A Message from Cokie’s Desk: Friday 3 for 3! Each Friday, Cokie will be bring you 3 points of interest in 3 minutes… …well, almost 3 minutes, she’s trying! Press Play…  Week in Review: Back on the East coast recently at “the world’s largest wealth management conference” Future Proof; Had a conversation with CNBC’s Bob Pisani (and a signed copy of his new book “Shut up and Keep Talking” —I’m listening!) and enjoyed the commentaries of the legendary “Bond King,” Bill Gross and industry disrupter, Joe Duran. Well worth the time and effort! We had a September “surprise” yesterday with markets across the board up almost 1% thanks to core inflation in-line with estimates and ARM’s successful IPO debuting yesterday with a 25% surge in price. The Winners: Alphavest’s Equity Income portfolio winner, Eli Lilly/LLY, is a top performer two weeks running with an impressive YTD return of 63.70%. The Losers (quid pro quo!): Did you know that we track the investments that we remove from models to learn about the efficacy of our portfolio decisions after we sell the stock or ETF? We remain pleased in the recent sales in GIS and RMD. No repeat offenders in the top 5 losers list this week. Apple led the list, and happy to report that all losers this week on the top five boast YTD gains ranging from Illinois Tool Works/ITW +7.99% to Pentair/PNT +47.55%. Alas, exhales extend beyond the tech giants, too. I touched on inflation as that was this week’s news–here’s a deeper dive; Yesterday we got the August inflation (CPI) numbers – a key report before next week’s Fed rate decision. Headline inflation rose again in August, reaching 3.7% YoY (orange line). However, core inflation (which excludes food and energy) kept slowing to 4.3% YoY (chart below, blue line). That’s good news for the Fed, who was concerned persistently high core inflation might still cause a wage-price spiral.  Headline inflation affected by oil prices A smaller negative contribution from energy (left chart, black bars) largely drove the upticks in headline inflation the last couple months because oil prices are up over 30% since late June (you might have noticed prices at the pump rising… right chart)–here’s where it makes sense that we own OILK the Alphavest Bull Bear Model, +12.94% YTD with dividend yield of 3.01%. Halfway through September, it looks like oil prices will add to headline inflation again.  Oil prices are up – not only because spending and economic growth has kept demand solid – but also because supply remains tight after Saudia Arabia and Russia recently extended their summer production cuts of 1.3 million barrels per day through the end of the year. However, this was known, so markets were prepared for an energy-driven increase in headline inflation. Core inflation mostly held up by housing Core inflation – which has recently attracted the most attention because it’s a better guide to where inflation is headed – fell further. That continues the trends we’ve seen in recent months. Improving new car inventory helped lower car prices and bring core goods inflation down to just 0.2% YoY (grey and black bars). (It remains to be seen if United Auto Workers strike against all Big Three automakers will effect car inventory and prices.) Even core services (excluding housing inflation) is down to 4% YoY from a peak of 6.5%, blue bars. That’s in large part because wage growth has slowed, along with the cooling labor market.  It’s mainly housing inflation that remains stubbornly high (purple bars). In fact, core inflation ex housing (navy line) is almost back to the Fed’s 2% target, while shelter inflation remains above 7% YoY (purple line).  Shelter disinflation should come soon Even though shelter inflation is still (too) high, it’s actually slowed for five straight months (chart below, purple line). And Zillow suggests we can expect (much) more shelter disinflation from here. Research shows that housing inflation lags market measures by about a year, and their observed rent inflation (a measure of newly-signed leases nationwide) has been in a downturn for 18 months. In fact, it’s now below pre-pandemic rates (blue line), so we should expect shelter inflation to keep falling from here (for a while), helping bring down core inflation.  Inflation data confirmed market expectations, leaving markets little changed Despite clear signs that core inflation is trending lower, with more disinflation to come, the inflation data had little impact on markets. The major equity indices and 10-year Treasury rates are close to flat for the day. That’s because yesterday’s data pretty much matched what markets had already priced in – and employment is still very strong. Given that, the markets still expect the Fed to keep rates unchanged next week, but a hike at the November or December meeting is still priced around a 45% chance.  However, if core inflation keeps falling (as expected) and the labor market keeps cooling, it will be hard for the Fed to justify another rate hike. The focus could instead turn to when the Fed begins cutting. Currently, markets expect the first cut next summer (orange line). That will give markets something to react (positively) to. Fewh. Moving on….. Let’s Grow: Chock full of Future Proof conference gleanings, I want to share with you two fairly new Exchange Traded Funds/ETFs that turned my head; MUSQ and DCHY. Music and democracy get my vote for inclusion this week in Let’s Grow. I heard from both portfolio managers and they got my attention. When names like Spotify are trading at 45% the valuation in comparison to Netflix, I’m looking and listening. |

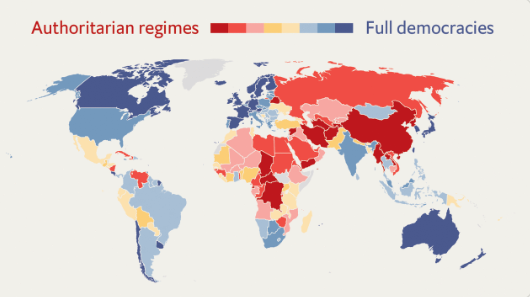

Who knew the Economist had a Democracy Index? Worth learning about if you agree that democracy offers a better capitalistic model than its authoritarian counterpart.

Not a political statement–a financial one.

| Fun Facts: This week’s fun facts is all things DOGS. Dogs of the Dow—and how Alphavest’s Aristocrats methodology is a more quality/less volatile approach to high growth dividend strategies. Tune in to this weeks video. Garden & Gun Good Dog annual photo contest is open for submissions! Who doesn’t love a gazillion pics of dogs. Take a look and/or submit your favorite pooch pic by October 2. Send us your thoughts on 3 For 3! We love your requests and feedback! EMAIL ADDRESS UPDATE!! Cokie Cox- [email protected] Donna Hightower- [email protected] Phone- 843-573-7277 Text- 866-662-5742 (866-MO ALPHA) Have you opted in for our cutting-edge text technology? Sometimes text is best…connect with us today! Just text ‘CONNECT’ to 866-662-5742 As always, sending you all….a Perfect Day,  To schedule your review, please contact Donna Hightower at 843-573-7277 or at [email protected] Advisory Services offered through Red Triangle, LLC DBA Alphavest. |