Quiet the Noise (Listen to the Data)

Below you will find a “temperature reading” on the market and the risk level on the “field.”

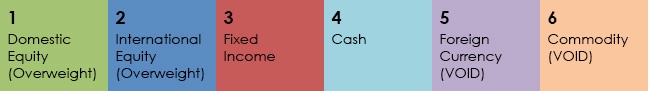

Relative Strength Line Up of the Asset Classes:

Q1 2015 Update: UNCHANGED

4/1/2015:

#1 Asset Class: Domestic Equities

#2 Asset Class: Bonds/Fixed Income

Market Status: BULL

NYSE Bullish Percent: 60% (UP from 54.17% Q1) OFFENSE (Reversed UP from Defense on 10/29/14 @ 43.11%)

Buffett, Graham and Churchill: An Essay on Ben Graham’s “Mr. Market” by Warren Buffett

The following is an excerpt from an annual letter to Berkshire Hathaway’s shareholders by Warren Buffett in 1987 regarding Buffett’s fondness of renowned teacher and mentor to Buffett, Ben Graham. I would like to make a practice of routinely including selected works of Buffett’s annual letters to shareholders in our quarterly newsletter.

In volatile, difficult and changing markets, I find solace in disciplined, stable, non-changing norms and principals. Even though a lot has changed since Mr. Buffett shared about Mr. Market with his shareholders in 1987, really, not much has. Enjoy!

“Mr. Market”

Whenever Charlie and I buy common stocks for Berkshires’s insurance companies (leaving aside arbitrage purchases, discussed in the next essay) we approach the transaction as if we were buying into a private business. We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale. Indeed, we are willing to hold a stock indefinitely so long as we expect the business to increase in intrinsic value at a satisfactory rate. When investing, we view ourselves as business analysts, and not even as security analysts.

Our approach makes an active trading market useful since it periodically presents us with mouth-watering opportunities. But by no means is it essential: a prolonged suspension for trading in the securities we hold would not bother us any more that does the lack of daily quotations on World Book or Fechheimer. Eventually, our economic fate will be determined by the economic fate of the business we own, whether our ownership is partial or total.

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be the most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the tow of you own may have economic characteristics that are stable, Mr. Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and we can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions he will name a very low price, since he is terrified that you will unload your interest on him.

Mr. Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behavior, the better for you. (This means NOW, 2015 — Cokie’s words.)

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom,that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren’t certain that you understand and can value your business far better than Mr. Market you don’t belong in the game. As they say in poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.” (Ahem, don’t be the patsy, contact Alphavest to help negotiate Mr. Market’s moods for you.)

Ben’s Mr. Market allegory may seem out-of-date in today’s investment world, in which most professionals and academicians talk of efficient markets, dynamic hedgings and betas. Their interest in such matters is understandable, since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising “Take two aspirins”?

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace. In my own efforts to stay insulated, I have found it highly useful to keep Ben’s Mr. Market concept firmly in mind.

Following Ben’s teachings, Charlie and I let our marketable equities tell us by the operating results— not by their daily, or even yearly, price quotations–whether our investments are successful. The market may ignore business success for a while, but eventually will confirm it. As Ben said: “In the short run, the market is a voting machine but in the long run it is a weighing machine.” The speed at which business’s success is recognized, furthermore, is not that important as a long as the company’s intrinsic value is increasing at a satisfactory rate. In fact, delayed recognition can be an advantage: It may give us the chance to buy more of a good thing at a bargain price.

Sometimes, of course, the market may judge a business to be more valuable than the underlying facts would indicate it is. In such a case, we will sell our holdings. Sometimes, also, we will sell a security that is fairly valued or even undervalued because we require funds for a still more undervalued investment or one we believe we understand better.

We need to emphasize, however, that we do not sell holdings just because they have appreciated or because we have held them for a long time. (Of Wall Street maxims the most foolish may be “You can’t go broke taking a profit.”) We are quite content holding a security indefinitely, so long as the prospective return on equity capital of the underlying business is satisfactory, management is competent and honest, and the market does not overvalue the business.

However, our insurance companies own three marketable common stocks that we would not sell even though they became far overprices in the market. In effect, we view these investments exactly like our successful controlled businesses — a permanent part of Berkshire rather than merchandise to be disposed of once Mr. Market offers us a sufficiently high price. To that, I will add one qualifier: These stocks are held by our insurance companies and we would, if absolutely necessary, sell portions of our holdings to pay extraordinary insurance losses. We intend, however, to manage our affairs so that sales are never required.

A determination to have and hold, which Charlie and I share, obviously involves a mixture of personal and financial considerations. To some, our stand may seem highly eccentric. (Charlie and I have long followed David Ogilvy’s advice: “Develop your eccentricities awhile you are young. That way, when you get old, people won’t think you’re going ga-ga.”) Certainly, in the transaction-fixated Wall Street of recent years, our posture must seem odd: To many in that arena, both companies and stocks are seen only as raw material for trades.

Our attitude, however, fits our personalities and the way we want to live our lives. Churchill once said, “You shape your houses and then they shape you.” We know the manner in which we wish to be shaped. For that reason, we would rather achieve a return of X while associating with people whom we strongly like and admire than realize 110% of X by exchanging these relationships for uninteresting or unpleasant ones.

*The above includes previously copyrighted material reprinted with permission.

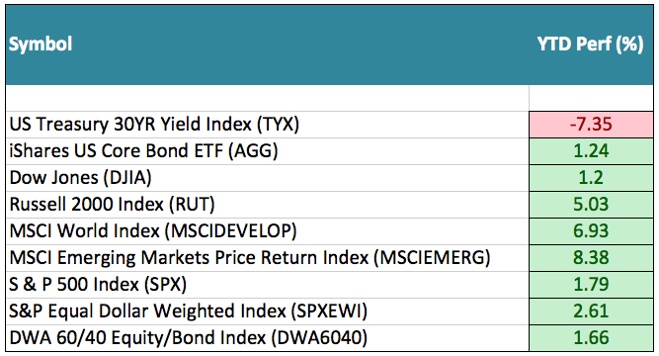

Q1 2015/YTD Market Stats

As you can see below, the theme shaping up this year is the shift to small capitalization (Russell 2000/RUT) stocks and the bounce in international equities (MSCI’s), both asset classes handily outperforming the S&P 500, YTD. We still remain underweight in international equities and overweight in bonds and domestic/US stocks.

YTD Performance: 12/31/2014 – 3/31/2015

The returns for indexes, ETFs, futures, and stocks do not reflect dividends and are based on the last sale for the date requested. Returns for mutual funds do account for distributions. Performance data does not include all transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

In our last newsletter, we announced the the shift from International equities being in the #2 spot to Bonds or Fixed Income taking the #2 position. International equities’ outperformance this quarter, keeps the asset class in close position as it continues to challenge bonds, again, who took the #2 ranking from International mid-December 2014 after an almost 2 year run in the #2 spot.

Why is the #2 spot important? We overweight the #1 and the #2 ranked asset class in all portfolios. So, for now, our most aggressive accounts, for example, hold bonds. Should International equities take back the #2 spot, that bond position for those clients will go away.

Furthermore, bonds holding a #2 spot signals to us that the market may be cooling off, and we have a completely different rule book and investment methodology for a market in which bonds occupy the #1 or #2 spot. A lot to digest, but the point is…We’ve got you managed.

Looking back to our January 2015 Market Outlook piece “The good, the bad and the not so ugly” I thought you may appreciate a market update by way of what we got right, and maybe not so right:

The Good:

The Outlook:

A strong Fed leadership to maintain low interest rates and low inflation

What did we have to say? …No rate hikes until the second half of the year—and that,”rate hikes should not be feared with the strong Fed leadership that’s committed to gentle changes in the name of stable US markets.” So far, RIGHT.

Domestic Equities still occupy the #1 spot for top performing assets

What did we have to say? “Stocks maintaining a strong hold on the #1 spot is good for future growth prospects of US markets. Next year, and early on, will prove difficult for those who have benefited from buy-and-hold or point-and-shoot investment management — the market returns will come from less stocks and fewer sectors, and will also require a disciplined, focused and narrow approach in order to have a winning portfolio. Volatility will be alive and well, and the selective investor will outperform those in a Vanguard S&P 500 index fund.” RIGHT.

A strong and growing GDP

What did we have to say? “It’s not a far reach to expect lower oil prices to give rise to consumer spending, which should help boost revenues for stores, restaurants, hotels, and more.” RIGHT. The retail sector, restaurants and other consumer discretionary stocks have strengthened YTD.

The Bad:

The Outlook: A less bullish Asset Class lineup

What did we have to say? “Having both of the asset classes that are equity asset classes, Domestic and International Equities in the #1 and #2 spots is the most bullish lineup on the relative strength asset scale. And since this is no longer true, it seems that overall returns have a less bullish outlook, as well. RIGHT.

The Not-So-Ugly:

The Outlook: China, not as gloomy as economists think

What did we have to say? We dispelled the many fearful sound bytes about China and the fear of it slowing worldwide economies as its slowdown ensues. With China’s GDP growth slowing, yes slowing to over 7% (wouldn’t we be so lucky!) in Q1 2015 compared to 7.3% Q4 2014 not only are other economies expanding, but the slowdown is not yet significant. RIGHT.

NOT SO RIGHT: Given our strict rules based methodology, we went underweight international equities when the asset class fell the to #3 ranking, leaving us underwieghted in international holdings all of Q1 2015. Clearly, international stocks outperformed all other indices and our rules-based philosophy that honors risk over return, clearly yielded investors less return this quarter. However, we wouldn’t have it any other way; we will continue to honor risk over return.

Much patience is required with a Relative Strength methodology such as ours, and 3 months is not a long enough time frame to predict a move out of an asset class being “right” or “wrong”. For now, it’s staus quo for our models with a continued underweight guidance for international equities, until (of course) the asset class overtakes bonds again for the #2 spot — which just may happen… Stay tuned.

A Relative Strength Update vis-à-vis “The Broken Yard Stick” and Other Indices

You may recall last quarter’s piece on “The Broken Yardstick” which touched on the short-falls of “benchmarking” investor’s returns to that of the S&P 500 (IF, you AREN’T invested 100% in US Large Company stocks). If your portfolio owns 25% in International stocks, you wouldn’t want to benchmark your portfolio to a 100% International index like the MSCI EAFE, right? The reality is, not many invest all their eggs in one basket, or in 100% large company stocks, for example.

Why not? You can lose 38% of your portfolio value in one quarter as in Q4 2008, that’s why. And, THAT’S why benchmarking to the S&P 500 is short-sighted; no investor wants the -38% in a quarter—but they DO want to be benchmarked to the index when its up double digits year over year, right? We call that having our cake and eating it, too—AND we love our clients to have their cake and eat it too—with a dose of quarter to quarter knowledge that, long-term, lets seek to beat the broken yard stick (for 100% equity clients, and say, 60% of those returns, for example for a “60/40” client—one who holds approximately 40% in bonds), but quarter to quarter, trust that under performing or outperforming the S&P 500 will not always be so–but that long term, our relative strength methodology will steer you best to out performance.

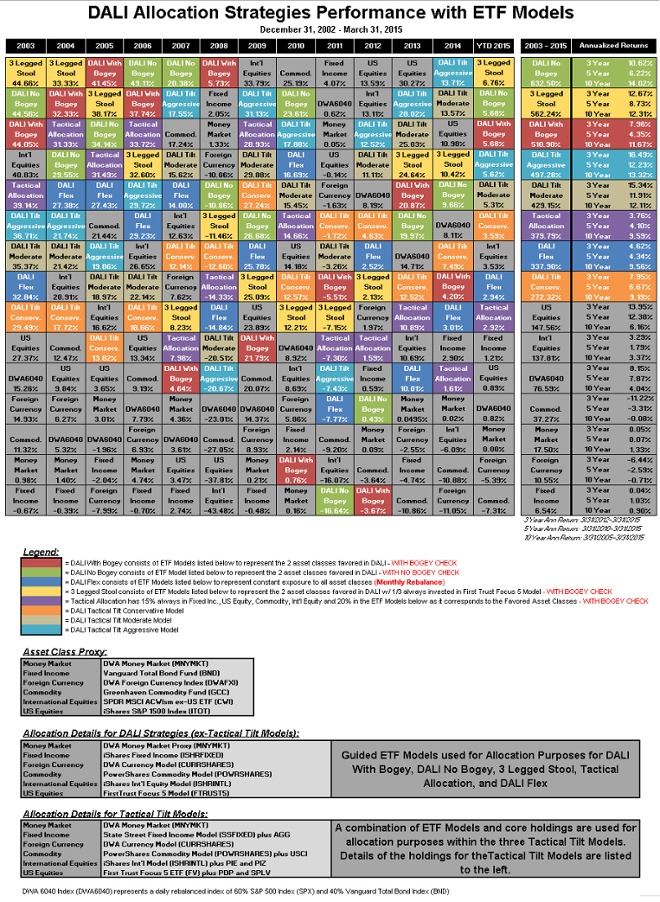

Below is from our friends at Dorsey Wright and Associates (DW&A) that illustrates the long-term performance of several of their relative strength models visa vie that of most major indices like that of the S&P 500, and the MSCI EAFE. We at Alphavest are not quite as sophisticated as DW&A to have audited, timely reports such as these model comparisons over such a long period, so understand that while these are not our returns, the below simply represents why we have adopted a relative strength methodology similar to DW&A’s models.

Our methodology most mimics that of the GREEN and RED boxes below depicting the performance of DW&A’s “DALI No Bogey/DALI With Bogey” model’s stats. It’s these boxes that apply a methodology similar to that of Alphavest overweighting the top 2 performing asset classes, like reported above in “Quiet the Noise” as well as in last newsletter’s Rules Quarterly (click below to enlarge):

So as you can see above, the DALI strategies we draw attention to don’t outperfrom US Equities (S&P 500) on a year-to-year comparison going back to 2010. However, one must note that the DALI no Bogey only lost -10.86% in 2008, versus that of the S&P 500’s loss of -37.81%, so the S&P had a lot more ground to make up.

Furthermore, you will see that the aforementioned DALI strategies DO indeed outperform the S&P or the US Equities’ performnace on a 10 year basis, which includes the 2008 sell off that all investors seek to avoid.

For more information about the indices above, please contact us and we’ll be happy to discuss!

Resources, Resources, Resources!

Check out our new website and our Resources page on the Alphavest website and explore the many resources with which we are trying to empower all investors.

A snapshot of what’s there:

Morningstar™ Fee Analysis.Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying.

Free Consultations with Cokie. Those who have ued this offer have found it benefical and have been pleased with value of 15 minutes of their time. We use this resource to offer investors a no-pressure opportunity to assess whether or not Alphavest is a good-fit. This is a great place to send those that you think may need our services. Thank you for your referrals and consideration!

FINRA Advisor Background check. FINRA reports that only only a small percentage of investors check their advisors record before making a switch. We run background checks on our employees, our childcare providers—why not run one–its FREE–on the person who manages your money? Rest assured our record is spotless (click here for Cokie’s U4). The important feature of the report is that it will report “NO DISCLOSURES,” which means no fraud or investor complaints.

Rules Quarterly

Some ask, “What makes Alphavest’s investment philosophy so different?” Or, “If you were to offer 1 thing investors should do to succeed….” and the answer is: RULES.

Last Quarter’s Rule in review:

Rule: Honor the Asset Scale by overweighting your portfolio in the top #1 and #2 ranked asset classes

IF: An asset class class falls from #2 on the Asset Scale to #3

THEN: Sell most, if not all of that asset class, and overweight the newly ranked #2 asset class.

Click here to review the last quarter’s Rules Quarterly.

New Rule to digest:

RULE: Raise cash when the NYSE Bullish Percent (NYSE BP) reverses down by 6%.

IF: The #1 and #2 ranked asset classes are NOT, BOTH Domestic Equities and International Equities, AND the NYSE Bullish Percent has a 6% down reversal (a statistically significant shift in risk)

THEN: Raise at least 20% cash.

An “NYSE BP” refresher:

The “NYSE BP” is an indicator, dating back to the 1950’s, that tracks the percentage of all stocks on the NYSE that are on a BUY signal. Not a subjective analyst’s “BUY” signal, instead its a reading of a factual, data driven, chart of the stocks performance being on a Buy Signal (positive chart of the stock’s price movement). These are 2 very different versions of determining whether a stock is a “Buy” or a “Sell”…one is subjective, or “emotional” and one is pure data based purely on a stock’s price movement. We only use one version at Alphavest—emotion is out, logic is in, right?!

Currently, with reading of 61.4% – this translates to 61.4% of all stocks traded on the NYSE are on a “Buy” signal – this is a proverbial tide you don’t want to swim against, RIGHT?

The “NYSE BP” is, of the many indicators we use to guide us, OUR MOST USED INDICATOR.

Why? The “NYSE BP” helps give us a RISK/”temperature reading.” Or to overuse an investing football analogy; the NYSE BP tells us if we are on Offense or Defense and what our “field position” is. In a Bull Market – where we find ourselves today – its important to know our “field position.” We could have the football (AKA we are on Offense) but the “plays” we run would be entirely different than the “plays” we would run if we were on our opponent’s 5 yard line versus OUR OWN 5 yard line. Get it?

Dating back to the 1950’s, a 6% shift in the NYSE BP, is a statistically significant shift. Herein lies why we raise cash when the NYSE BP reverses down by 6%. Historically speaking, when this happens, it a signal of increasing equity exposure, or risk. Hence, our rule of raising cash when we are overweighted in equities.

Our field position currently is one of OFFENSE and 61.4%–so, we’ve got the ball and have great field position (over 70% is when we start taking some caution).

The bottom line is, that’s right…We’ve got you managed.

Subscribe to Cokie’s Blog for more frequent updates on Markets and Matters….

Most of my blogs are less than 200 words – short and sweet! I have 2 weekly posts — one is uber-short and the other highlights our Investment Management “Rules” with one Rule detailed each week.

Q1 Most Read Blogs:

Join the Liberated Investor Movement TODAY!

We launched the Liberated Investor Movement in an effort to educate investors on how to break free from being held hostage by “Big Brokerage.”

The Liberated Investor Tool Kit exposes five areas of the investment management industry where the deck is stacked against investors and offers simple and direct advice:

- Excessive Fees and What Can Be Done About Them

- The Myth of Buy and Hold

- The Emotion Behind Market Timing

- Industry Conflicts of Interest

- How to Hire An Advisor That’s On Your Side

Download the Tool Kit today and share with your Facebook community and friends and family!

The best way to refer us? Tell others to download the FREE The Liberated Investor Tool Kit: