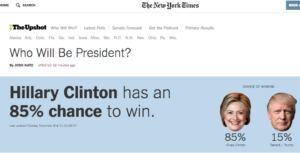

Last Tuesday, many Americans watched in great surprise as Donald Trump won our presidential election. Just that day, the  New York Times had placed Hillary Clinton’s odds of winning at 85%, based on a range of state and national polls. But, like the Brexit vote this past June, 2016 seems to be the year of unexpected outcomes. New York Times had placed Hillary Clinton’s odds of winning at 85%, based on a range of state and national polls. But, like the Brexit vote this past June, 2016 seems to be the year of unexpected outcomes.

As predicted, the markets initially reacted to uncertainty as they often do: with losses. Futures for the Dow, NASDAQ, and S&P 500 all dropped at least 4% in the middle of the night after Trump’s win. But come Wednesday morning, everyone was in for another surprise.

Despite many predictions that the markets would sell-off if Trump won, all of the major U.S. indexes ended the week ahead. The S&P 500 was up 3.80%, the Dow gained 5.36%, NASDAQ increased 3.78%, and MSCI EAFE added 0.05%. The Dow even closed at an all-time high on Thursday and posted its best week since 2011, despite being slightly down on Friday.

Needless to say, these two developments last week gave significant surprises for most people. Let’s look a bit deeper at the market’s reaction and what may lie ahead.

Understanding the Rally

The markets hate uncertainty, but they love economic growth. After Trump’s win, investors saw potential for decreased corporate tax rates, individual income taxes, and government regulation, plus increased infrastructure spending. All of these changes could help drive economic growth.

When you look at which sectors outperformed, you can see who investors believe may benefit from a Trump presidency:

- Biotech jumped nearly 16% on expectations that Trump may not fight price increases as Clinton would have.

- Financials increased 11.33%, because increasing interest rates, deregulation, and infrastructure projects would serve them well.

- Industrials were up 7.96%, which would benefit from infrastructure projects.

Seeing Beyond Stocks

While the major markets posted impressive gains, gold had its worst week in three years, losing roughly 6.2%.

But why?

A multitude of reasons come into play, but one stands out most clearly: If Trump is able to hold to his promise of $1 trillion in infrastructure spending, inflation will likely pick up and the Federal Reserve could significantly increase interest rates during that time. As a result, gold’s appeal would lessen as other investments offer a more attractive income yield.

Analyzing What’s Ahead

Right now, the election is fresh on everyone’s minds and directly affecting the markets. But like all major events, another one will eventually capture our attention. As we stand now, the fundamentals tell us that the economy is performing well. Unemployment is at only 4.9%, hourly earnings are rising, and GDP is growing. Thus, there is a good chance that the next big event on the financial horizon is a Federal Reserve interest rate increase in December.

If the Fed does choose to increase rates, we may see additional volatility in the short-run-but the underlying data shows us that the economy is fundamentally strong.

Looking to the Long-Term

Seeing last week’s market performance might make you want to find even more ways to capture growth. Remember, just as in down cycles, emotion has no place in investing. We are here to help guide you through these tumultuous times and keep a tireless focus on achieving your long-term goals.

The markets and our political environment may be full of surprises, but our goal is to make your financial life as peaceful and comfortable as possible.

ECONOMIC CALENDAR:

Tuesday: Retail Sales

Wednesday: Industrial Production

Thursday: Consumer Price Index, Housing Starts

Friday: Leading Indicators

|