A Note from Cokie: I wish that I could bring some market news to you that is worthy of some sustaining excitement! But as we begin this week, most investors feel like they are in the same position as they were last week. It is just more of the same; and honestly, this feeling of uncertainty probably will continue as the U.S. deals with its healthcare crisis and also as we move closer to the November election.

Tensions with China remain a strong concern. Both the U.S. and China have said they would level or keep in place established sanctions. There is some light at the end of a tunnel for those who are still out of work due to COVID-19. We show a slower pace for the quarterly earnings reports and Wall Street forecasters say that trading today and this week more than likely will reflect the latest developments on the U.S.-China front as well as those in Washington.

Over the weekend, House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin said they were willing to restart COVID-19 aid talks. But this measure only came after the President’s executive order to boost economic pandemic related aid.

The longer time between federal Coronavirus relief packages, the greater the expected impact on GDP forecasts. This is because consumers have historically driven almost two-thirds of the domestic economy. The second half of the year is usually stronger due to Back to School and the holiday shopping.

So, anyway you crunch the numbers, you have to know that you are in the market for the “long haul” and not just a short sprint. The Coronavirus will continue to be a major player in how the stock market reacts on a regular basis.

The following is a mid-week update from W&P Wealth Management.

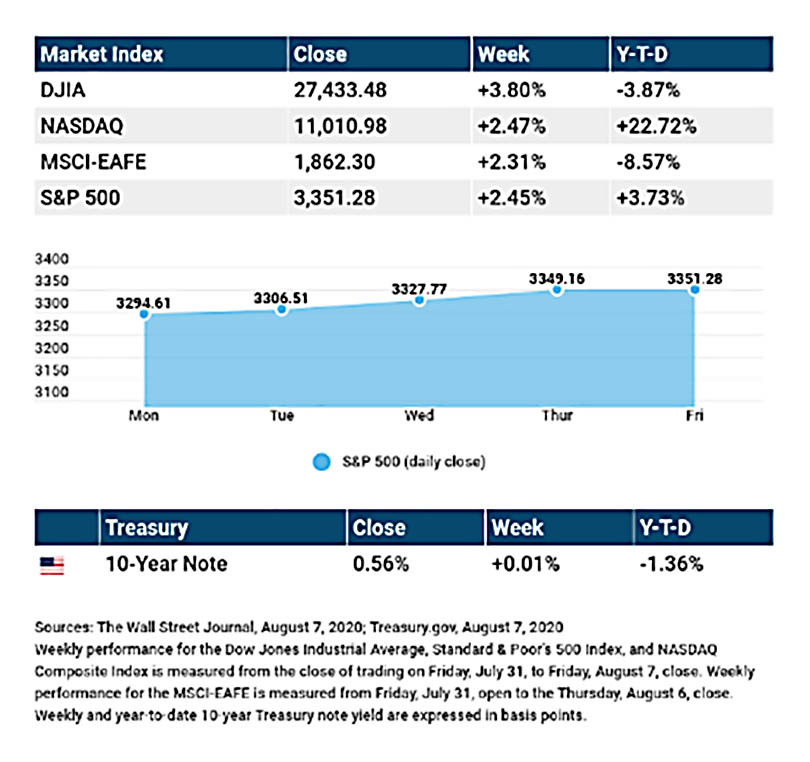

The Week on Wall Street Overlooking stalled efforts by Congress to pass a new fiscal stimulus bill, stocks marched higher last week with the Dow Jones Industrials leading the way and the NASDAQ Composite setting multiple fresh record highs. The Dow Jones Industrial Average gained 3.80%, while the Standard & Poor’s 500 rose by 2.45%. The Nasdaq Composite index climbed 2.47% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.31%.[1][2][3]

Earnings Season Winds Down A string of encouraging news reports, including a decline in new COVID-19 cases nationwide, pushed stock prices higher throughout the week. Stocks also rallied on signs of a pick-up in manufacturing activity, factory orders that came in well above estimates, and a better-than-expected new jobless claims number.[4][5] Congress wasn’t able to come to an agreement on a stimulus package, which disappointed some investors. But it wasn’t enough to slow the daily climb in the equity markets, with the NASDAQ Composite index closing above 11,000 for the first time, while the S&P 500 index closed in on its record high set in February of this year.[6] Stocks drifted on Friday even though the employment report showed that employers added 1.8 million jobs in July, lowering the unemployment rate to 10.2%.[7]One Eye on Bonds, Gold The continued rally in stock prices appears to suggest that the U.S. economy may maintain its recovery through the second half of the year and into 2021. But the bond market and gold prices suggest a different outlook. Last week the yield on 10-year Treasuries touched their lowest level since early March, signaling that bond investors may be less convinced about economic prospects.[8] Meanwhile, gold traded over $2,000 per ounce. While the rise in gold prices this year has been largely propelled by historically low interest rates, its reputation as a store of value has attracted investors worried about stock market volatility and a potential uptick in inflation.[9]

Final Thoughts It was reported last week that the U.S. and China agreed to meet by videoconference on August 15 to discuss compliance with the terms of the Phase One trade deal.[10] With tensions running high between the two nations, expect Wall Street to keep a close eye on any developments that may appear connected to the virtual meeting.

THIS WEEK: KEY ECONOMIC DATA

Monday: Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Consumer Price Index (CPI).

Thursday: Jobless Claims. Friday: Retail Sales. Industrial Production. Consumer Sentiment. Source: Econoday, August 7, 2020 The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Marriott International (MAR)

Wednesday: Cisco Systems (CSCO), Tencent Holdings (TCEHY), Lyft (LYFT) Friday: Draftkings (DKNG) Source: Zacks, August 7, 2020 Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

| Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896. The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. |

| [1] The Wall Street Journal, August 7, 2020 [2] The Wall Street Journal, August 7, 2020 [3] The Wall Street Journal, August 7, 2020 [4] MarketWatch.com, August 4, 2020 [5] The Wall Street Journal, August 6, 2020 [6] CNBC, August 6, 2020 [7] The Wall Street Journal, August 7, 2020 [8] MarketWatch, August 4, 2020 [9] The Wall Street Journal, August 5, 2020 [10] CNBC.com, August 4, 2020 |