Quiet the Noise – Listen to the Data

Below you will find a “temperature reading” on the market and the risk level on the “field.”

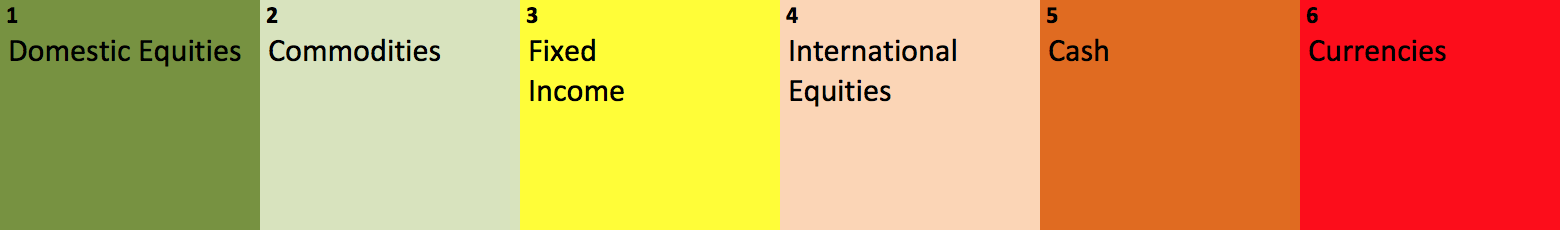

Relative Strength Line Up of the Asset Classes:

10/21/2016 Status:

- #1 Asset Class: Domestic Equities

- #2 Asset Class: Commodities

- Market Status: BULL MARKET

- NYSE Bullish Percent (NYSE BP): DEFENSE @ 58.65% Reversed down @ 60% on 10/12/2016

Q3 2016 Asset Scale Activity

August held much in the way of Asset Scale shifting:

8/5/16: Fixed Income fell from #2 to #3, trading places with Domestic Equities. With Domestic equities moving from #3 to #1 this quarter, we are pleased that leadership is taking hold and with what we call “risk on” assets.

8/11/16: The second of the two “risk on” asset classes, International Equities, likewise moved to a more favorable position of last place to #5, trading with Foreign Currencies.

8/15/16: Commodities traded first place with Stocks/Domestic Equities offering a much more favorable environment for investors to seek returns. YTD, the lack of leadership among the first four asset classes, or the spread between them has been so slight, that seeking returns was a risk-return scenario that was lackluster. We now see a much wider margin between the top four asset classes making it more prudent to seek equity-like returns.

The Other Horse’s Mouth

Manager Insights: Third Quarter Review

By: DWA & Associates 10/10/2016

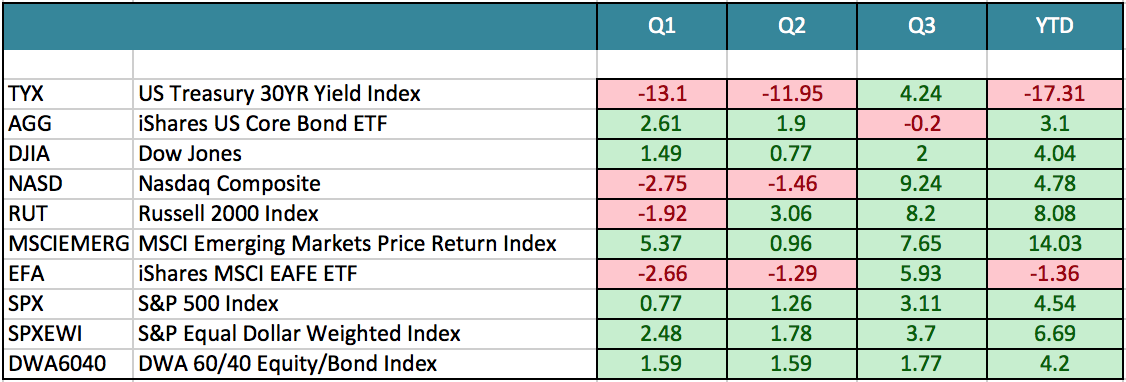

The stock market spent the majority of the summer months moving sideways in a tight trading range. The S&P 500 finished the quarter up almost 4%, and is sitting on a gain of 7.8% so far this year. International equity markets were a bright spot, and outperformed domestic markets. Developed markets finished up 6.5% and Emerging markets finished with a gain of 9.2%. Bonds also finished in positive territory with a 0.5% gain. Commodities were a weak spot in the third quarter. After strong gains in the first six months of the year, the S&P GSCI Commodity Index gave back 4.2% over the summer and now sits at a gain of 5.3% for the year. The stock market spent the majority of the summer months moving sideways in a tight trading range. The S&P 500 finished the quarter up almost 4%, and is sitting on a gain of 7.8% so far this year. International equity markets were a bright spot, and outperformed domestic markets. Developed markets finished up 6.5% and Emerging markets finished with a gain of 9.2%. Bonds also finished in positive territory with a 0.5% gain. Commodities were a weak spot in the third quarter. After strong gains in the first six months of the year, the S&P GSCI Commodity Index gave back 4.2% over the summer and now sits at a gain of 5.3% for the year.

We continue to see rotation below the surface in a number of different asset classes. This is nothing new, but we think the rotations we are seeing now have the potential to be very beneficial to our strategies. In the U.S. equity markets there has been a momentum shift out of areas such as high dividend and low volatility stocks. The relentless reach for yield drove many investors into stocks instead of bonds, and drove valuations to historically high levels. The same valuation issues cropped up in low volatility stocks, which have been quite the hot ticket for the last year or so. These are not the areas that usually lead a robust bull market. Low Volatility, especially, tends to lead during down markets. As a result, there was a lot of hand wringing about how solid the market actually was with that kind of leadership. We felt the leadership we were seeing was more a result of investor’s preference for yield (and the lack of good fixed income options) rather than an indictment on the overall market. We continue to see rotation below the surface in a number of different asset classes. This is nothing new, but we think the rotations we are seeing now have the potential to be very beneficial to our strategies. In the U.S. equity markets there has been a momentum shift out of areas such as high dividend and low volatility stocks. The relentless reach for yield drove many investors into stocks instead of bonds, and drove valuations to historically high levels. The same valuation issues cropped up in low volatility stocks, which have been quite the hot ticket for the last year or so. These are not the areas that usually lead a robust bull market. Low Volatility, especially, tends to lead during down markets. As a result, there was a lot of hand wringing about how solid the market actually was with that kind of leadership. We felt the leadership we were seeing was more a result of investor’s preference for yield (and the lack of good fixed income options) rather than an indictment on the overall market.

The new leadership that appears to be emerging is what is traditionally considered positive for a strong bull market. Small capitalization stocks have had spotty performance for a while, but they really picked up steam in the third quarter. The Russell 2000 Total Return index finished with a gain of 9% moving it well ahead of the S&P 500 for the year. Technology stocks also dramatically outperformed what could be considered the old leadership (Utilities, Consumer Staples, and Low Volatility) over the summer. The relative improvement in these higher volatility areas shows investors are gaining more confidence in the market. Confidence is an incredibly important piece of the puzzle for momentum strategies so we are looking at this new development very favorably. The new leadership that appears to be emerging is what is traditionally considered positive for a strong bull market. Small capitalization stocks have had spotty performance for a while, but they really picked up steam in the third quarter. The Russell 2000 Total Return index finished with a gain of 9% moving it well ahead of the S&P 500 for the year. Technology stocks also dramatically outperformed what could be considered the old leadership (Utilities, Consumer Staples, and Low Volatility) over the summer. The relative improvement in these higher volatility areas shows investors are gaining more confidence in the market. Confidence is an incredibly important piece of the puzzle for momentum strategies so we are looking at this new development very favorably.

The appetite for higher volatility investments is also increasing internationally. As previously mentioned, Emerging markets had a fantastic third quarter. Latin America has been the biggest driver of that performance so far this year. For the past couple of years, international markets have not fared as well as our domestic markets. That appears to be changing, and we are seeing increasing allocations to Emerging markets in those account styles that allocate internationally and globally. The overall composition of those portfolios has changed dramatically over the course of the year. The appetite for higher volatility investments is also increasing internationally. As previously mentioned, Emerging markets had a fantastic third quarter. Latin America has been the biggest driver of that performance so far this year. For the past couple of years, international markets have not fared as well as our domestic markets. That appears to be changing, and we are seeing increasing allocations to Emerging markets in those account styles that allocate internationally and globally. The overall composition of those portfolios has changed dramatically over the course of the year.

As we head in to the final three months of the year it is impossible not to think about the upcoming election. Frankly, it is nothing short of a circus sideshow at this point. We fully understand the uncertainty people feel because neither candidate seems like a good choice. That, however, is politics, and we are investing. We encourage you not to get caught up in the headlines. We do expect some volatility around election time, but we don’t think either candidate’s victory means doom or exuberance for the stock market. It is incredibly difficult to forecast how politics will affect the market, and most so called experts get it wrong. Keep your politics out of your investing plan and you will be much better off for it in the long run. Never forget that there is always some reason not to invest, but the reality is that investing in stocks is a tremendous way to build wealth over time. As we head in to the final three months of the year it is impossible not to think about the upcoming election. Frankly, it is nothing short of a circus sideshow at this point. We fully understand the uncertainty people feel because neither candidate seems like a good choice. That, however, is politics, and we are investing. We encourage you not to get caught up in the headlines. We do expect some volatility around election time, but we don’t think either candidate’s victory means doom or exuberance for the stock market. It is incredibly difficult to forecast how politics will affect the market, and most so called experts get it wrong. Keep your politics out of your investing plan and you will be much better off for it in the long run. Never forget that there is always some reason not to invest, but the reality is that investing in stocks is a tremendous way to build wealth over time.

The final three months of the year should be interesting to say the least. There are pieces falling in to place that lead us to believe our relative strength strategies can do quite well if these trends are sustainable. If you have any questions about any of our strategies please give us a call at any time. The final three months of the year should be interesting to say the least. There are pieces falling in to place that lead us to believe our relative strength strategies can do quite well if these trends are sustainable. If you have any questions about any of our strategies please give us a call at any time.

This information is from sources believed to be reliable, but no guarantee is made to its accuracy. This should not be considered a solicitation to buy or sell any security. Unless otherwise stated, performance numbers are not inclusive of dividends or fees. Investors cannot invest directly in an Index. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This information is from sources believed to be reliable, but no guarantee is made to its accuracy. This should not be considered a solicitation to buy or sell any security. Unless otherwise stated, performance numbers are not inclusive of dividends or fees. Investors cannot invest directly in an Index. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

Q3 Bottom Line:

Major Index YTD Performance through 9/30/2016:

What’s In Store For Q4:

- November 8, 2016 – Are you ready for the Hil-Rump Election?

- November 16, 2016 – Check your mailboxes for the big news!

Save The Date!

November 16, 2016

PARTY at the Grand Bohemian

55 Wentworth Street, Charleston

6-9 PM

Fears of a global recession have subsided thanks to US Growth starting to tick higher. With forecasts for emerging markets to stabilize, US interest rates stable and a credit boom in China boosting growth in the near term, global recession seems averted.

Come ready to CELEBRATE!

RSVP: [email protected]

Resources, Resources, Resources!

Newly Featured:

NEW! Alphavest Website. Check out our beautifully designed new website. The site was developed with a simple design to help you locate our resources more easily.

NEW! Alphavest Website. Check out our beautifully designed new website. The site was developed with a simple design to help you locate our resources more easily.

NEW! Alpha-Track™. No longer do investors have to rely on outdated financial plans that reflect their financial situation at a particular point in the past. Spending, saving, and markets are constantly changing and so is your financial outlook. Alpha-Track™ tracks and monitors your financial outlook on a daily basis. *Available to clients only

Check out our Resources page at Alphavest.com and explore the many ways in which we are empowering investors.

A Snapshot of What’s There:

Morningstar™ Fee Analysis. Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying. Morningstar™

Fee Analysis. Learn just how much you pay each year in fees and help others to educate themselves on what they pay too! Did you know that excessive fees can amount to upwards of 21% of your wealth over a 20-30 year period? We are committed to offering the lowest fees possible and want all of our clients to know what they are paying.

Free Consultations with Cokie. Those who have used this offer have found it beneficial and have been pleased with the value 15 minutes of their time provides. We use this resource to offer investors a no-pressure opportunity to assess whether Alphavest is a good fit. This is a great place to send those that you think may need our services. Thank you for your referrals and consideration!

FINRA Advisor Background check. FINRA reports that only a small percentage of investors check their advisor’s record before making a switch. We run background checks on our employees, our childcare providers — why not run one, it’s FREE — on the person who manages your money? Rest assured our record is spotless (click here for Cokie’s U4). The important feature of the report is that it will indicate “NO DISCLOSURES,” which means no fraud or investor complaints.

Subscribe to Cokie’s Blog:

Most of my blogs are less than 200 words (except our quarterly newsletter) — short and sweet! I post as a means of quick and efficient communication with you, my clients. Your feedback is very important to me. THANK YOU for letting me know what you like reading… and what you don’t!

Most of my blogs are less than 200 words (except our quarterly newsletter) — short and sweet! I post as a means of quick and efficient communication with you, my clients. Your feedback is very important to me. THANK YOU for letting me know what you like reading… and what you don’t!

Top 3 blog posts from Q3:

- Attention Investors: Brace For A Hudson River Landing

- Want to Claim Back 21% of Your Retirement

- S&P 500 Hits Record High; Time For Tactical Or Strategic Asset Allocation?

Join the Liberated Investor Movement Today!

The Liberated Investor 2.0

We originally launched the Liberated Investor Movement in an effort to educate investors on how to break free from the shackles of “Big Brokerage.” Many things have changed since the initial launch of the Liberated Investor Tool Kit, which is why we developed a second edition.

The Liberated Investor Tool 2.0 exposes three areas of the investment management industry where the deck is stacked against investors and offers simple and direct advice:

- Excessive Fees and What Can Be Done About Them

- How to Invest with Disciplined Action

- How to Eliminate Conflicts of Interest

Download the Tool Kit today and share with your Facebook community and friends and family!

The best way to refer us?

Tell others to download the FREE The Liberated Investor Tool Kit: