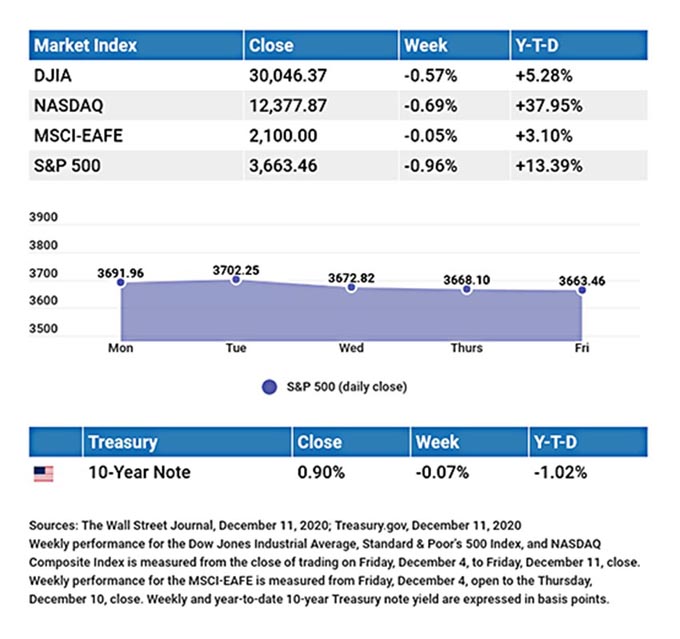

| A Note from Cokie: It seems that there are some on Wall Street that can’t get past the rise in Covid cases despite the optimism surrounding the release of a vaccine. We all know the impact Covid has had on our country and on many of us personally, but now is not the time to “flag.” It’s a time to remain positive as we begin to see more and more people taking measures to STOP this virus through personal care and government release of a hopeful vaccine. I do believe because the need is great, we will see some type of stimulus package put together before the first of the year. But some investors wonder if the news concerning the vaccine will translate into bad news for stocks, especially if it undercuts prospects for another round of fiscal stimulus from Washington. At the forefront is whether the economy will need a boost to get through the winter. Many fear that an economic rebound from the second quarter’s implosion will lose steam as consumers tap savings and a rise in COVID-19 cases curtail consumer and business activity. Megan Horneman, director of portfolio strategy at Verdence Capital Advisors, says, “We continue to believe another package is needed to bridge the gap as we move through the tough winter months.” There are some economists who contend the economy remains in a V-shaped rebound and that the underlying fundamentals remain robust. I like the view from where I stand right now but if you are having difficulty with what you see when you look at your portfolio, schedule a free 15-minute consult and checkup! The Week on Wall Street Stocks retreated last week on rising COVID-19 infections and slow progress on an economic relief bill. The Dow Jones Industrial Average dipped 0.57%, while the Standard & Poor’s 500 dropped 0.96%. The Nasdaq Composite index fell 0.69% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 0.05%.[1][2][3] |

| Stimulus Stalls, Stocks Stumble The market grappled all week with worries over rising COVID-19 cases and the economic restrictions that followed. Nevertheless, there were moments of optimism- such as the starting of vaccinations in the U.K.- that drove markets to record highs.[4] But gains could not be sustained as an agreement on a fiscal stimulus bill remained elusive and daily news regarding COVID-19 cases undermined investor sentiment. Markets were also challenged by having to absorb a number of new and secondary stock offerings last week, including two high-profile technology IPOs. The Energy sector continued its strong run, while small and mid-cap stocks posted another week of positive performance.[5] A “No-Deal” Brexit More Likely The prospects of an agreement to manage Britain’s exit from the European Union by year end dimmed as the two parties failed to narrow their differences in a meeting held last week.[6] Though primarily a European issue, a no-deal Brexit may hold consequences for U.S. businesses and investors. The failure to reach an agreement has the potential to disrupt an already fragile supply chain and cause issues in the financial markets. A supply chain disruption may weaken European economies (e.g., Germany) that are important to American companies. Another consequence may be a stronger U.S. dollar, which would make American exports more expensive and less competitive. Little time remains in striking an agreement since the prevailing framework ends December 31, 2020. THIS WEEK: KEY ECONOMIC DATA Tuesday: Industrial Production. Wednesday: Retail Sales, Federal Open Market Committee (FOMC) Announcement. Thursday: Housing Starts, Jobless Claims. Friday: Index of Leading Economic Indicators. Source: Econoday, December 11, 2020 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THIS WEEK: COMPANIES REPORTING EARNINGS Thursday: General Mills (GIS) Friday: Darden Restaurants (DRI) Source: Zacks, December 11, 2020 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice. |

[1] The Wall Street Journal, December 11, 2020

[2] The Wall Street Journal, December 11, 2020

[3] The Wall Street Journal, December 11, 2020

[4] USAToday.com, December 8, 2020

[5] CNBC.com, December 10, 2020

[6] CNBC.com, December 9, 2020