Today, we celebrate “Rounded Pi Day” as it is 3/14/16.

Today, we celebrate “Rounded Pi Day” as it is 3/14/16.

Pi, or 3.14159 rounded to 3.1416, is today’s date. Consider yourself educated and among the Pi enthusiasts who aren’t knocking down the celebration a rung this year, realizing that last year was pure Pi Day, or 3.1415.

Also, today is Albert Einstein’s 137th birthday. How fitting that a genius, such as Einstein, would be born on Pi Day — as it seems very true to me that, just like Pi, his legacy will go on to infinitum.

Now for portfolio talk — how the heck will I weave that in on Pi Day? The 30 Year Treasury Yield, why of course. If Pi enthusiasts get to geek out on March 14th every year, then I’m going to use this opportunity to be a bond geek.

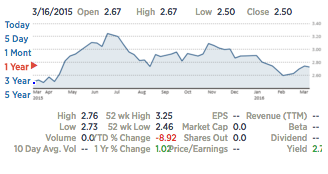

Last July, we briefly saw a 3.14% yield on the long bond, or the 30 Year Treasury Bond. Today, the 30 Year is bouncing around 2.75%, but remains an important metric for many investors — in particular, those with high allocations to bonds, bond mutual funds and exchange traded funds (ETFs).

It’s unfortunate, but those investors are the ones that need more safety and stability in their portfolios — as they tend to be Baby Boomers nearing or in retirement, but that’s not necessarily what they’re going to get. As Yellen and the Fed continue with the current rate hike policy, albeit dovish — slow and kind, investors in the wrong type of bond investments will most likely see their portfolios decrease in value.

It’s unfortunate, but those investors are the ones that need more safety and stability in their portfolios — as they tend to be Baby Boomers nearing or in retirement, but that’s not necessarily what they’re going to get. As Yellen and the Fed continue with the current rate hike policy, albeit dovish — slow and kind, investors in the wrong type of bond investments will most likely see their portfolios decrease in value.

Bond Yields 101

When interest rates (and usually in tandem, the 30 Year Treasury Bond/other bonds) go up, bond prices decline. WHY? Investors of tomorrow are unwilling to pay today’s prices for a bond offering less interest. Make sense? You’d pay more for a bond that pays you 3.14% interest than one paying 2.5%, right? WHEN 30 Year yields go from today’s 2.71% to 3.14%, for example, the bond you bought yielding 2.71%, today, will be worth less when yields are 3.14% — thus declining in value.

Note: I said WHEN and not IF the 30 Year Yield goes to 3.14%. Rates and yields will go higher if the Fed and Yellen do their jobs as our economy currently dictates. According to Bloomberg, current polls rank the likelihood of a rate hike between now and December at 74%.

With Bonds in the #1 spot in terms of Relative Strength performance above all other asset classes — investors of all ages and risk factors should be heavily allocated in the bond arena. This creates a quagmire for DIY investors, advisors and robo-advisors that have or will have bond allocations set to auto-pilot. It’s these portfolios that will most likely see portfolio losses at exactly the time when their clients would like to be adding modestly to the bottom line.

How to avert the Pi Bond Yield time bomb?

- Low maturity/duration bonds

- Bond alternatives that have low correlation to the 30 year bonds and stocks; this can get tricky

- Cash in your bond allocation until we see Pi yields (3.14%) again; then dip your toe in for more

- Floating rate bond investments that will minimize interest rate risk and “float” up with bond yield exposure as rates go up

Above all, this is not time to DIY. Nor is it a good time to be invested with a robo-advisor. Check what’s under the hood in your bond portfolio and ask your advisor what’s in the engine.

In the meanwhile, Happy Birthday, Albert. May the legacy of the Liberated Investor be so lucky as to fulfill your 137 years and perhaps, Pi to infinitum! Oh, and remember #WeveGotYouManaged