Up your Tax ROI, a $750-1500 RAISE, AND, a heartfelt THANK YOU.…

PRESS PLAY for 3 For 3:

Last week’s doozy of a 3 For 3 with Yield Curve Inversion data, stats and whether or not we will have a “soft” or a hard landing recession….ALL remains unchanged. So, we’re gonna lighten it up this week with increasing investor’s return on investment/ROI, a raise and a BIG THANK YOU to all Veterans.

Lets start with YOUR RAISE!

The IRS announced yesterday….

The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

Other changes for 2024:

- Marginal rates: For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

The other rates are:

35% for incomes over $243,725 ($487,450 for married couples filing jointly)

32% for incomes over $191,950 ($383,900 for married couples filing jointly)

24% for incomes over $100,525 ($201,050 for married couples filing jointly)

22% for incomes over $47,150 ($94,300 for married couples filing jointly)

12% for incomes over $11,600 ($23,200 for married couples filing jointly)

The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

Up your Investor ROI

Up your Year-End return on investment/ROI with tax loss harvesting and eliminating inefficient and unnecessary mutual fund capital gains distributions in DECEMBER.

Did you know? Two-thirds of stock mutual funds distributed capital gains to clients in 2022 when the S&P 500 was -18%. BEWARE if you own mutual funds at Year-End—you could be getting a tax bill you don’t deserve.

Alphavest clients very rarely own stock or bond mutual funds for this and various other reasons–tax inefficiency and added client cost among the top reasons. AND, we tax loss harvest for our clients every year at year-end, in other words, we balance the gains and losses, individually, in client accounts so that they pay as little in taxes in the coming year as possible.

Portfolio returns are not just from your investments returns—bettering your after-tax return is how to UP your ROI.

THANK A Veteran!

With times as turbulent abroad as they are, we have many reasons to be THANKFUL for US Veterans. To those that have served, and are currently serving our great Nation, THANK YOU—We continue to send prayers of peace to those nations currently under attack, in particular the Ukraine and Israel.

Talk is cheap–therefore, Alphavest is extending 2023 Liberated Investor pricing, flat fee pricing of $20/mo, for veterans for ALL OF 2024. No minimum, No maximum. Learn more if interested.

Above all—Thank you for your service.

WEEK IN REVIEW

Another positive week as most indexes eecked out gains across the board, a nice follow thru as US markets post the best weekly gains for the year last week up over +5%. Yet, oil, the dollar and bond yields slip…all good things as we exited our dollar position, lightened up in oil and increased our bond exposure (note when bond yields decline, returns/prices go UP) last week.

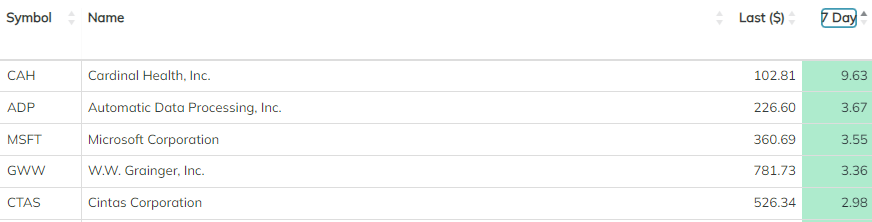

WINNERS

WW Grainger, Inc/GWW our Aristocrats Model winner 2 weeks running +40.54% YTD

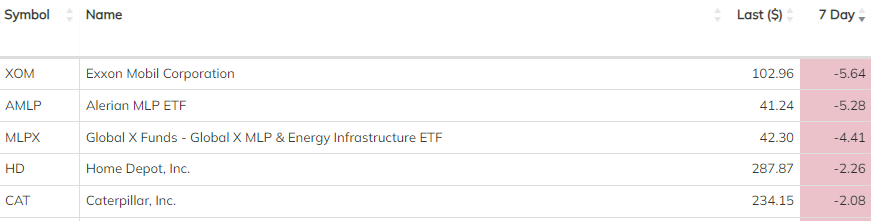

LOSERS

OIL holdings, and MLPs…

Be a winner and not a loser:

Maximize your portfolio’s ROI with year-end tax loss harvesting, just say NO to mutual funds, and THANK a Veteran, today, tomorrow and always!

Get your thankful on,

Advisory Services offered through

Red Triangle, LLC DBA Alphavest

PS: Save the Date for our Annual WRAP Party! 12/6/2023 at the office. Get those gifts purchased and bring to us to wrap! Its time for some Holiday Cheer!

Subscribe to this weekly update. AND–if you enjoyed this 3 For 3,

the greatest thank you can give is a comment here or forward it to a friend. Thank you!