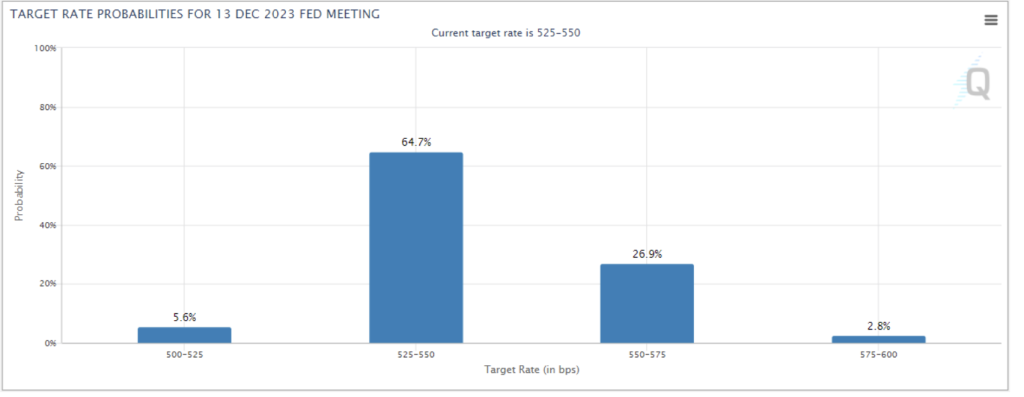

The Federal Reserve concluded its July meeting on Wednesday, 7/26 and raised the federal funds rate by 25 basis points, as had been widely expected. In the press conference following the meeting Chair Powell said that the FOMC’s decisions about future rate hikes would continue to be data-driven. With June CPI reading showing that inflation has continued moderate, there has been speculation that this could be the final hike in the Fed’s tightening cycle. Fed futures are currently pricing in a 70% chance that the federal funds rate will be at or below its current target of 500-525 basis points at year-end.

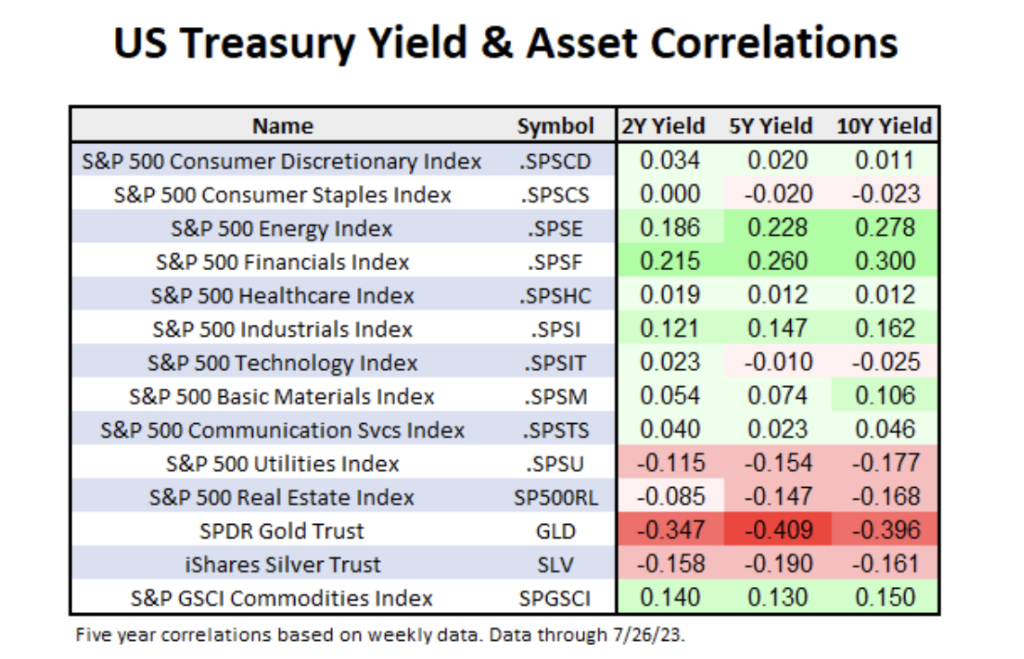

It’s a given that the end of the Fed’s tightening cycle would be a welcome development for bond investors. But today, we wanted to take a look at which other areas of the market might stand to benefit (or struggle) if rates begin to decline. The table below shows the correlations of the two-, five-, and 10-year US Treasury yields to the 11 S&P 500 sector indices, the SPDR Gold Trust (GLD), the iShares Silver Trust (SLV) and the S&P GSCI Commodities Trust. All else being equal, we would expect those assets with positive correlations (in green) to perform better when yields are rising and those with negative correlations (in red) to perform better when yields are falling.

One of the first things we see is that most of the S&P 500 sectors have weakly positive relationships to yields; although rising yields are often talked about as a headwind for equities due to higher borrowing costs and their effect on valuations, rising yields are most often seen during periods of economic expansion, periods when we also expect equities to perform well. Two sectors – energy and financials – have relatively strong correlations to yields. The basic business model of banks is to borrow on the short end of the curve and lend on the long end and spreads between short- and long-term yields are generally wider when yields are higher, helping to boost banks’ profits. The energy sector’s relatively strong positive correlation to yields is likely due to the increased demand for energy during periods of economic expansion as opposed to a direct relationship to profitability.

On the other end of the spectrum, utilities and real estate are the sectors that show the strongest negative correlations to yields and therefore would be expected to be among the sectors most helped by falling yields. For real estate investment trusts (REITs), lower rates mean lower mortgage payments and higher profits. Additionally, both REITs and utilities typically carry above-average yields and are therefore more attractive to yield-seeking investors.

Gold shows a stronger relationship to yields than any of the 11 equity sectors, and interestingly, has had a significantly higher correlation to yields than silver has over the last five years. When yields are lower, especially when real yields are near zero or negative, precious metals are relatively more attractive as a store of wealth as investors earn relatively little (or even lose money in real terms) by investing in Treasuries. As to why gold has exhibited a stronger inverse relationship to yields than silver, this may be due to silver having more industrial uses, making its price less dependent on its attractiveness as a store of wealth. It is worth pointing out that commodities at large do not exhibit the same inverse relationship to yields, as the table shows the S&P GSCI Commodities Trust (SPGSCI) shows a positive correlation to short-and long-term yields.

Unlike fixed income, where interest rates are the most important driver of prices for most segments of the market, the direction of yields is a secondary consideration for equities. Even for those sectors showing relatively high correlations to yields – like financials and utilities – there are more important drivers of performance. So, it would be imprudent to base an investment based only on an opinion about the direction of yields. Currently, utilities and real estate, the two sectors most likely to benefit from a decline in yields rank ninth and 11th in the DALI sector rankings respectively, squarely in underweight territory. Furthermore, at this point, there is no technical evidence that a decline in US Treasury yields is imminent. The US Treasury 10-year Yield Index (TNX) remains on multiple consecutive buy signals and crossed above 4% again on Thursday following the stronger-than-expected Q2 GDP numbers.

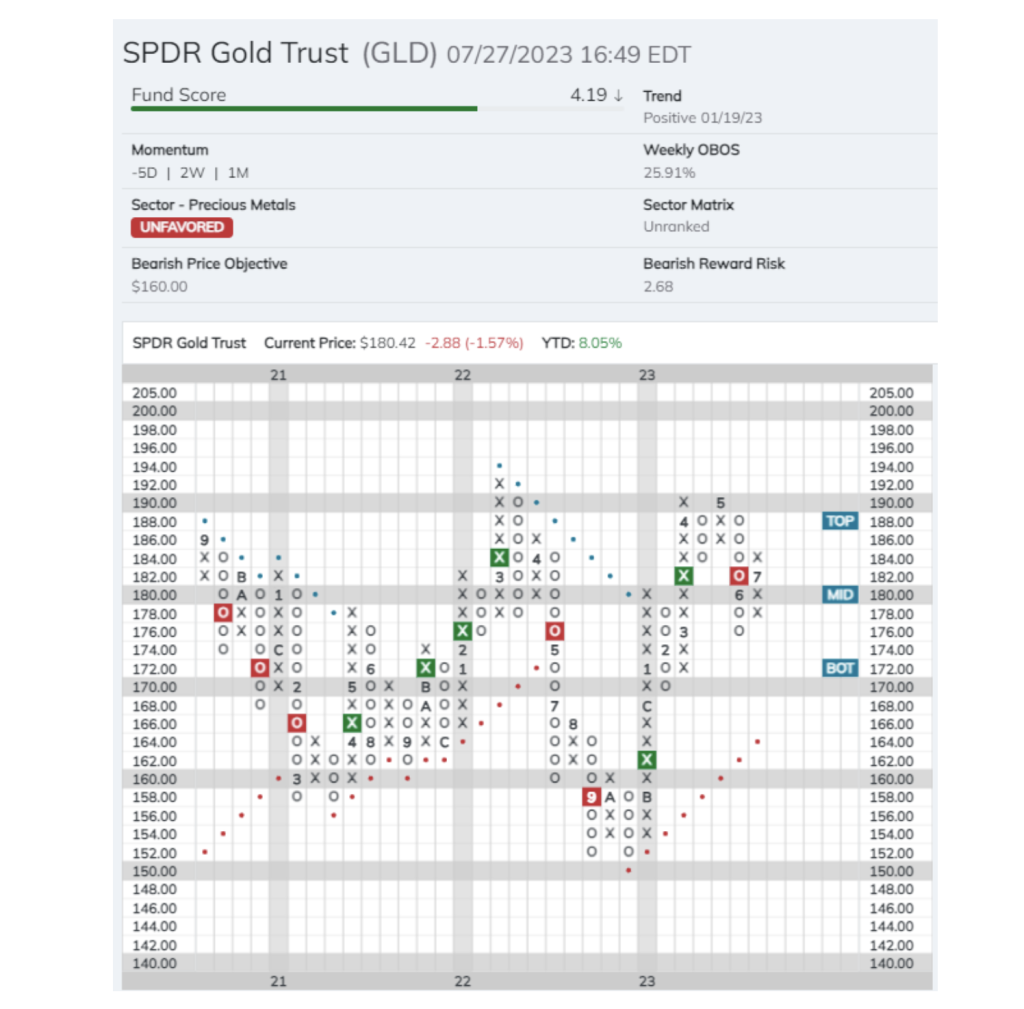

For those intent on trying to front run a potential move in interest rates, the SPDR Gold Trust (GLD) may be the most attractive option as it has an already sound technical picture to which a potential decline in yields could be an added tailwind. The fund currently has a favorable 4.19 fund score, which is 0.75 points better than the average for all precious metals funds. GLD returned to a positive trend on its default in January and is currently in the action phase of a potential shakeout pattern, which would be completed with a triple top breakout at $1920. $176 could be considered as a potential stop-loss and it would violate the potential shakeout pattern.

oxlive.dorseywright.com

Module: Default, Controller: Auth, Action: Login

oxlive.dorseywright.com

Module: Default, Controller: Auth, Action: Login

oxlive.dorseywright.com

Module: Default, Controller: Auth, Action: Login

oxlive.dorseywright.com

Module: Default, Controller: Auth, Action: Login