You have less than 2 weeks to decide whether you’re converting an IRA to a ROTH… but why on earth would you do  that?

that?

To pay Uncle Sam less taxes and keep more for yourself.

Consider the following:

- Did you have substantially less income in 2014 than usual?

- Did your IRA suffer losses?

- Will your small business post a NOL (net operating loss) in 2014?

If you answered yes to any of these, then you need to consider converting your IRA to a ROTH IRA.

Why? Convert now, pay taxes now and the account grows tax FREE, for life – not tax deferred like an IRA.

Here’s a great example from Putnam for the new business owner who will post a NOL this year:

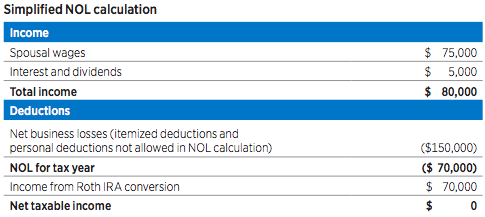

Example – the illustration below makes the following assumptions:

- John is a sole proprietor, married, with two children

- He has a SEP IRA valued at $200,000

- Due to investments within the business and a poor economic environment, business losses total $150,000

- His wife earns $75,000 annually

- They report an additional $5,000 in income from interest and dividends

- Non-business deductions total $35,000 (itemized deduction + personal exemptions)

End result: John is able to convert $70,000 of his SEP IRA to a Roth without tax consequences.

Bottom Line

If you have an IRA, call your advisor and ask the question – you’ll never know if you don’t ask. Your $30K IRA could be worth substantially more if it’s tax FREE at 60, versus fully taxable at 60.

Get Savvy—Get Grooving on your 2015 Resolutions TODAY!