Did you know that if you’re not careful, 21% of your retirement nest egg will be forfeited to excessive fees and conflicts of interest? How does that happen? What do you do? Because investors know little about fees, how they are charged, what is fair, or how to negotiate—many are paying way too much and many investors are being taken advantage of.

Did you know that if you’re not careful, 21% of your retirement nest egg will be forfeited to excessive fees and conflicts of interest? How does that happen? What do you do? Because investors know little about fees, how they are charged, what is fair, or how to negotiate—many are paying way too much and many investors are being taken advantage of.

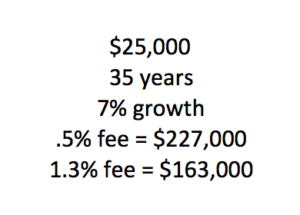

With compounding, we estimate that over payments of 80 basis points or .8% per year for 25-30 years equals about 21 percent of an investor’s retirement nest egg. In other words, the fees investors are paying are eating into 21 percent of their retirement dollars. Assume you have an investment portfolio of $25,000 and that you have 35 years until retirement—if your returns on those investments average 7% and your fees and expenses are only 50 basis points or .5% per year, then your account balance would grow to $227,000 at retirement. However, if you increase your fees and expenses by 80 basis points, as mentioned earlier, then your account is only going to grow to $163,000. The .80% difference in fees is what will reduce your account balance at retirement by approximately 21%.

those investments average 7% and your fees and expenses are only 50 basis points or .5% per year, then your account balance would grow to $227,000 at retirement. However, if you increase your fees and expenses by 80 basis points, as mentioned earlier, then your account is only going to grow to $163,000. The .80% difference in fees is what will reduce your account balance at retirement by approximately 21%.

The Cost of Conflicts

The Council of Economic Advisors produced a report, which puts fees and conflicts of interest into perspective. The report examined the evidence on the cost of conflicted investment advice and its effects on Americans’ retirement savings, with a focus on IRAs. The CEA’s survey of the evidence suggests that conflicted advice reduces investment returns by roughly 1 percentage point for investors receiving that advice. In the aggregate, such investors hold about $1.7 trillion of IRA assets. Thus, the CEA estimates the aggregate annual cost of conflicted advice is about $17 billion each year. This report greatly influenced the Department of Labor (DOL) to take action and limit the big brokerage firms abusive authority over investors.

NerdWallet, a consumer information provider, does a great job at explaining the heart of the conflicts of interest matter in their blog post from June 2016. Among the many cases in NerdWallet’s study—one case found that paying just 1 percent more in investment fees could cost a person more than $590,000 in returns over 40 years.

The Bottomline

Moving away from firms that don’t or haven’t always adhered to this new Department of Labor’s fiduciary standard is a great first step toward getting back every bit of that nest egg you deserve. Alphavest has complied with the DOL ruling since inception—looking out for our clients best interests remain priority number one. Who’s looking out for your best interest?

#wevegotyoumanaged