The recent scary news of the bank closure of Silicon Valley Bank and Signature Bank, I wanted to send you some commentary on this development, offer an update from last month’s market update and touch on SAFETY.

Last Tuesday’s market response has been encouraging—with US markets up initially, 1-2% across the board signaling investors relief and sentiment that perhaps the fears of further bank “contagion” given the SVB and Signature Bank failures are “contained,” to quote CNBC, yet today we are seeing some reversal of that sentiment given further negative news out that “Credit Suisse is adding pressure to the already troubled banking sector.” This, on the heels of a plan from bank regulators to offer access to SVB depositors.

Follow us on LinkedIN, if you prefer for weekly updates…..

The market response has been encouraging—with US markets up initially, 1-2% across the board signaling investors relief and sentiment that perhaps the fears of further bank “contagion” given the SVB and Signature Bank failures are “contained,” to quote CNBC, yet today we are seeing some reversal of that sentiment given further negative news out that “Credit Suisse is adding pressure to the already troubled banking sector.” This, on the heels of a plan from bank regulators to offer access to SVB depositors.

SAFETY

- Bank deposits (most) are FDIC insured up to $250k.

- Brokerage institutions (most) like TDAmeritrade/Schwab and Folio/Goldman Sachs offer SIPC insurance up to $500k on customer deposits—AND, additional supplemental insurance in the event of institution failure. In the case of Schwab, up to $149.5 million per customer–this is a reassuring piece to validate Schwab’s insurance coverage that applies to most of you.

NOTE: Neither SIPC nor the supplemental insurance coverage protect against losses resulting from a decline in the market value of securities.

Market Update and Recap from last month:

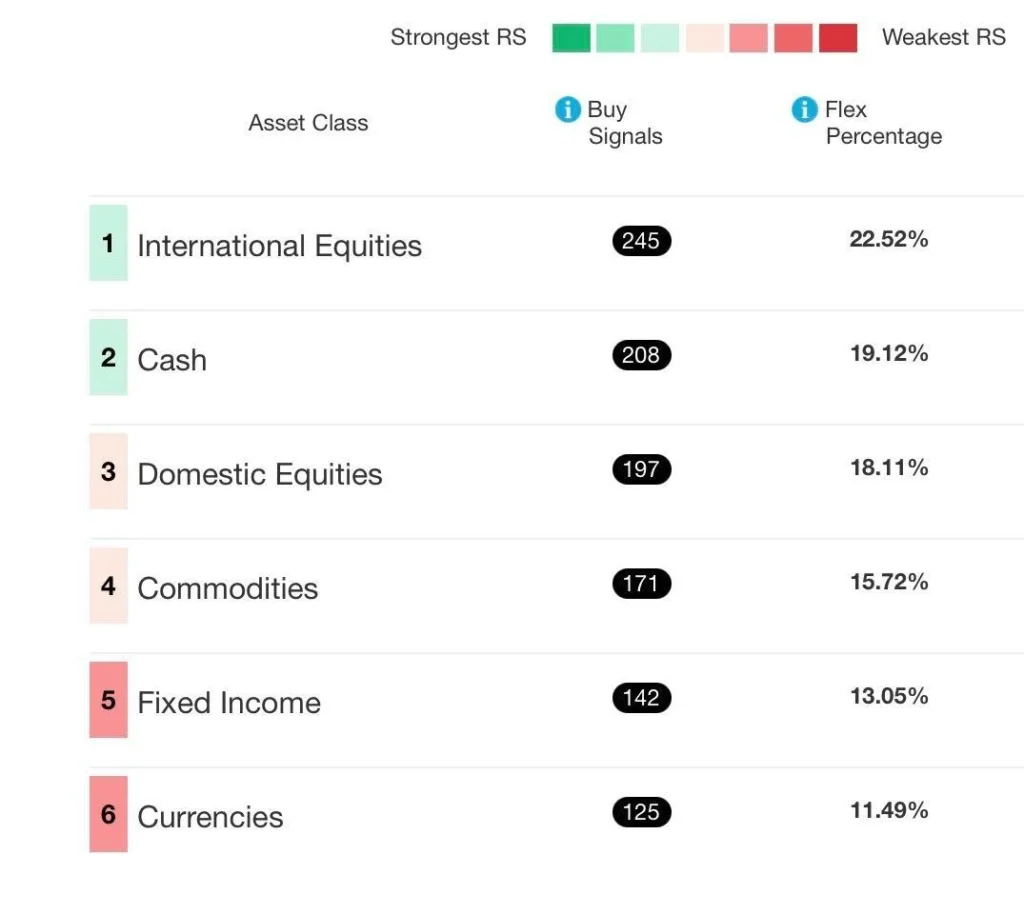

For a recap and update on broader markets and asset class developments, let’s review the Relative Strength readings from the Dorsey Wright Asset Scale, sent last month:

Note that Domestic Equities has joined a top 3 spot (2/01/2023) while its footing is not as strong as it was last month, 3rd is better than 4th, 5th or 6th–

here is a tally update (black ovals below) to assess the immaterial moves in all asset classes, despite the market’s ups and downs in the last month;

International Equities: 248/+3

Cash: 207/-1

Domestic Equities: 190/-7

Commodities: 186/+15

Fixed Income/Bonds: 136/-6

Currencies: 124/-1

CLICK HERE for a more in-depth look from our partners at Dorsey Wright.

I spoke last month’s video/email address (link below) of being aware and ready for the “next wave” in the market. We just rode it, and yesterday’s rally and today’s sell-off are examples of the waves I see that will continue to come our way. The VIX/Volatility index is back to almost 31; the first time the VIX has been above 30 since last April 2022. Given this high reading, I expect more of the same—VOLATILITY for the short-term. The VIX spiked from 18.51 last Tuesday to an intraday high of 30.81 on 3/13, marking a 66% increase in expected volatility for the S&P 500 Index over the next 30 days. Volatility doesn’t necessarily mean losses—it means ups and downs. This is why its critical to ensure proper security selection and even more importantly, that your overall allocation to stocks/bonds/cash is in alignment with your needs/risk tolerance.

How much should you invest in Equities right now?

Depending upon whether your allocation calls for shoring up your 3-YR, and/or re-assessing your 10-YR buckets will determine, largely, how you weather this next wave. You’ll recall my comment about buying “stocks on sale” in your 10-YR bucket—when the VIX spikes, as we just saw, is the time to do that. Many of you, however, should, and can afford, to play it safe and sit out the “stock sale” that happened last week. UNSURE what opportunities you should or should NOT be taking? I welcome the opportunity to more precisely integrate your current portfolio into 3 tangible, manageable “Buckets” that should ease, and better, I believe, improve your overall investing experience in this, yes—STILL, volatile time. KNOW that our Tactical models are managing risk with an allocation to cash, AND most of you have already been reallocated to more conservative models given added pressures with the current market scenario. As you experienced and have heard from me before—“WE HAVE YOU MANAGED.”

I am committed to customizing a PLAN that resonates with you for a better market experience, today and for years to come. VIDEO REPLAY CLICK HERE: this a replay of last month’s video that offers more insight to this “Bucket” Planning approach reiterated herein.

Lets connect!

Need more info? Grab a 15-minute time slot with Cokie to discuss risk and allocation so that we can ensure you are on the right track! Also, Q2 review season is almost here–grab a spot. See you in May 2022, if not sooner.

Thank you, as always for your feedback on how we can better communicate with you, and improve your experience navigating markets.

Committed to you financial success,

Helen “Cokie” Cox, CFP®

Alphavest, CEO

Wealth Enhancement & Preservation, Managing Partner, Charleston