A Note from Cokie—Market Investors were nervous at the end of last week, especially over the latest tensions between the U. S. and China. The Trump administration told Beijing to close its consulate in Houston. And China countered by ordering the closure of the U.S. consulate in the southwestern city of Chengdu. This adds tension to the market but also stress to U. S. trade, technology, and human rights issues between these two big global economies.

Investors also worry about a rise in U.S. layoffs as spiking coronavirus numbers increase and lead more businesses shutting down or postpone reopening. Extra unemployment benefits expire this week, and Congress has yet to agree on more economic aid.

Rightfully so, US stocks reacted as investors realized that the country is in for prolonged negotiations between Democrats and Republicans on another round of economic stimulus. It all adds up to a strained and fractured week on Wall Street! The following is our weekly update from W&P Wealth Management.

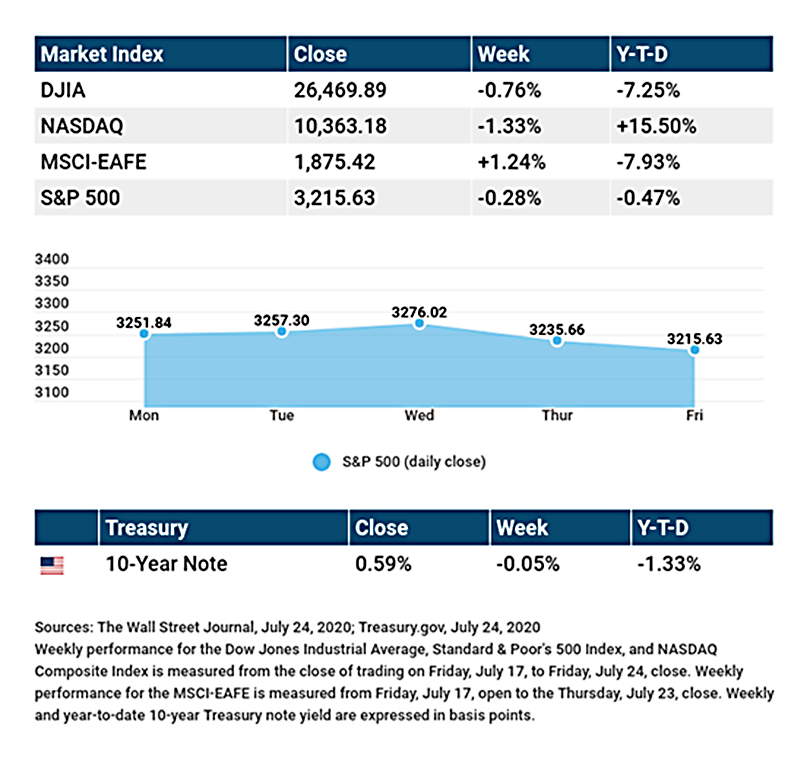

Stocks slipped in the final days of trading last week on higher jobless claims and rising tensions in the U.S. — China relationship. The Dow Jones Industrial Average lost 0.76%, while the Standard & Poor’s 500 dipped 0.28%. The Nasdaq Composite Index dropped 1.33% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, rose 1.24%.[1][2][3]

Stocks Lose Momentum Stocks marched higher to begin the week on progress with a COVID-19 vaccine and a string of upbeat corporate quarterly reports. Firming oil prices and the passage of a fiscal stimulus bill by the European Union also helped buoy investors’ spirits. Market sentiment, however, turned negative after Thursday morning’s report of an uptick in new unemployment claims, which suggested a possible slowdown in hiring. The market was led lower by the technology sector ahead of quarterly reports from some of the sector’s biggest names.[4]

U.S.-China Tensions Escalate Tensions escalated last week as the U.S. ordered China to close its consulate in Houston, which the White House claimed was stealing American information. A day earlier, the U.S. had accused China of attempting to steal COVID-19 research data. China responded by ordering the U.S. to close its consulate in the city of Chengdu.[5][6]

The markets appear more focused on the apparent deteriorating relations between the two nations, worried about a repeat of the trade battle in 2018. Whether the rancor is managed is likely to remain a top concern for investors in the weeks ahead.

Final Thoughts The mega-cap technology companies’ market dominance is a concern to some. Last week it was reported that six of these mega-cap stocks represent 41% of the Nasdaq market capitalization.Five mega-cap names included in the S&P 500 Index account for 22% of that index’s market capitalization.[7] Investors have embraced these firms because they appear to be able to show solid financial performance in the midst of an economy coping with COVID-19.

THIS WEEK: KEY ECONOMIC DATA

Monday: Durable Goods Orders.

Wednesday: Federal Open Market Committee (FOMC) Meeting Announcement.

Thursday: Gross Domestic Product (GDP), Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, July 24, 2020. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Tuesday: Advanced Micro Devices (AMD), Visa (V), Pfizer (PFE), McDonalds (MCD), 3M Company (MMM), eBay (EBAY), D.R. Horton (DHI).

Wednesday: Facebook (FB), Boeing (BA), Qualcomm (QCOM), PayPal (PYPL), General Motors (GM), Shopify (SHOP), Teladoc Health (TDOC).

Thursday: Apple (AAPL), Ford (F), Alphabet (GOOGL), Mastercard (MA), Procter & Gamble (PG), Eli Lilly (LLY), United Parcel Service (UPS).

Friday: AbbVie (ABBV), Exxon Mobil (XOM), Caterpillar (CAT), Merck (MRK), Chevron (CVX).

Source: Zacks, July 24, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

[1] The Wall Street Journal, July 24, 2020

[2] The Wall Street Journal, July 24, 2020

[3] The Wall Street Journal, July 24, 2020

[4] NYTimes.com, July 23, 2020

[5] CBSnews.com, July 22, 2020

[6] APNews.com, July 24, 2020