A Note from Cokie — While the market continues to struggle, the nation’s economy is in recovery. “This market is more akin to the emotional swings of March and April than in recent months,” says Mark Hackett, chief of investment research at Nationwide. Hackett continues by saying, “We are likely to continue in a period of directionless volatility as bulls and bears wrestle between the strong Fed liquidity and improving economic backdrop and the continued uncertainty and elevated valuations.”

The Nasdaq closed 0.6% lower at 10,853.55—it worse since March. At its session high, the composite rose as much as 1%; it was down more than 1.7% at one point as well. Apple dropped 1.3% and Amazon fell by 1.9%. Facebook, Alphabet and Microsoft were all down.

What we need to realize is that Wall Street is coming off a session in which the major averages closed sharply lower after a steep downturn in tech names. Those losses came after these stocks gave up solid gains. We’ll know more about the nation’s recovery in the coming days. Here’s an up date from Wealth Enhancement & Preservation.

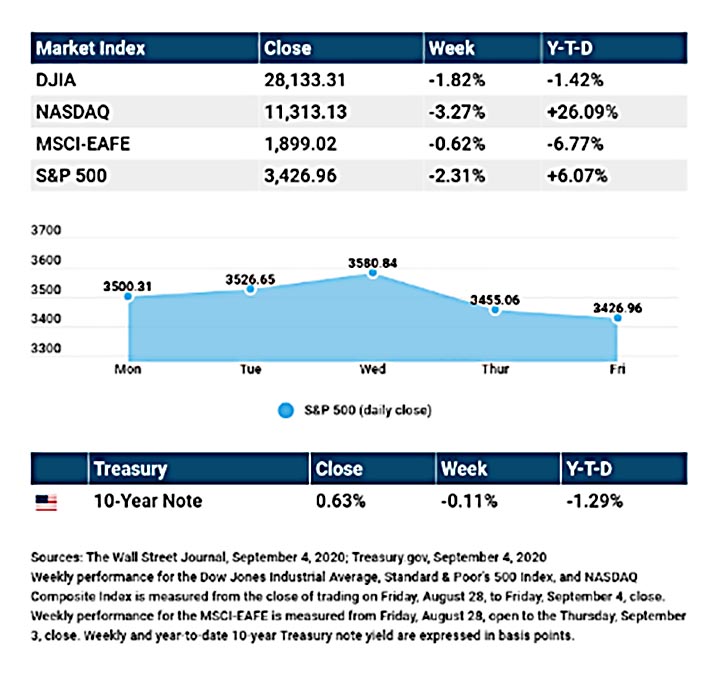

The Week on Wall Street A late week sell-off sent stocks broadly lower as investors took some profits after stocks reached all-time highs earlier in the week. The Dow Jones Industrial Average slid 1.82%, while the Standard & Poor’s 500 slumped 2.31%. The Nasdaq Composite index dropped 3.27% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 0.62%.[1][2][3]

| Gravity Reasserts Itself Stocks hit a wall late last week as the technology companies, which had led the market higher, slipped in Thursday and Friday trading, dragging down the overall market. The week began on an upbeat note as August momentum continued into the start of September. While participation in the rally on Tuesday and Wednesday was fairly broad, technology stocks continued to be the focus of market strength. But that sentiment changed quickly on Thursday. With little warning and no obvious catalyst, it remains unclear whether the technology selloff last week was the result of market technicals or a fundamental change in investor outlook. The coming weeks may provide some clarity in this regard. Labor Market Recovery Sputters Forward Last week saw a series of employment-related reports that evidenced a continued labor market recovery. The Automated Data Processing (ADP) employment survey showed that private payrolls increased by 428,000 in August, falling short of consensus expectations of over 1.1 million.News turned more positive as new jobless claims checked in at 881,000-an improvement from the over one million new claims the prior week. Americans receiving unemployment declined by 1.24 million to 13.3 million-half the peak number in May.[4][5][6] Finally, the monthly jobs report indicated that nearly 1.4 million non-farm jobs were added last month, with the unemployment rate declining to 8.4%. The progress was predominantly attributable to government hiring, primarily of new Census workers, though the retail, leisure, and hospitality sectors saw gains in new hiring.[7] THIS WEEK: KEY ECONOMIC DATA Wednesday: Job Openings and Turnover Survey (JOLTS). Thursday: Jobless Claims. Friday: Consumer Price Index (CPI). Source: Econoday, September 4, 2020The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. THIS WEEK: COMPANIES REPORTING EARNINGS Tuesday: Lululemon (LULU), Coupa Software (COUP), Slack Technologies (WORK) Thursday: Chewy (CHWY), Peloton (PTON) Friday: Kroger (KR) Source: Zacks, September 4, 2020Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice. |

| [1] The Wall Street Journal, September 4, 2020 [2] The Wall Street Journal, September 4, 2020 [3] The Wall Street Journal, September 4, 2020 [4] CNBC, September 2, 2020 [5] CNBC, September 3, 2020 [6] CNBC, September 3, 2020 [7] CNBC, September 4, 2020 |