A Note from Cokie — As much as I want to write that we are off the roller coaster ride regarding the market, I don’t believe we are. You still need to be aware that you will see market gains and loss as the country seeks to get back “online” amid the constant chatter that there is a second wave of Covid-19 coming.

Early week record highs have been erased. The noise coming out of Wall Street today (Thursday) is much more than a sigh after many of the US states are reporting a rise in coronavirus cases. This gloomy outlook from the Federal Reserve removed investor “giddiness” that a quick recovery was at hand.

What can you do? Stay informed (we will recover), but also realize that the best plan to have for the future is the one you have put in place with your financial advisor. Stay steady, stay on course, and stay safe. I continue to offer free 15-minute consults. Let’s review yours!

The Week on Wall Street

A positive jobs report sent stocks soaring last Friday, capping a solid week as evidence of a global economic recovery outweighed concerns over civil unrest and tensions with China.

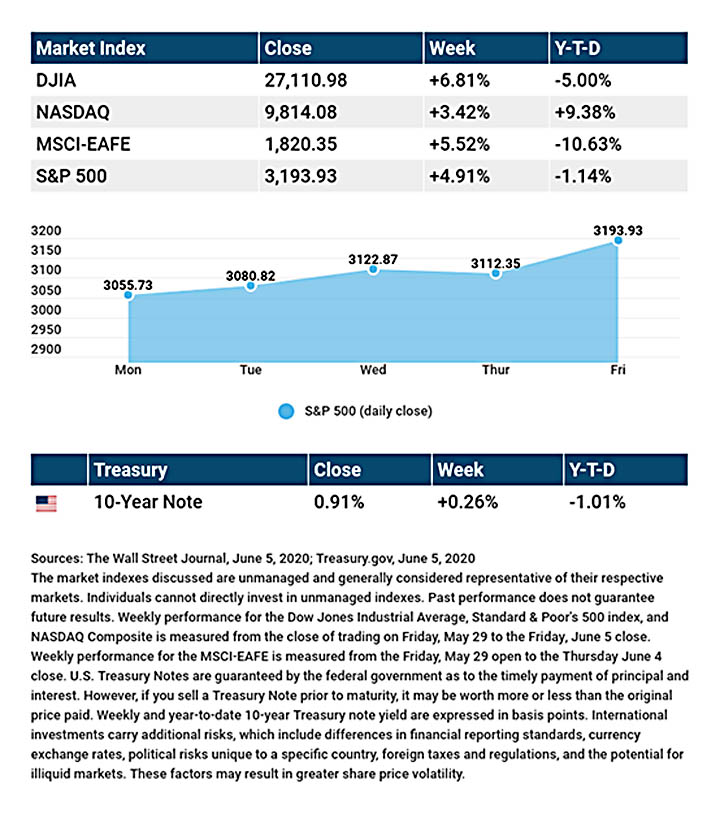

The Dow Jones Industrial Average jumped 6.81%, while the Standard & Poor’s 500 advanced 4.91%. The tech-heavy Nasdaq Composite Index lagged, climbing 3.42%. The MSCI EAFE Index, which tracks developed stock markets overseas, gained 5.52%.[1][2][3]

Stocks March Higher

Despite multiple headwinds, stocks rode a wave of optimism over economic recovery and were encouraged by signs that a feared spike in COVID-19 had not occurred.

Firming oil prices and positive global manufacturing data helped boost stocks during the week. The market continued to be led by industry sectors that were most battered in the March decline, as price advances slowed in growth-oriented stocks, primarily technology names.

After a pause on Thursday, stocks surged on Friday when a jobs report surprisingly showed 2.5 million new jobs in May, with the unemployment rate falling to 13.3%. Wall Street expected a jobs decline of over 8 million and an unemployment rate of 19.5%.[4][5]

A Wall of Worry

While the markets continued to move higher last week, many investors are concerned that the recovery may be hindered by simmering tensions with China and the civil unrest that erupted last week.

China has been a longstanding source of market worry, but the civil unrest introduces a new challenge. For now, the market appears to have shrugged off these concerns.

Final Thought

This past Wednesday marked the best 50-day gain for the S&P 500 in the index’s history. During a period that approximates the lifespan of a mosquito, stock market sentiment has swung from near-absolute despair in late March to positively bullish.[6]

Often, the most impactful lessons in life tend to be those most recently learned. If the last three months have offered investors any lesson, it may be that trying to time the market is a challenging proposition.

THIS WEEK: KEY ECONOMIC DATA

Wednesday: Consumer Price Index (CPI). Federal Open Market Committee (FOMC) Meeting Announcement. Federal Reserve Chair Press Conference.

Thursday: Jobless Claims.

Source: Econoday, June 5, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Coupa Software (COUP).

Tuesday: Chewy (CHWY).

Thursday: Lululemon (LULU).

Source: Zacks, June 5, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

| Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896. The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. |

| [1] The Wall Street Journal, June 5, 2020 [2] The Wall Street Journal, June 5, 2020 [3] The Wall Street Journal, June 5, 2020 [4] CNBC, June 5, 2020 [5] CNBC, June 5, 2020 [6] The Wall Street Journal, June 4, 2020 [7] Wide Open Eats, June 5, 2020 [8] IRS.gov, June 5, 2020 |