PRESS PLAY for a LIVE Friday 3 For 3!

The Fed sound byte; the FOMC concluded its September meeting on Wednesday and left rates unchanged, as had been expected. The statement of economic projections released following the meeting showed that FOMC members’ projections for the level of interest rates in 2024 and 2025 had increased by 50 basis points.

Long-term US Treasury yields rose on Thursday with the 10-year yield index hitting a new multi-year high at 4.49%. Further in on the yield curve, the five-year yield index reached 4.65%, its highest level since August 2007. Federal Reserve officials voted to hold interest rates steady at a 22-year high and revealed a divide over whether they should raise them once more this year, with most leaning toward another increase.

Fed Chair Jerome Powell said that officials didn’t need to decide yet whether to lift rates again after a historically rapid series of increases over the past 18 months and as they await evidence that a recent inflation slowdown can be sustained.

“Really, what people are saying is, ‘Let’s see how the data come in,’” he said at a news conference Wednesday. “They want to be convinced. They want to be careful not to jump to a conclusion.”

Fed officials also indicated they expect to keep rates higher for longer through 2024 than they anticipated earlier this year. This isn’t the first time you’ve heard this from me—higher rates could mean further sideways markets; I believe when I look back, 5 years or more from today, I will recognize, as I do today—the POWER of cash earning 5%+, with DAILY liquidity. THAT. More powerful than AI? Maybe not—but the best “risk-free” asset of the decade, YES.

Back to the Fed . . . Projections released at the conclusion of the Fed’s two-day policy meeting showed 12 of 19 officials favor raising rates one more time this year, while seven think they can leave them unchanged. They meet Oct. 31-Nov. 1 and again in December.

“The fact that we’ve come this far lets us really proceed carefully,” said Powell. He used those words “proceed carefully” six times during Wednesday’s news conference, a sign of heightened caution about lifting rates.

“He didn’t sound to me like he was itching to hike again,” said Michael Feroli, chief U.S. economist at JPMorgan Chase, who thinks the Fed’s July rate rise will be its last for the current cycle. “For Powell, he sounds like he’s pretty comfortable where they are, sitting back, and watching things play out,” Feroli said.

Officials appeared to be more confident than they were in their last set of projections in June that they could bring inflation down to their 2% goal without a sharp economic slowdown, achieving a so-called soft landing.

They saw a brighter outlook for economic growth and hiring than they did in June, when officials projected a rise in the unemployment rate of a magnitude that has only occurred during a recession. They now see the unemployment rate, which was 3.8% in August, rising to 4.1% at the end of next year.

“This would be a beautiful outcome. You’d be in macroeconomic heaven,” said former Fed governor Laurence Meyer, who runs an economic advisory firm. While the forecast “looks optimistic, I basically agree with it,” he said. There it is . . . Macroeconomic heaven. You gotta love economists. How about lower inflation, higher wage productivity and growth and lower rates . . . that, I offer, is macroeconomic heaven.

With economic activity stronger than anticipated, most officials expected they would need to keep interest rates near their current level through next year. The median projection showed officials expect to lower the fed-funds rate to around 5% by the end of 2024, implying two rate cuts next year if they hike again this year. So what, who cares? YOU do—rate cuts mean more solid footing for equity markets. Don’t hold your breath. We have a few more traverses to climb

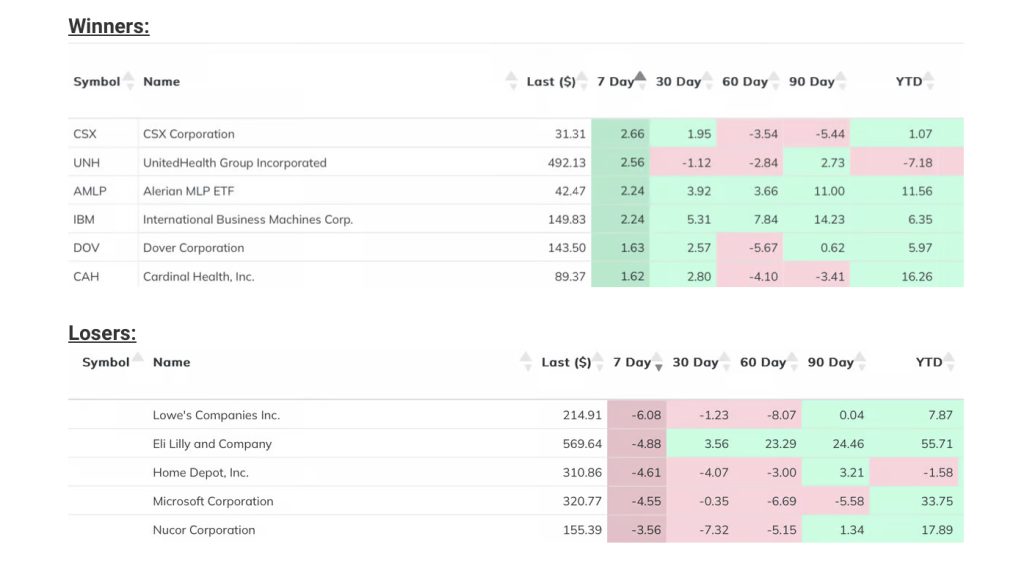

Below you’ll see winners and losers for this week. I’ll give you a longer view on the portfolios holdings at the end of each quarter–that’s coming soon! WInners aren’t always as they seem; note CSX and UNH, members of our Equity Income portfolio are our #1 and #2 winners this week, YET performance YTD is far below that of the Dow Jones Industrials benchmark return of 10.08% YTD. These positions, as mentioned before are being evaluated for replacement in the Equity Income portfolio.

It was a tough week for all markets, off across the board from the Dow to the Nasdaq of 2.4%-5.04%, respectively. We were expecting this, right? Its September. The portfolios have been positioned more defensively with high yielding cash levels, higher dividend “yielders” in the Aristocrats model and our Equity Income models and with our Tactical model long the US Dollar, up for the week.

Given our strong US Dollar outlook, we are underweight International exposure and with approximately 2/3rd of the portfolio’s overall positions outperforming the S&P 500 this week, we see evidence that we’re positioned well for further rate hikes and potentially lower equity returns for the near future.

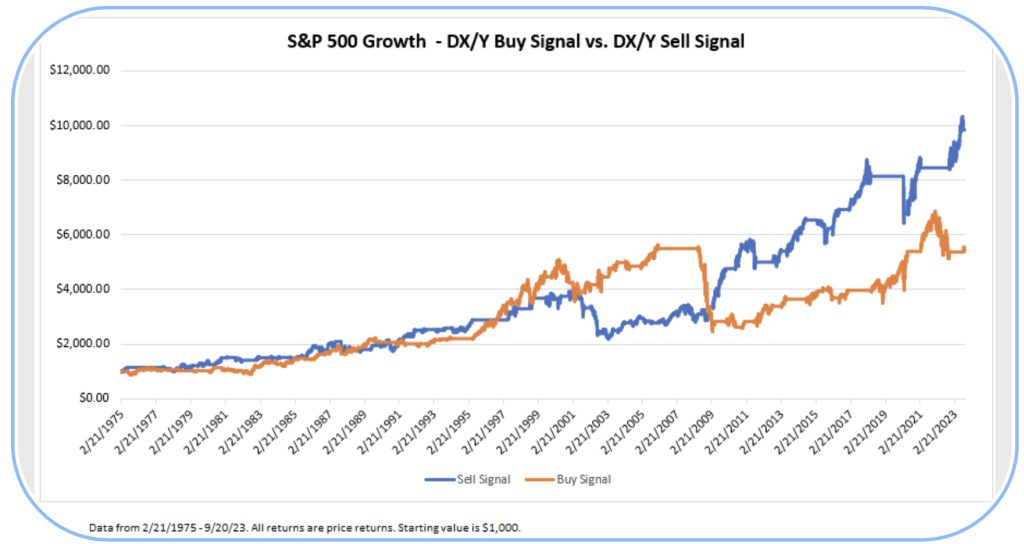

| A pre-cursor to this week’s “Let’s Grow”–a US Dollar 101 Mini Masterclass: So what is it about the US Dollar relationship and stocks? A deeper dive, since 1975, the earliest data for the Dollar index, the S&P 500 has performed significantly better during periods when dollar is on a sell signal than when it is on a buy signal. Since February 21, 1975, the S&P 500 has returned just under 885% when the Dollar is on a sell signal. During periods when Dollar has been on a buy signal, SPX has generated a cumulative return of just over 441%, or less than half of the growth rate during Dollar index sell signals. |

| At first glance, these figures may appear low – after all, the S&P 500 is up more than 5,000% since 1975 – but this illustrates the magic of compounding returns. A “Perfect” time to insert a 3-6-10 Allocation mention. Keep your 10-Year bucket invested. The takeaway here isn’t that we should eliminate or even reduce US equities exposure when the dollar is rising; by doing so we would have missed out on a significant chunk of SPX’s growth over the last 48 years. However, what it does tell us is that we should expect US equities grow at a faster pace during periods when the Dollar is on a sell signal/trending downward. In the case of international equities, the reason for a rising US dollar acting as a headwind is mechanical – foreign denominated holdings are worth less when converted back to US dollars. However, in the case of US equities, the relationship is less straightforward. One explanation is that the US dollar is the world’s reserve currency and seen as a safehaven, so when markets are risk-off, demand for the dollar is higher and vice versa when the posture is risk-on. A Penny… or a dollar for your thoughts…. |

Let’s Grow

I spoke with a potential client this week—and it was a Perfect Day. Why? She asked me, “You’re a fiduciary, right?” The industry has come a long way—what a Perfect Day for investors! I am a Fiduciary- I have been since 2008 when I left “big brokerage”, synonymous with firm/advisor centric advice vs. what you deserve, investor-centric advice. I feel like that’s a boring topic…but in the scope of “Let’s Grow,” how about this: It’s estimated that non-fiduciary advice costs investors an unnecessary $17 billion dollars per year in fees and commissions. Those are serious Perfect Day retirement dream dollars!

It’s sad that our industry has a distinction for those advisors that do and don’t put their clients’ best interest ahead of their own. WHAT!?! It’s sad that advisors even exist that don’t have to abide, legally, by a Fiduciary Standard.

Do you have other accounts that have you wondering if your advisor is a Fiduciary? Let’s talk!

AND…We’re hiring. Know of an Advisor that wants to take the Fiduciary leap? It can hurt to walk away from fees and commissions. We can help that Advisor, financially, take the next right step. Now you’ve grown, in regulatory knowledge and professional confidence, with Alphavest…and we’re growing…our Alphavest Advisors. Demand the highest standard. Demand a Fiduciary!

Fun Facts:

“Help me to make things better!” Jane Goodall.

Did you know that 89 year old Jane Goodall travels and speaks 300 days a year? She spoke in Charleston, SC this week and conveyed the importance of motherhood, a sense of hope that is only possible with community, and imparted that we all can do our part to impact our planet. The emphasis on her mother’s role on her often regarded “iconic” life path was touching to me.

Here is a link to a moving video she shared with us about a near-to-death chimpanzee, “Wounda” who was rehabilitated and released on a private island in Africa.

To quote a client who joined me for the event,

“It enlarged me. It will be one of my favorite events for 2023.” —KC, Charleston, SC

“Jane” is the title of the 2017 Documentary of her life and she closed the event on Tuesday by sharing that her next great adventure will be dying. WOW.

What’ll it be? What’s your next great adventure? Respond for brownie points and funding to Jane’s Roots and Shoots via the Jane Goodall Foundation in your name! Connect with us–we want to know!