash a year ago and chip designer Nvidia delivered one of the biggest earnings surprises in recent memory, investors clambered to get in on the action.

Nvidia’s stock has surged some 230% in 2023, while Microsoft (a high-profile backer of ChatGPT creator OpenAI) is up 53%. The Morningstar Global Next Generation Artificial Intelligence Index, which tracks 49 companies with exposure to AI, is up 75% on the year.

Strategists agree AI isn’t going anywhere, and everyone is wondering what the next big breakthrough will be. “So far, the AI story has been just Nvidia, Microsoft, and OpenAi,” says Bakkum. But he says a more diverse landscape is just around the corner as other firms get in on the action, and points to semiconductor companies like Advanced Micro Devices AMD as potential beneficiaries.Read More: 7 Charts On the AI Stock Boom One Year After ChatGPT’s Launch

Hopes of a Soft Landing Spur ‘Everything Rally’

Financial markets staged a major comeback at the end of the year, thanks in large part to renewed confidence in the Fed’s ability to engineer a soft landing.

“We had the exact opposite of 2022,” Buchbinder says. The Morningstar US Core Bond Index is up almost 5% for the year, as compared to the Alphavest Fixed Conservative and Aggressive bond models, up 4.25% and 6.43%, respectively.

Those gains have come as investors grow confident about rate cuts, but strategists say risks remain. Bakkum points out that some lagged effects of the Fed’s tightening may not have yet materialized, and on top of that, growth is poised to slow down next year. Not to mention the potential for a second wave of inflation—a downside risk for both bond and equity prices.

“The conundrum for investors,” says Hetts, is whether we’ll see a “Goldilocks cut,” wherein inflation falls but growth remains strong, or a recessionary cut, prompted by policy becoming too restrictive. The answer to that question will have major implications for investors’ strategies in 2024. “Are we pedal-to-the-metal or slam-on-the-brakes, from a risk perspective?” Hetts asks.

All that uncertainty is uncomfortable, but long-term investors can be confident that one of the first rules of the markets will hold. “The biggest risk investors face in an environment like this is being uninvested and missing the eventual rally,” Hetts says. And, RIP, Berkshire Hathaway’s Charlie Munger who said it best, “The first rule of compounding: Never interrupt it unnecessarily.” HOW does one NOT risk being uninvested and NOT risk interrupting compounding? Mrs. Claus couldn’t end without these 3 little numbers….3-6-10.

Grateful it’s a WRAP–and for what’s in STORE for ’24,

Advisory Services offered through

Red Triangle, LLC DBA Alphavest

PS: Grab a spot to review in January! First slots go to those who use our new text number! Text us at; 1-866 MOALPHA/866-662-5742 and of course, you can email or call anytime, too!

PSS: Mrs. Claus sent everyone home for the holidays. The gift of time and reducing the stress of the season for staff is on my heart and so they are done for the year–I’m SENDING YOU the same gift of time and peace! Thank you for TEXTING me some holiday cheer and/or your year-end requests! THANK YOU! 866-662-5742

Subscribe to this weekly update. AND–if you enjoyed this 3 For 3,

the greatest thank you can give is a comment here or forward it to a friend. Thank you!