Quiet the Noise – Listen to the Data

Below you will find a “temperature reading” on the market and the risk level on the “field.”

Relative Strength Line Up of the Asset Classes:

Q2 2016 Asset Scale Activity:

- Most activity in the Asset Scale since 2011

- Domestic Equities/Stocks fell from #2 to back to its #3 it maintained briefly in Q1

- Commodities have moved up from #5 to FIRST PLACE last quarter, after holding the #6 place since June 2012, hence Gold’s impressive YTD 25%

- Their is very little leadership among the top 4 asset classes so we remain invested in all top 4 and are void International equities given its last, or 6th place position.

7/15/2016 Status:

- #1 Asset Class: Commodities

- #2 Asset Class: Fixed Income/Bonds

- Market Status: BULL MARKET

- NYSE Bullish Percent (NYSE BP): OFFENSE @ 62% Reversed up @ 58% on 7/11/2016.

Last Quarter In Review:

Q2 2016 brought historic and unprecedented market events. There is some cause for optimism as we look ahead, but much of what we’ve seen will likely persist: low equity returns, ultra-low yields on bonds and loads of market high volatility. Brexit, late June, added historic global market swings and will also bring future uncertainties along with the uncertainties of a Presidential election this fall.

Incredible rebounds in energy and commodity stocks drove a large percentage of market returns not only in Q2 but YTD 2016. With negative interest rates and continued equity market uncertainty and volatility, bond prices soared. This is a conundrum to most investors and understandably so. As demand for “safety” and “higher yield” US bonds have experienced staggering inflows/net new investments which has driven prices up and yields down.

Energy and Commodities experiecend large inflows, as well. I included dates on the Asset Scale above so you could see the active movement of the asset classes, in June in particular. Note that Commodities (to included energy and gold) rose to the #1 spot on 6/29, and impressive run up from the #6 spot it had held since 2012 until it began its rise to glory off the bottom February 2016. A move this fast (2/2016-6/2016) from #6 to #1 is quite rare. Thankfully, going into Q2 we were over allocated in Bonds and increased our gold and energy exposure through MLP’s, Utilities and Commodity based ETF’s adding to traditional stocks dismal returns YTD.

You may recall Q2 newsletter citing a major reduction in cash holdings and added commodity exposure—this led to all major models having positive performance in Q2:

Best returning Models in Q2:

Fixed 200: +8.16%

Other fixed Models returned between 3.23-8.16% in Q2–significantly more than the 20 year Treasury bond is yielding in one year much less it’s 3 month yield! We are ready to shift to a more “Multi-Asset” income strategy when the bond market signals a cooling off.

Utlities: +7.86%

REITs: +4.97%

The Barclays Aggregate Bond Index was up 2.11% in Q2.

Our “equity” models didn’t disappoint:

Core: +6.21%

SPY DIV: +2.87%

Equity Income: +3.46%

The S&P 500 and Dow Jones Industrials were up 2.45%, and 2.07%, respectively in Q2.

(New Newsletter Section!)

The Other Horse’s Mouth

The Summer Olympics and Relative Strength Investment Methodology:

By: DWA & Associates 7/14/2016

Every four years the international sporting competition trials add a little more excitement to the summer, as we watch the world’s greatest athletes come together to compete for top honors in their respective sports. It’s hard to believe that the Summer Games are upon us once again, as we’re now half way through 2016. No matter what the storyline is heading into the Summer Games, I can’t help but stay glued to the television and watch the athletes wow us with their extraordinary feats of athleticism, agility, speed, and calculated recklessness. When the events are over and the winners are awarded their medals, it’s just astounding to think that out of thousands of athletes that compete in these sports, the ones who end up on the medal podium are the best in the world, or as we like to say, “world class.”

It was 2012 when we last had the opportunity to watch these athletes compete on such a grand scale, but the athletes that make it to these games are not chosen at random or for their perceived potential. They must earn their trip to Rio by performing well in trials. Much like these athletes, stocks too compete for the right to be added to your portfolio. Think about it for a second. Out of the thousands of stocks that are traded throughout the global exchanges, all of these stocks have to compete against each other on a day-to-day basis. Athletes are chosen to represent their country based on quantifiable metrics i.e. time, distance, and points. Those that rank the best are rewarded with a spot on their country’s team.

So, when one has to determine which stock, sector, or asset class is worthy of that coveted spot on a team — meaning a place in your portfolio, it’s best to start by putting each stock through its own competition. One quantifiable metric that has a tried and true history of providing an objective measure of performance is price. Every day stocks compete in the market and every day the result of these competitions are recorded. By recording the results of this daily competition we can rank stocks, sectors, and even asset classes in order to objectively see which areas of the market are performing the best, in addition to seeing which stocks areas are performing the worst. The resulting rankings provides us with the ability to select holdings in a portfolio that have earned their way in the same manner that Summer Games athletes must earn their ticket to the Summer Games.

Taking a look at how competitions within the stock market have gone thus far this year, most investors would characterize 2016 as challenging. After experiencing a 10 percent correction during the first quarter the market rebounded during the second quarter. In many cases the first quarter saw a number of trends end and new ones emerge, while the second quarter saw many of the new trends begin to hit their stride much like an track relay team passing the baton from one runner to another runner who is ready to complete his or her leg of the race. All told the S&P 500 Index gained 1.90 percent during the second quarter despite the volatile swings that took place during June. The Energy, Basic Materials, and Utilities sectors were leaders within the domestic equity space, while the Consumer Discretionary and Industrial sectors underperformed, on the whole, during the second quarter.

Interest rates around the world moved lower in the 2nd quarter sparking talk of negative rates. Here in the US, the Fed closed the possibility of an interest rate rise in June because of a poor May jobs report. The yield curve continued to flatten as longer term rates fell. We saw improvement in many of the fixed income asset classes even including emerging markets but the long duration government and corporate bonds were the better performing classes.

There was no shortage of volatility in the International Equities asset class as markets speculated on the possible news of the UK leaving the European Union. While the developed markets, especially in Europe, struggled in the quarter, the emerging markets such as Brazil and Russia, helped by Energy and Basic Materials, were the place to be.

While much of the focus was on the global equity markets, Commodities quietly became a leading asset class in the second quarter. After a year of underperformance, commodities performed very well during the quarter as energy and certain agricultural markets rallied sharply. Commodity indexes also benefited from the strong performance of gold. While we do not know if these newer trends will continue we do know that our relative strength driven processes will guide us in adapting to changes.

Performance numbers provided are the performance of indexes that are not available for direct investment and do not include dividends or transaction costs. Please be aware that the content of this newsletter is based on the opinion of Dorsey, Wright research and may differ from the research provided by Red Triangle, LLC. Past performance is not indicative of future results and there is no assurance that any forecasts mentioned in this report will be attained.Stocks offer growth potential but are subject to market fluctuations. Dividends are not guaranteed; companies can reduce or eliminate their dividend at any time. There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions.Technical analysis is just one form of analysis. You may also want to consider quantitative and fundamental analysis before making any investment decisions.

Q2 Bottom Line:

Major Index YTD Performance ranked highest to lowest for Q2, through 6/30/2016:

Q3 What’s In Store?

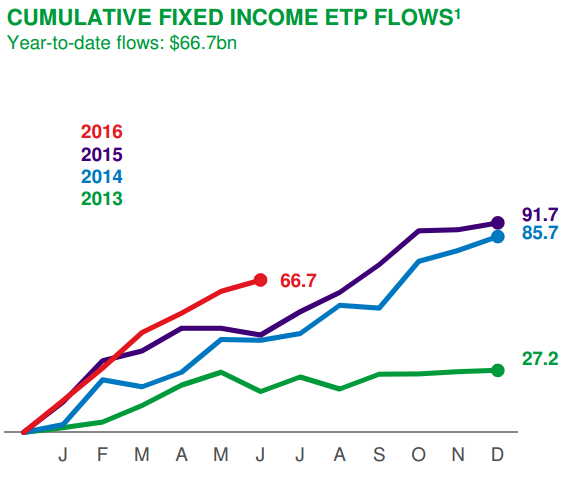

While it may appear I’ve said enough about bonds, the old adage a picture tells a thousand words applies here, one can’t deny the record $1B inflow to coporate bonds on July 11, 2016 as reported by Bloomberg—this is a tide we can’t and shouldn’t swim against right now. Inflows=higher bond prices;

Global fixed-income ETFs, which track bond indexes and trade like stocks, attracted $66.7 billion of inflows this year, according to data compiled by BlackRock Inc. That puts the market on pace to top last year’s record total of $91.7 billion.

Bond funds are gaining favor as investors seek exposure to credit assets amid record-low yields on government debt. Growth has also been stimulated by a loss of faith in active managers and deteriorating trading conditions in credit markets.

“As yields go lower and lower globally investors are looking for every bit of incremental yield, whether investment-grade, high-yield, or even dividend stocks,” said Peter Tchir, head of macro strategy at Brean Capital LLC. “IG has the additional ‘safety’ advantage which is a benefit as we are at all-time highs in the S&P 500 and have the lowest treasury yields in recent memory.”

Growth of bond ETFs has also been supported by investors seeking stability “in light of heightened volatility and a high level of geopolitical uncertainty,” said David Mazza, head of ETF and mutual fund research at State Street Global Advisers in New York. ETFs have emerged as a popular choiceamong investors seeking to navigate the market rout following Britain’s vote to leave the European Union.

Portfolio Changes:

One of my favorite sayings is “Performance measured is performance improved.” I am constantly tuning our strategies, rules and models and measuring past performance in order to bring optimal risk-adjusted performance to our clients. After almost 3 years of due diligence, I will be increasing the number of Models/Allocations that Darrin Cohen and his team at Infinite Asset Management (IAM) manages for us, in-house at Folio.

Currently, IAM manages 7 of our 20 Models. IAM not only adds an extra layer of money management expertise, but also represents a way to diversify our 100% Pure RS strategy. As you’ve read above, there are benefits to a pure RS strategy, but over a market cycle, opportunities exist for alternate strategies to outperform — and hence, compliment a RS approach. IAM does employ RS, but also incorporates alternate tactical strategies beyond my expertise. This is a strategic partnership worth mentioning and one that we are excited about.

Furthermore, IAM brings a host of alternative options for our portfolios such as private equity and multi-strategy hedge fund options to our host of offerings.

Resources, Resources, Resources!

Website upgrades and enhancements coming in Q3! Look for Account Aggregation tools to assist you in managing all of your fiancial accounts in one place!

Check out our Resources page at Alphavest.com and explore the many ways in which we are empowering investors.

A Snapshot of What’s There:

Morningstar™ Fee Analysis. Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying.

Free Consultations with Cokie. Those who have used this offer have found it beneficial and have been pleased with the value 15 minutes of their time provides. We use this resource to offer investors a no-pressure opportunity to assess whether Alphavest is a good fit. This is a great place to send those that you think may need our services. Thank you for your referrals and consideration!

FINRA Advisor Background check. FINRA reports that only a small percentage of investors check their advisor’s record before making a switch. We run background checks on our employees, our childcare providers — why not run one, it’s FREE — on the person who manages your money? Rest assured our record is spotless (click here for Cokie’s U4). The important feature of the report is that it will indicate “NO DISCLOSURES,” which means no fraud or investor complaints.

Subscribe to Cokie’s Blog:

Most of my blogs are less than 200 words (except our quarterly newsletter) — short and sweet! I post as a means of quick and efficient communication with you, my clients. Your feedback is very important to me. THANK YOU for letting me know what you like reading… and what you don’t!

Most of my blogs are less than 200 words (except our quarterly newsletter) — short and sweet! I post as a means of quick and efficient communication with you, my clients. Your feedback is very important to me. THANK YOU for letting me know what you like reading… and what you don’t!

Subscribe to Cokie’s Blog

Join the Liberated Investor Movement Today!

Liberated Investor, Edition 2 is soon to be released—stay tuned!

We launched the Liberated Investor Movement in an effort to educate investors on how to break free from being held hostage by “Big Brokerage.”

The Liberated Investor Tool Kit exposes five areas of the investment management industry where the deck is stacked against investors and offers simple and direct advice:

- Excessive Fees and What Can Be Done About Them

- The Myth of Buy and Hold

- The Emotion Behind Market Timing

- Industry Conflicts of Interest

- How to Hire An Advisor That’s On Your Side

Download the Tool Kit today and share with your Facebook community and friends and family!

The best way to refer us? Tell others to download the FREE The Liberated Investor Tool Kit: