The fourth quarter is here–the final stretch. 5 of 6 of our core investment models beat the market last quarter and yesterday, all outperformed with the sell off–I’m smiling right now! Its nice to see and realize a prudent, cautious portfolio stance come to fruition.

While it won’t always be this way, and, if I’m honest–we, like most active or passive managers are underperforming for the year, it goes to show you a cautious market stance isn’t always perfectly timed but this time it was. We were cautious early it seems that may help us here in Q42023 as we endeavor to outperform not only benchmark returns, but on a risk-adjusted basis. While we owned several of the sizzling magnificent seven; Alphabet/Google, Apple, Amazon, Meta, Microsoft, NVIDIA, and Tesla–we weren’t as concentrated in those holdings as the broad indexes were and are for 2023.

The U.S. equity market’s “Magnificent Seven”1 surged to a 27% weight in the MSCI USA Index in July 2023, up from 7% a decade ago. The concentration is even larger within the MSCI USA Large Cap Growth Index, for which the same seven companies now make up 55%.

In the middle of the last decade, from 2013 until mid-2017, when the cumulative weight of the Magnificent Seven was modest, their median weight in U.S. large-cap growth managers’ portfolios closely mirrored the benchmark, the MSCI USA Large Cap Growth Index. But as the index weight of these stocks climbed, nearly all active growth managers began to underweight them. Managers may have had several motivations, such as low conviction in their performance prospects and the desire, or the regulatory requirement, to mitigate concentration risk. Investors come in all shapes and sizes; in 27 years of asset management, and client facing wealth management, few of the individuals we manage investments for would wish for 55% of their portfolio’s allocation in 7 tech names in 2022/2023–if ever. Have you seen the FOMC tape since Q4 last year?! A majority of other managers agree–

“Active bets” often offset underweights in the Magnificent Seven

Underweight positions in the Magnificent Seven have been a drag on growth managers’ performance relative to their benchmarks over the 10 years ending March 2023. Yet, nearly two-thirds (63%) of growth managers partially or more than offset this negative contribution with active bets on other stocks.

The headline performance of an active manager relative to their benchmark does not tell the whole story. A manager’s skill can be revealed by understanding their active bets in the context of high levels of market concentration. Thus, assessing an active manager on their prioritization of concentration risk over tracking risk can be prudent in markets where concentration is elevated.

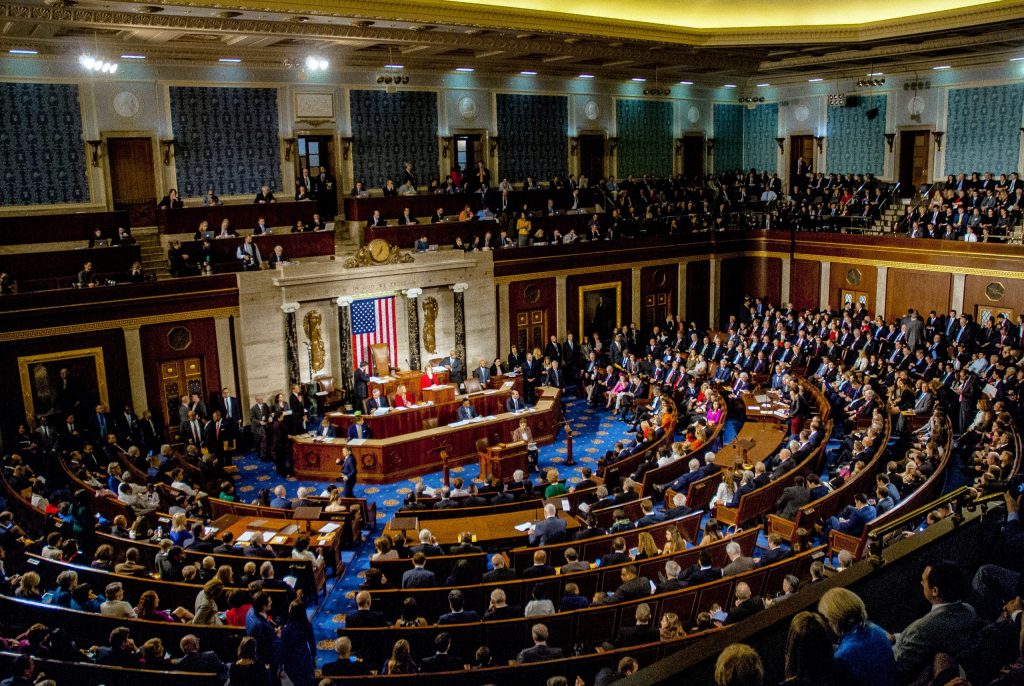

Remember, when there’s uncertainty within the economy, and as it seems within our own government, markets rarely smile. However, for those who “get” what portion of their assets are in what we call their “10-Year Bucket”, it is a time to smile. This is where “active bets” and perhaps adding more not only to our high quality holdings that have been hurt in Q32023, but also a time to consider additions to the ‘Searing Seven.” If you’re objective–and most investors aren’t–most quality names, will bear no affect short, medium or long term to Senator McCarthy’s ousting, especially when allocated in a non-concentrated fashion. Adding to higher quality names at rocky times continue to serve to offset concentration risk; offering a boost to a better gauge of returns–risk adjusted returns–over that of highly concentrated benchmarking.

Our big standout holdings during a “rocky’ September 2023; and including yesterday, are our oil and master limited partnership (MLP) holdings. Our portfolio’s stocks that have contributed on 10-year basis that have helped our risk-adjusted returns shine versus that of the 7, Eli Lily, Cintas and West Pharma of our Alpahvest Aristocrats and Equity Income models are a few of the unlikely winners; add a dose of Caterpillar, and Nucor Steel and a big dose of Vanguard money market at 5%+ and you’ve got a great recipe for sitting tight and seeing this quarter through to better times–without concentration risk. Ta-da! And who knows, with a PEG–a trusted gauge of valuation–under 1 for the first time since COIVD markets and prior to that, 2018, maybe its time for some Meta. AND, ahem, maybe some Tesla.

Not ready to sit tight–need to define your 10-year bucket? Grab a 15-minute time slot with me to discuss risk and allocation so that we can ensure you are on the right track!

Helen “Cokie” Cox, CFP®

Alphavest, CEO