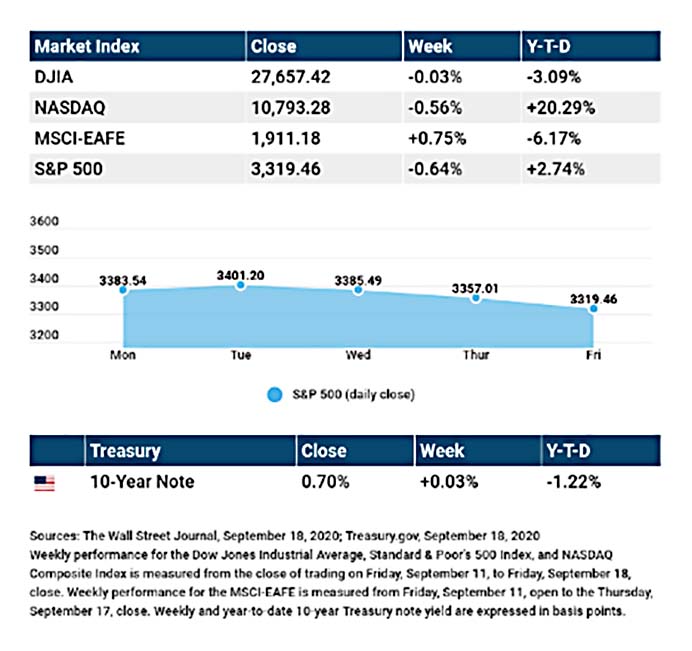

| A Note from Cokie— Big Tech companies continue to slide making the adage true: “As the Big Tech companies’ go, so goes the market.” After a brief span before the Labor Day weekend, when all of the ten most valuable members of the Nasdaq hit all-time highs, the group did a turn-around and dropped 7.2% by the close on September 15, essentially undoing $700 billion in market cap from their peak, though the vast majority of stocks––including beaten down financials and airlines––proved resilient over that period. Their numbers and strength were not sufficient to offset the drag from the falling tech titans. Remember: it’s the Big Tech companies that wield the power. When you look over a longer period of time, you find this group has rebounded since the initial drop in early September, showing that once again companies like Apple and Tesla may be on the march. Since the coronavirus crisis hit in March, investors flocked to buy shares of Tech stock. They were convinced that their already dominant positions in the American economy would only grow stronger as lock downs resulted in more people working from home. So, has the gamble paid off? Stay tuned this week and the following for more results. The following is a weekly update from Wealth Enhancement & Preservation. The Week on Wall Street Stocks slipped as the technology sector remained under pressure and a mid-week announcement by the Federal Reserve failed to inspire investors. The Dow Jones Industrial Average declined 0.03%, while the Standard & Poor’s 500 fell 0.64%. The Nasdaq Composite index dropped 0.56% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, rose 0.75%.[1][2][3] |

| Technology Pulls Stocks Lower As has been the case in recent weeks, technology stocks led the market higher, then lower in an otherwise turbulent week of trading. Merger and acquisition activity announced at the start of the week generated a rush back into technology stocks, sparking a rebound from the previous week’s drop. Stocks continued to advance until Wednesday, when investors began to digest comments from the Fed’s Federal Open Market Committee meeting. The Fed delivered a message that coupled assurances of continued low rates with concerns about the health of the economic recovery.[4] The Fed Stays the Course In the last Federal Open Market Committee (FOMC) meeting before the November election, the Fed signaled that interest rates would not be increased “until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.”[5] Most Fed officials do not see this happening until 2023. While the Fed maintained its view on the importance of fiscal stimulus to help American workers and businesses, it did improve its outlook for unemployment in its latest economic outlook. The Fed now expects unemployment would average around 7-8% in the final three months of the year, down from its June prediction of around 9-10%.[6] THIS WEEK: KEY ECONOMIC DATA Tuesday: Existing Home Sales. Thursday: Jobless Claims. New Home Sales. Friday: Durable Goods Orders. Source: Econoday, September 18, 2020 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THIS WEEK: COMPANIES REPORTING EARNINGS Tuesday: Nike (NKE), Autozone (AZO), Fedex (FDX) Wednesday: General Mills (GIS) Thursday: Costco Wholesale (COST), Darden Restaurants (DRI), Carnival Corp. (CCL) Source: Zacks, September 18, 2020 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice. |

[1] The Wall Street Journal, September 18, 2020

[2] The Wall Street Journal, September 18, 2020

[3] The Wall Street Journal, September 18, 2020

[4] The Wall Street Journal, September 16, 2020

[5] The Wall Street Journal, September 16, 2020

[6] The Wall Street Journal, September 16, 2020