What we know upfront is that not every investment will be a winner. However, there’s a potential silver lining even for a losing investment.

In fact, you may be able to use your loss to lower your tax liability and better position your portfolio going forward. This strategy is called “tax-loss harvesting,” and it’s one of the many tax-smart strategies that investors use.

Tax-loss harvesting is an important stagey that works like this: You sell an investment that’s under-performing and losing money. You use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income.

The you reinvest the money from the sale in a different security that meets your investment needs and asset-allocation strategy. The principle behind tax-loss harvesting is potentially very good but there are some pitfalls. Read on and learn more.

Imagine reviewing your portfolio, and you see that your tech holdings have risen sharply while some of your industrial stocks have dropped in value. As a result, too much of your portfolio’s value is exposed to the tech sector. To realign your investments with your preferred allocation, you sell some tech stocks and use those funds to rebalance. In the process, you end up recognizing a significant taxable gain.

Tax-Loss Harvesting Basic 101

This is where tax-loss harvesting comes in. If you also sell the industrial stocks that have also declined in value, you could use those losses to offset the capital gains from selling the tech stocks, thereby reducing your tax liability.

If your losses are larger than the gains, you can use the remaining losses to offset up to $3k of your ordinary taxable income (or $1,500 each for married taxpayers filing separately). Any amount over $3,000 is carried forward to future tax years to offset income down the road.

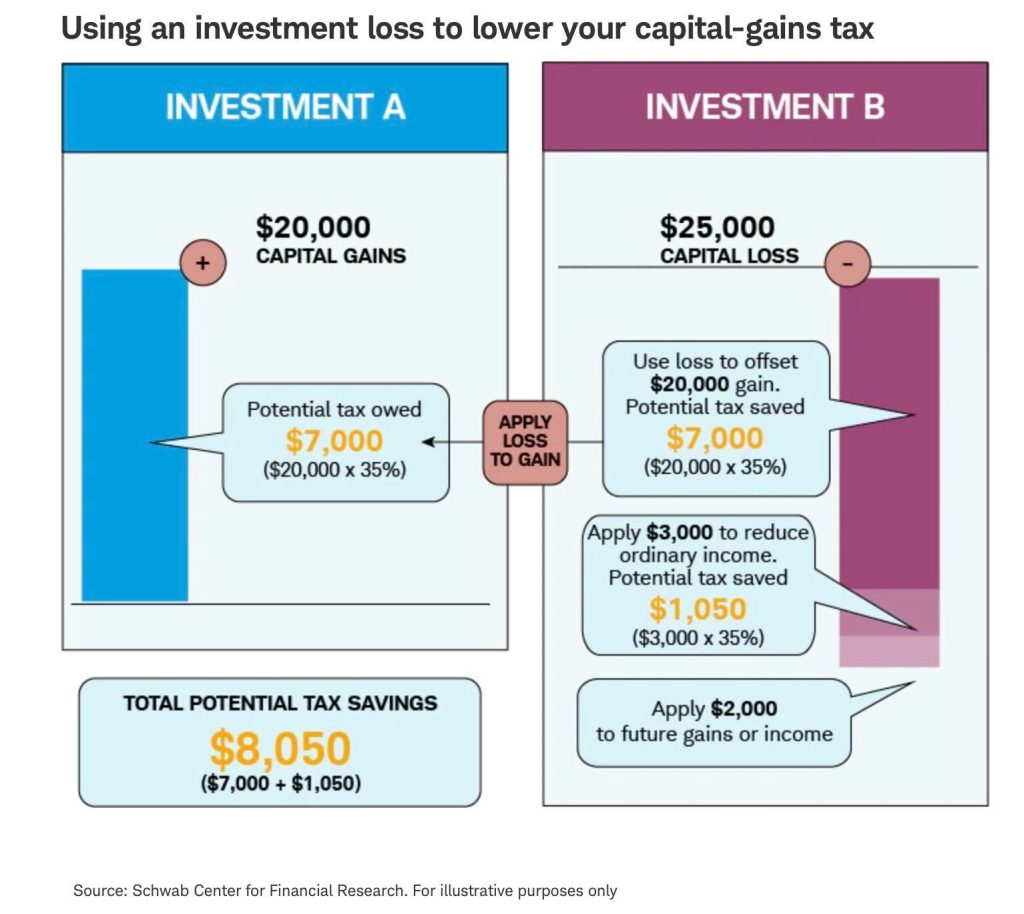

For example, there is a gain of $20,000 on a stock you bought less than a year ago (Investment A). Because you held the stock for less than a year, the gain is treated as a short-term capital gain and is taxed at the higher ordinary-income rates rather than the lower long-term capital-gains rate, which apply to investments held for more than a year.

At the same time, you also sell shares of another stock for a short-term capital loss of $25,000 (Investment B). Your $25,000 loss would offset the full $20,000 gain from Investment A, meaning you’d owe no taxes on the gain, and you could use the remaining $5,000 loss to offset $3,000 of your ordinary income. The leftover $2,000 loss could then be carried forward to offset income in future tax years.

Assuming you’re subject to a 35% marginal tax rate, the overall tax benefit of harvesting those losses could be as much as $8,050. Let’s look at how this works.

Using an investment loss to lower your capital-gains tax Source: Schwab Center for Financial Research. For illustrative purposes: By offsetting the capital gains of Investment A with your capital loss of Investment B, you could potentially save $7,000 on taxes ($20,000 × 35%).

Because you lost $5,000 more than you gained ($25,000 – $20,000), you can reduce your ordinary income by $3,000, potentially lowering your tax liability an additional $1,050 ($3,000 × 35%), for a total savings of $8,050 ($7,000 + $1,050). You could then apply the remaining $2,000 of your capital loss from Investment B ($5,000 – $3,000) to gains or income the following tax year.

Things to Consider before Utilizing Tax-Loss Harvesting

As with any tax-related topic, there are rules and limitations:

• Tax-loss harvesting isn’t useful in retirement accounts, such as a 401(k) or an IRA, because you can’t deduct the losses generated in a tax-deferred account.

• There are restrictions on using specific types of losses to offset certain gains. A long-term loss would first be applied to a long-term gain, and a short-term loss would be applied to a short-term gain. If there are excess losses in one category, these can then be applied to gains of either type.

When conducting these types of transactions, be aware of the “wash-sale” rule, which states that if you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the loss is typically disallowed for current income tax purposes.

A Tax Break for Ordinary Income

Even if you don’t have capital gains to offset, tax-loss harvesting could still help you reduce your income tax liability.

Here’s an example: Let’s say Sofia, a single income-tax filer, holds XYZ stock. She originally purchased it for $10,000, but it’s now worth only $7,000. She could sell those holdings and take a $3,000 loss.

Then, she could use the proceeds to buy shares of ZYY stock (a similar but not substantially identical stock) after determining that it’s as good as or better than XYZ, given her overall investment goals and objectives.

Sofia could use the $3,000 capital loss from XYZ to reduce her taxable income for the current year. If her combined marginal tax rate is 30%, she could receive a current income tax benefit of up to $900 ($3,000 × 30%). She could then turn around and invest her tax savings back in the market. If she assumes an average annual return of 6%, reinvesting $900 each year could potentially amount to approximately $35,000 after 20 years.

Over the long run, harvesting losses regularly and proactively when you re-balance your portfolio, for instance, can save money, effectively boosting your after-tax return.

Need to know more: Grab a 15-minute time slot with us to discuss investment planning and how we can help! (Advisory Services offered through Red Triangle, LLC DBA Alphavest)

(The above blog is based on information about Tax-Loss Harvesting from Charles Schwab.)