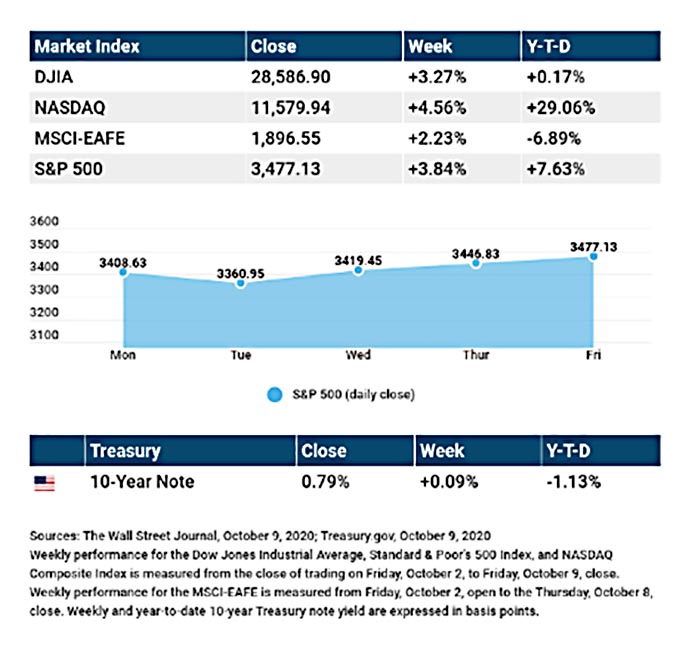

| A Note from Cokie: For the last couple of weeks I have answered basically the same election question: What do I need to do if the person I support is not elected president? Here’s what I tell them, “Never invest as a result of your politics!” Savvy investors focus on long-term economic trends. These trends are likely to continue no matter which party is in the White House. Therefore, you need to set a plan in place and stick to it. I can help you with this. It is the long-term trends that will have a profound impact for years, even decades. What trends are holding firm and even rising? Manufacturing is on the rise. That’s good for our economy! In fact, manufacturing jobs are returning to the USA, which will drive employment growth, productivity and corporate margins. Technology also is and will continue to drive growth in the economy. Tech companies continue to see solid growth. Finally, even though we are still working through a pandemic, Global growth continues to be strong. What does all of this mean? Well, hang on. While the next few months may appear turbulent because elections do have consequences, long-term trends are embedded in our economy. We will get through this time well regardless of how the political winds blow! The Week on Wall Street Stocks staged a powerful rally last week, riding a wave of optimism over the prospect of the passage of a new fiscal stimulus bill. The Dow Jones Industrial Average rose 3.27%, while the Standard & Poor’s 500 increased 3.84%. The Nasdaq Composite index gained 4.56% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.23%.[1][2][3] |

| Stimulus Stalemate? The anticipation of lawmakers passing a new round of economic stimulus was a decisive driver of market action all week. A mid-week tweet by President Trump announcing that he was ending stimulus negotiations sent stocks lower. Losses were exacerbated by sharp declines in some mega-cap technology companies as details emerged from a House Judiciary subcommittee report on its investigation into their competitive practices.[4] Stocks quickly reversed direction, climbing after the President tweeted that he would sign a limited stimulus bill, but lawmakers appeared to reject a piecemeal approach. Stocks consolidated on Friday, helped by continuing stimulus talks and new election polls that suggested that the risk of a contested outcome appeared to be fading. Small Cap Rally The outperformance of large cap stocks relative to small cap stocks has been both wide and persistent during the last ten years. Last week’s action in small cap stocks, as represented by the Russell 2000 Index, indicates that smaller companies may finally be making up some ground.[5] Last week, the Russell 2000 Index rose 6.33%, outperforming the S&P 500 by 2.4%.[6] While this outperformance may be fleeting, a potential broadening of the stock market rally may be considered a healthy development. Final Thoughts This week begins the third-quarter earnings season, with companies from a variety of industry sectors reporting (see below). Early earnings reports start predominantly with the major banks, whose earnings results may provide insight into the general health of American consumers. As is often the case, company guidance about the future earnings may be of greater interest to investors than past results. THIS WEEK: KEY ECONOMIC DATA Tuesday: Consumer Price Index (CPI). Thursday: Jobless Claims. Friday: Industrial Production. Consumer Sentiment. Source: Econoday, October 9, 2020 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THIS WEEK: COMPANIES REPORTING EARNINGS Tuesday: Johnson & Johnson (JNJ), J.P. Morgan Chase (JPM), Citigroup (C), Blackrock (BLK) Wednesday: Bank of America (BAC), UnitedHealth Group (UNH) Thursday: Morgan Stanley (MS) Friday: Schlumberger (SLB), J.B. Hunt Transport Services (JBHT), Kansas City Southern (KSU), V.F. Corporation (VFC) Source: Zacks, October 9, 2020 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice. |

| [1] The Wall Street Journal, October 9, 2020 [2] The Wall Street Journal, October 9, 2020 [3] The Wall Street Journal, October 9, 2020 [4] CNBC.com, October 6, 2020 [5] The Wall Street Journal, October 8, 2020 [6] The Wall Street Journal, October 9, 2020 |