This week’s 3? Timing, Wake up calls–No more “Rip Van Winkling” it with the long dead 60/40 portfolio, Its Recession-Proof time…Treasuries or Tesla? What’ll it be?

THIS WEEK IN REVIEW

This week’s 3? Timing, Wake up calls–No more Rip Van Winkling it with the long dead 60/40 portfolio, Its Recession-Proof time…Treasuries or Tesla? What’ll it be? Don’t miss this opportunity— reallocate and breathe easier.

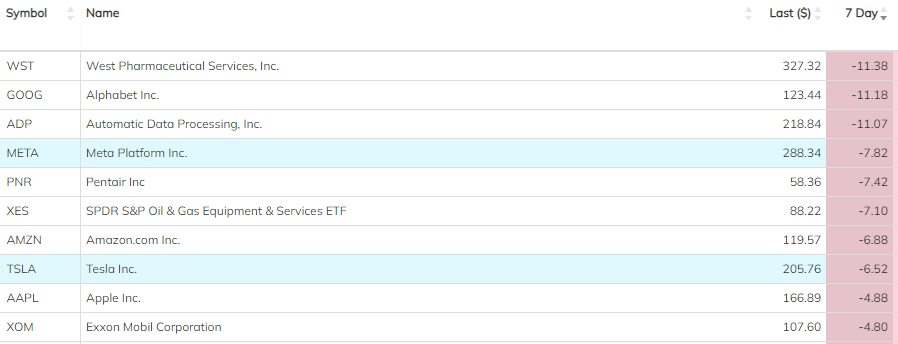

Crystal ball; it’s a great time to re-evaluate your stock AND bond allocations in favor of MORE in each. With Q3 GDP strong at +4.9%, and the much anticipated hit to the magnificent 7 this week–6 of the 7 down -4.5% to Google’s -11.5% loss this WEEK– investors should take in a dose of reality: Diversification. Safety in an investment portfolio has NOT paid off this year. Back to my yellow light analogy of week’s past–do we want to utilize caution when approaching a yellow light, in a 2000 pound moving steel object, and with our hard earned investment/retirement dollars and/or our lives, in a word: YES. No’s can day-trade, over-allocate to risky tech positions and put their lives in danger at the next intersection or market sell-off (ahem, it’s happened, and is there more to come?).

This is the real game of LIFE, not the board game, to date myself. Point is, the average investor doesn’t realize that diversification–safety–has its downfalls; you get there slower and safer. The iShares S&P 500 Aggressive Allocation Fund/AOA is up how much YTD? Can you guess? Note the S&P 500 is up almost 8% YTD. AOA… up +4%? NO. AOA is up a paltry +2% YTD. The iShares S&P 500 Aggressive Index. Up 2%. THIS is why it is an exciting and interesting time to be anticipatory for both stocks AND bonds. This is a buying opportunity—wait for it, 3-6 months from today–and today is a good day for investors; Recession will be in the rearview mirror and interest rates will be dropping. Our new partners at Morningstar are predicting -175 basis point decline in rates for 2024 and beyond–think .25-.50 interest rate hikes we’ve been experienced and that equates to about 4-8 cuts of .25 to .50 in 2024.

When “risk-free” cash/treasuries yield 5%+, Investment Grade Corporate Bonds are yielding 6.25%+, and stocks/major indices have sold-off between 4-12% in the last 90 days, it’s time to breathe easier and perhaps allocate more to all asset classes, including cash and bonds.

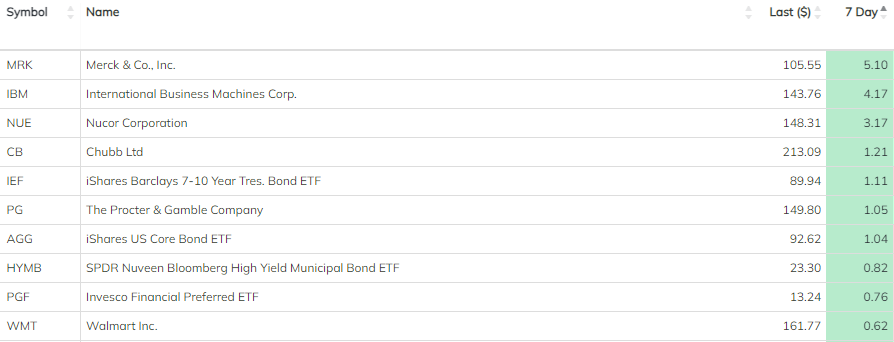

Winners

Finally, our stable-ables from our Equity Income and Aristocrats Models top the list. Including new kid on the block, Alphavest Equity Income Portfolio, Insurance behemoth, Chubb, Ltd/CB, up 1.21%. As with losers, below, I’ve changed it up a bit this week and included the Top 10 winners. 4 of the portfolio’s top 10 assets are bonds or bond-like securities. Highlighting sentiments in this week’s 3 For 3 opener–opportunities exist on the stock AND the bond side of the equation—giving rise to the shunned for over a decade “60/40 allocation.” It’s been the 40% in bonds of the 60/40 that has keep this balanced portfolio out of favor. With 10 YR Treasury yields holding on to 5% yields–highs since 2007, when they come down in 2024, bond prices will increase in value, hence the re-birth of 60/40. Don’t miss an opportunity for a much needed boost to sleepy safe and diversified returns, in bonds, NOW.

LOSERS

I’ve included the “Magnificent 7” in the line-up to offer a moment in time, albeit it may be brief, that you were glad you did not own these positions. Below are the top 10 Losers….yet 4 of the 6 we don’t own; GOOG, META, AMZN, TSLA–those that remain, Apple and Microsoft we do own, were down -4.88% and -1.03%. NVIDIA, not in the portfolio, was down -4.32% for the week. It should be touched on that West Pharmacuetical/WST, an Alphavest Aristocrats Model component–the Model up 15+% YTD vs competitors, KNG and NOBL -7% and -5%, respectively–ahem, not all high dividend stocks models are alike!–was down -11.38% on lower top line guidance for the year citing, “a slowdown in restocking trends by large Pharma and Generic customers…,” yet they approved a 5.3% increase in their dividend and reported sales +8.8% YTD. Still a HOLD, we like the stock, all things considered with a 2.11% dividend yield, yet the valuation is running a bit high. YTD, WST boasts a hefty +39.08% return. ON WATCH.

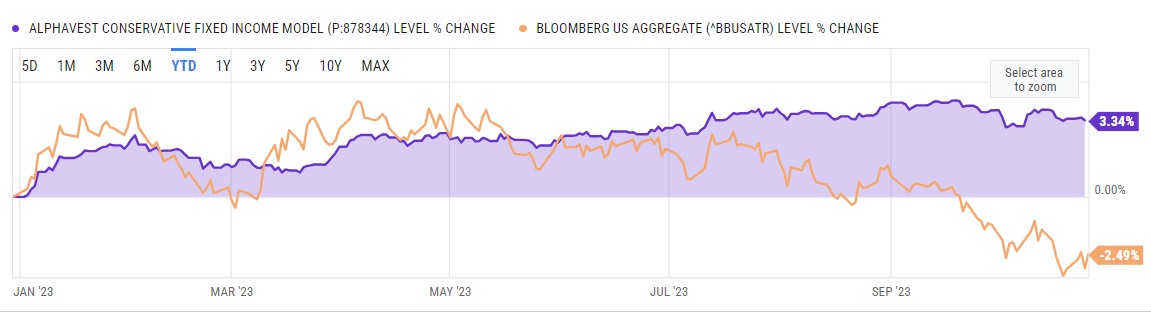

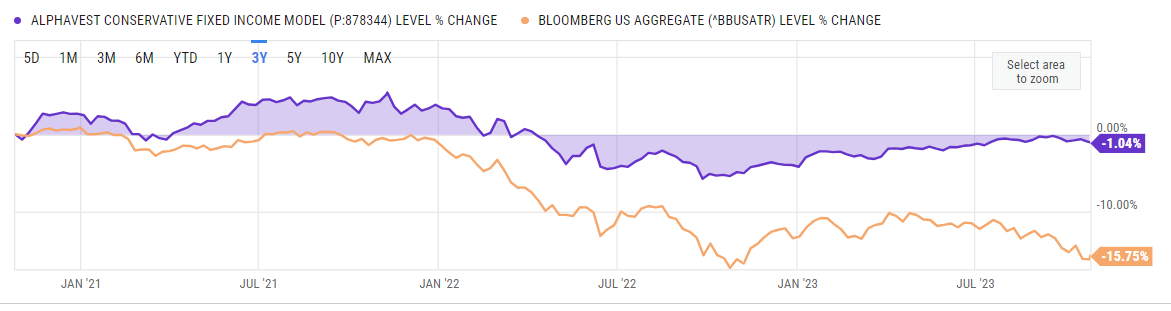

While we rarely tout our Bond Portfolio…it seems the “time” is now. WHY? Take a look YTD with at the Alphavest Conservative (we have an Aggressive Bond Model, too)–in purple, far outperforming the Aggregate Bond Index/AGG, up +3.34% versus -2.49%. On a 3 year basis, (2nd chart) you’ll see the model outperforming handily -1.04% versus -15.75%. Hence the “RVW” wake up call. A day late, and many dollars short for the average, unsuspecting bond investor.

It’s TIME for 60/40 to “make hay”–the sun is about to shine! Inquire about our Aggressive Bond Allocation (or the “plain Jane” Conservative version) –it just may give Tesla a run for its money.

In a year when only cash, visa-vie the majority of stocks and bonds, has been the risk-adjusted return winner for 2023, don’t be a loser and miss what’s happening NOW in the multi-asset opportunity that’s unfolding. Many have asked is now the time to invest cash–the answer is…IT DEPENDS on your journey. Take a look at this study and decide.

Want to know the power of the shunned-for-over-a-decade 60/40 allocation— book a FREE Consult, then, you can “RVW-it” and get some sleep.

Wink-Wink,

Advisory Services offered through

Red Triangle, LLC DBA Alphavest.

PS: Do you believe “Who Controls Capital Matters” ? I DO.

Join us for a very special Farm to Table event

3-5 PM on November 12th

Bedaw Farms, Awendaw, SC

Hear from me and TSWS Portfolio Manager, Kate Nevin

while enjoying a curated culinary experience that promises to inspire!

Subscribe to this weekly update. AND–if you enjoyed this 3 For 3,

the greatest thank you can give is a comment here or forward it to a friend.