This firm has taken some criticism from others and clients for addressing any fear or concerns related to COVID-19. But as a trusted advisor, one who cares deeply about our clients from not only a stocks and bonds basis, it is the right thing to do now and going forward. I plan to update you on the sentiments of other experts as it relates to your overall well-being.

I’m not always right, nor are the experts, so I hope you’ll receive each update and blog that is written with the care its intended.

If you are, like most people, highly concerned about the “downs” of the Market. Here are 10 things you can do to avoid panicking! https://www.marketwatch.com/story/freaking-out-doesnt-help-10-smart-things-to-do-right-now-instead-of-panicking-about-the-dows-plunge-or-coronavirus-2020-03-09 )

As an update: The World Health Organization (WHO) has a set of recommendations for how to deal with stress stemming from the virus. And while I’m NOT a stress expert, it does feel like I could have an honorary PHD in stress management, especially given the investment management conundrums I have gained since 1996.

As of the third week in March, the coronavirus infected 128,392 people globally and killed 4,728 and even now those numbers are rising quickly. According to data from Johns Hopkins University’s Center for Systems Science and Engineering, there have been 69,607 recoveries.

At the beginning of this week, the New York Times reported that the U.S. has over 30,000 confirmed coronavirus cases and 40 deaths. https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html

WHO also recommends people limit the amount of time “you and your family spend watching or listening to media coverage that you perceive as upsetting.” I agree—so digest, criticize or heed. Pick up an outdated copy of Dave Ramsay’s Financial Peace University or download my Liberated Investor eBook and grab a piece of tried and true financial advice that may just distract you from worry or fear and guide you toward concrete, controllable action.

Financial advisers say the same is true for those who are worried about their 401(k) or their investments in their favorite stocks, whether it’s AAPL, -3.445% Google GOOG, -2.679%, Tesla TSLA, -11.539% or Facebook FB, -5.300%.

“Freaking out doesn’t help you stay healthy,” said Catherine Belling, a professor at Northwestern University, Feinberg School of Medicine, who studies the role of fear and anxiety in health care. “It just makes you feel really bad and keeps you from doing the rational things that actually might help you stay healthy.” Instead of throwing yourself into a rabbit-hole of panic and anxiety, here are 10 ways to regain your sense of control.

Distract yourself from alarming headlines

If you’re a relatively young, long-term investor; you should accept that market corrections are normal and that long-term financial plans take into account these types of downturns.

If you have more than 10 years before needing the investments that you’re currently worried about, you shouldn’t be worrying. There are only five instances back to 1907 where the S&P 500 has lost money on a 10 year basis. Bottom line: stay put.

There’s no question that markets like this one, the last Black Swan event, 911, and not unlike the recession of 2008 and the tech bubble of 2000 offer great insights and learning moments for properly assessing your risk tolerance. For over 20 years, I have predicted when a bad market is on the horizon.

When a client approaches me about taking more risk in their accounts, I ask that person to evaluate your risk based on how much you’re willing to lose, and NOT how much you’d like to gain. We have a robust risk tool that can help you re-evaluate your concept of risk and match it to your portfolio. AND you should wait until this market reverses back. It will, within the next 3 months, I suspect.

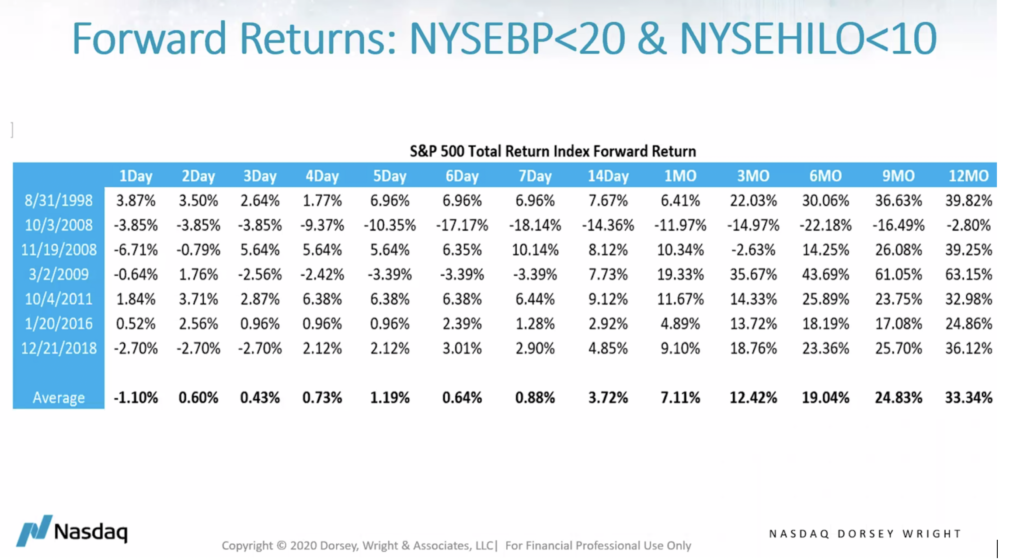

Two key indicators that my friends at Dorsey Wright and associates track, the HILO and NYSE Bullish Percent indicators, offer that the opportunity is good for a reversal in the stock market and most likely double-digit positive returns on a 3, 6, 9 and 12 month basis from a reversal.

Remember at Alphavest, we are stock agnostics. We don’t believe in owning stocks if we are in a bear market. So, we don’t have to believe the above chart. I’ll explain more below; but, quickly, by this I mean, we simply aim to steer our clients clear of Bear markets. We don’t espouse to be wise enough to do this for Black swan events—side-stepping market downturns, that is.

So, you can count on us to prudently evaluate the risk on the field as measured by the relative strength of the most actively traded assets classes, like stocks and bonds and international stocks. Instead, we tactically guide you to shift your investments based on price performance data, not emotions or opinions. IF bonds are outperforming stocks, that makes us bonds owners. And this is what we are today.

The indicators, the pure data mentioned above, are steering us as if it were in January 2008 again. Yes–that was 9 months ahead of the bear market which began, by my data, in July 2008. Both asset shifts far in advance of the Q4 2008 sell off of nearly 40%. So, are we in a bear market? NO.

For those with significant market history the bear market indicator, we purely (not subjectively) look at the performance of being long meaning the S&P 500 (SPY) versus the performance of being SHORT the S&P 500 (SH).

Being “short” is not what you want (when the S&P is down 10%—you want to be up 10%), in essence, you really want to perform better than this, so you don’t want to own stocks. If you do, you’ll lose money 80% of the time.

At Alphavest, and in our All-Weather model, you are in 70% stocks and bonds right now.

We haven’t seen all the indicators that confirmed the 2000 tech bubble in October 2000 or the 2008 Financial Crises in July 2008. So, the question really is, will you know how to respond to the Market or will you be invested as if you knew.

I can show you how to “be invested as if you knew. Call me for a free 15 Minute CONSULT.