Quiet the Noise (Listen to the Data):

Below you will find a “temperature reading” on the market and the risk level on the “field.”

Relative Strength Line Up of the Asset Classes:

Q3: Unchanged from last quarter

7/1/2014: (All Unchanged since 3Q 2013)

- #1 Asset Class: Domestic Equities

- #2 Asset Class: International Equities

- Market Status: BULL

- NYSE Bullish Percent: 69.85% (up from 62% Q2) OFFENSE (Reversed up from Defense on 2/24/14)

Independence or Not?

Independence day this year rung in with a new milestone on the Dow Jones Industrial Average closing above the 17,000 on July the 3rd.

Is this move too, an independent move or supported by the remainder of the market?

Indeed there is much supporting this move as most indices improved in Q2 while all assets classes either remained unchanged in their rank amongst one another, or improved slightly. So, while there was little illustration of any change of leadership amongst sectors and none in the way of asset class leadership shift, the risk on the field has edged up a small step, but statistically a great leap.

Why? The holy grail of Alphavest’s risk metrics is the NYSE Bullish Percent Index. We began the quarter with a reading of 62% (refresher: 62% of stocks are trading on a BUY signal…VERY POSITIVE), and rung in the new quarter with a modest increase to a reading of 69.85%. Not a big move, right? Yet it is.

A reading over 70% changes which play book we will use for investment selection and portfolio design. Remembering that RULES are the cornerstone to a successful and disciplined investment strategy, we will be playing by the rules and switching to the “70% NYSE BP Play Book.”

Is this bad or scary to have a reading of 70%+? NO. It simply means that above 70%, only 30% of stocks need to improve to a “BUY” status—basically a pretty chart of upward performance. And 30% isn’t much, so, while a tide running at 70% is one that we never swim against, AKA selling or taking profits at this time, it is a time to make some more conservative investing decisions. It may be exhale time, in other words, and we will be prepared given the play book switch.

A few “70% Play Book” moves:

- A move to more ETF ownership versus risking owning single stock names. In other words we’ll lean towards buying a tech index ETF such as QQEW that owns 101 tech names such as Apple versus taking a new position in Apple.

- A “no exceptions” policy to holdings falling below a reading of 3-SELL, SELL, SELL

- Setting more stop losses on our big gainers so as to not let all our profits slip away

My challenge continues: to ensure that 100% of our clients GET our “follow the leadership” philosophy. Let us know how we are doing! If you have any questions about the particulars of your portfolio, or would like to discuss the potential opportunities that I have seen arise within the equity market, please click here to email me and let’s connect!

As we journey into 70%+ territory, just remember: We have you MANAGED! Did you find this too technical? Let me know what you want to hear about next Qtr!

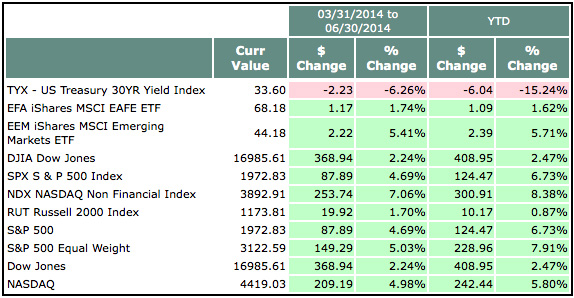

Q2 2014 and YTD Market Stats:

3/31/2014 – 06/30/2014

The returns for Indicies, ETFs and Stocks do not reflect dividends and are based on the last sale for the date requested

Resources, Resources, Resources!

Check out our new website and our Resources page on the Alphavest website and explore the many resources that we are trying to empower all investors with.

A snapshot of what’s there:

Morningstar™ Fee Analysis. Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying.

Free Consultations with Cokie. Not many use this function, but those who do have been pleased! We use this resource to offer investors an no-pressure opportunity to assess good-fit with Alphavest. This is a great place to send those that you think may need our services. Thank you for your referrals and consideration!

FINRA Advisor Background check. FINRA reports that only only a small percentage of investors check their advisors record before making a switch. We run background checks on our employees, our childcare providers—why not run one–its FREE–on the person who manages your money? Rest assured our record is spotless…here’s a copy of ours: Cokie’s U4. (How do we attach a PDF here?) The important feature of the report is that it will report “NO DISCLOSURES” which means no fraud or investor complaints.

Rules Quarterly

Some ask, “What makes Alphavest’s investment philosophy so different?” Or, “If you were to offer 1 thing investors should do to succeed….” and the answer is RULES.

I want to demystify the noise for investors and and help them break free from Wall Street’s games. One way to do this, beyond lowering fees and eliminating conflicts of interest is to abide by a rule-based, not an emotion or ego based investment methodology.

At Alphavest, that’s what we do: FOLLOW THE RULES.

Last Quarter’s Rule in review:

IF: An Asset Class (bonds, equities, commodities, currencies) is underperfoming CASH….

THEN: DON’T invest in it.

Click here to review the Q2 2014 overview.

New Rule to digest:

Rule #4: This rule is an expansion of the above commentary about our “Play Book” when the NYSE Bullish Percent is over 70%.

IF: NYSE Bullish Percent is over 70% and we are on Offense,

THEN: Move towards ETF (Exchange Traded Fund) ownership versus owning single stock names.

So, while currently Healthcare and Industrials are top of our list, we will be looking to own RYH (Healthcare ETF that owns 52 stocks) with a 2% position in Celgene versus buying a 5-10% position in Celgene, outright—much different risk scenario.

Stay tuned for Rule #5 next quarter.

Subscribe to Cokie’s Blog for more frequent updates on Markets and Matters….

Most of my blogs are less than 200 words – short and sweet! I have 2 weekly posts one is uber-short and the other highlights our Investment Management “Rules” with one Rule detailed each week.

Q1 Most Read Blogs:

- 3 Crash Proof Retirement Ideas For 2014

- What Are Investment Objectives?

- 5 Questions to Ask Fee Only Planning Professionals

Join the Liberated Investor Movement TODAY!

We launched the Liberated Investor Movement in an effort to educate investors on how to break free from being held hostage by “Big Brokerage.”

The Liberated Investor Tool Kit exposes five areas of the investment management industry where the deck is stacked against investors and offers simple and direct advice:

- Excessive Fees and What Can Be Done About Them

- The Myth of Buy and Hold

- The Emotion Behind Market Timing

- Industry Conflicts of Interest

- How to Hire An Advisor That’s On Your Side

Download the Tool Kit today and share with your Facebook community and friends and family!

The best way to refer us? Tell others to download the FREE The Liberated Investor Tool Kit: